What were the best financial investments in 2019? This is the question that many people ask in the hopes of finding that secret formula for their stock portfolio in 2020. So, what they really should be asking is, “What will be the best financial investments in 2020?” You see, nobody really asks one question without asking the other. Everyone asks what the best financial investments were in 2019 because they are trying to figure out what therefore will be the best performing financial investments in 2020. In this Benchtalk, we are going to be addressing these questions and we will see if we can predict the Best Financial Investments in 2020.

Looking at the Data

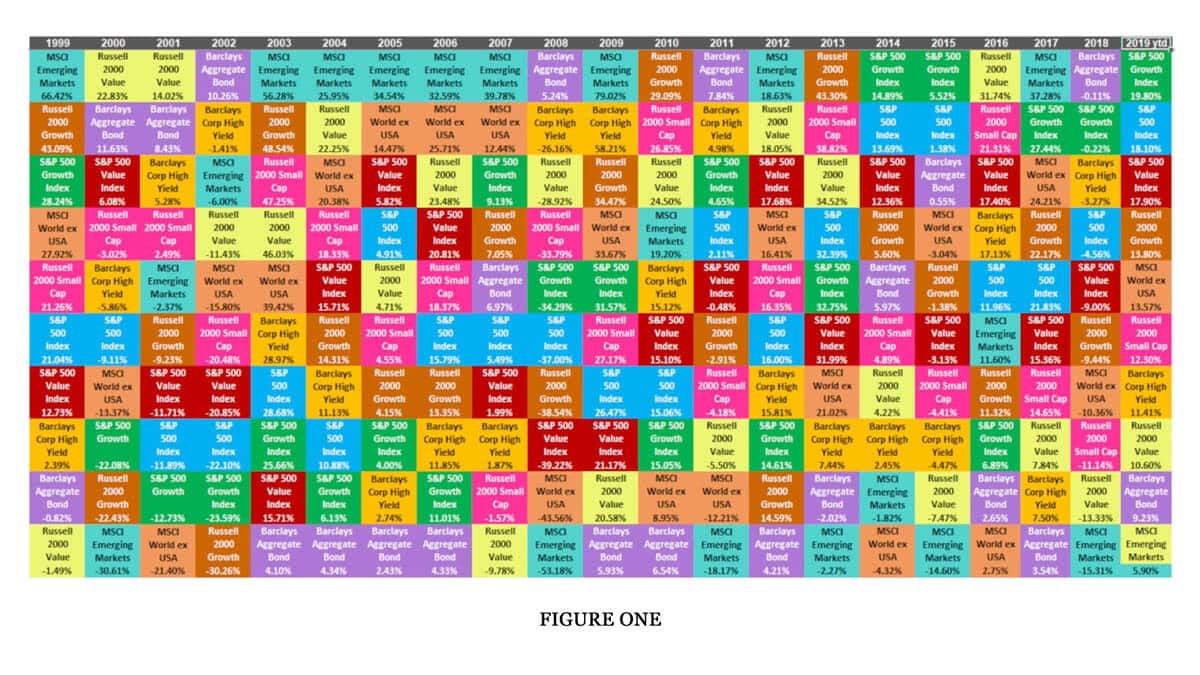

We have some data that we can use to help us answer this question. The table below, figure one, shows us what investment categories performed the best all the way back from 1999 until 2019. We use investment categories to analyze and organize stocks into groups based on certain criteria. This allows us to get a better understanding of how certain stocks perform without having to actually analyze each and every single stock. As you can see, the table below shows us the performance of numerous investment categories.

A Dangerous Assumption

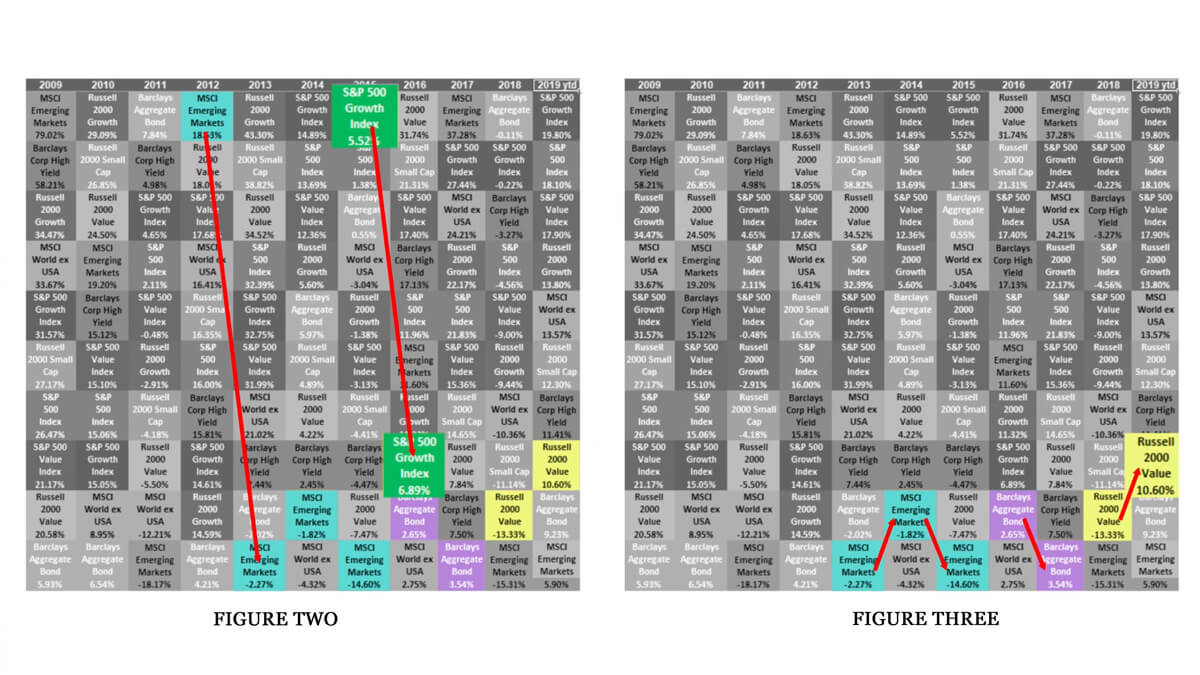

Now back to the question, “What will be the best financial investments in 2020”? In figure 1 we can see that the S&P 500 Growth Index outperformed every other investment category in 2019. You might be tempted to make a very dangerous assumption, like many do, that in 2020, the S&P 500 Growth Index will also perform well. However, if we track any given investment category from 1999 to 2019, we can see that the best performing investment categories do not always remain the best in the future. To illustrate this, we added some arrows to the chart, figure 2, below.

We wish we could easily say that which is on the top goes to the bottom and therefore that which is on the bottom goes to the top but sadly, this is not true. If it was, we would just tell our clients to invest in whatever investment category performed the worst last year in the hopes that it would perform the best in the following year.

But as you can see in figure three above, those investment categories that exist at the bottom do not necessarily come to the top. Sometimes, they just hover around and stay at the bottom.

So… What’s The Point?

The point to all this is that it IS pointless. There is no point in using last year’s best performing investment category with the hopes of predicting the next best investment category for 2020. There simply is no pattern from one year to the next. You can not use what was best in one year to predict what will be best in the next year.

Invest for the Long-Run

So, what can you do? Well, you can invest for the long run. You see, for each individual investment category, the short-term performance is absolutely unpredictably. However, performance over the long run is very predictably. We can be fairly accurate in saying what investment category will have a great rate of return over the long run. Diversifying also helps as well. So, going back to our initial question, “What will be the best financial investments in 2020?”, it isn’t the right question to be asking. What we should be asking ourselves is “What will be the best investment in… 2030?…2040?…etc. In other words, we’re always looking at the long-term. That question is a lot easier to answer.

When it comes time for you to focus on your financial future, we hope that you will focus on the long-term. Not the “secret formulas” or stock tips that people pass around on the internet. If you have any questions or concerns about investing, don’t hesitate to contact us. We always offer 100% objective, fee-only advice.

Also, check out this related blog post to learn more | All You Need To Know About Investing