America is still a place where if you work hard, save your nickels and dimes and practice prudent financial strategies, you can build substantial wealth for your enjoyment and that of your children. Sadly, though, one of the great obstacles you’ll face in trying to provide a better life for your kids is the estate tax. We’ve often written on the importance of planning for retirement, especially in understanding how to manage retirement income and cash flow. But equally important is understanding how the federal estate tax can disrupt your plans and how to avoid estate tax legally.

What Is The Federal Estate Tax?

The estate tax, or death tax, is a tax charged on your net worth when you pass your assets on to your kids. As we write, there is an exemption amount ($13.99 million for an individual and $27.98 million for a couple). However, those high exemptions may crash to a much lower threshold in the coming years, when/if Congress amends the law, as they have historically discussed.

This new, potentially much lower, exemption amount will impact most successful business or real estate owners, so it’s a real threat, and you need to take action NOW!

How bad can it be, you ask? After the exemption amount, the federal estate tax rate starts at 18% – still a sizeable chunk – but quickly grows to 40% for anything over $1 million over the exemption. That means with the new limit around the corner, your net assets in excess of the exemption amount will be hit with a 40% rate federally and perhaps hit more if you live in a state which imposes its own estate tax burden.

Some states will also imposes an inheritance tax. Inheritance taxes are a tax on any assets inherited from someone’s estate. Inheritance taxes differ from estate taxes in that the beneficiaries of an estate are personally responsible for paying the inheritance tax, whereas estate taxes are taken directly from the estate itself.

Currently, there are only six states that impose an inheritance tax. So if there are family members who reside in one of these states, they may have to pay estate and inheritance taxes.

The good news is that there are ways to reduce the estate tax now, in the short-term and in the long-term (for your kids and grandkids). These techniques run the gamut from simple to complex. Depending on your net worth, earnings, and cash flow, some or all of these might be worth implementing.

One cautionary note. Many of these techniques reduce your cash flow as well as your tax liability. It is critically important to review your situation with an objective, fiduciary financial advisor who can help you decide which techniques are right for you.

How to Avoid Estate Tax – 10 Techniques

We’ve compiled a list of 10 techniques to help you determine how to avoid estate taxes.

1. Gift Money To Your Kids

The easiest thing to do is to give money away. Federal estate taxes apply to your assets in excess of the exemption amount. If you own it when you die, your heirs include the asset in the calculation of your estate and apply the 40% tax to the excess. If you’ve given some money to your kids or grandkids before you pass away, the amount of the gifts do NOT count in the value of your estate; they can’t be taxed.

Gifting does face some restrictions. In 2025, you are allowed to gift $19,000 per person per recipient without any gift tax consequences. That means mom and dad can gift $38,000 to one of their kids ($19k from dad and $19k from mom). Gifting can be repeated to each child each year.

If you gift more than that, the excess gift reduces your estate tax exemption. Barring congressional action, the exemption is set to return to approximately $7 million in the coming years. If you give $100,000 to one of your kids, you’ve exceeded the $19k limit that year. You gave away $81,000 too much. That’s OK because the IRS simply deducts that $81k excess from the $3.5 million exemption (using the projected exemption based on current law). Here’s the math:

Dollar for dollar, in total, you can give away $19,000 per year plus $7,000,000. What happens if your estate is larger than $7,000,000? Or what if your estate grows to be larger than $7,000,000? Your heirs pay the estate tax on the balance of your estate.

2. How To Avoid Estate Tax With Life Insurance

Instead of gifting money to get it out of your estate, you could use some of the money to purchase life insurance. At your death, the full life insurance proceeds payout could cover your estate tax, and your heirs would receive the full amount of your estate.

3. Use A Life Insurance Trust To Purchase Life Insurance

This is very similar to number 2 above, but it also helps reduce your estate tax liability. The process is fairly simple. You establish an irrevocable trust, gift money each year to that trust, and have the trust purchase the life insurance on your life. The amount you gift is out of your estate (like number 2 above), but in addition, the entire amount of the life insurance is out of your taxable estate.

Remember, estate taxes apply to the net assets you own at your death. Because the insurance trust owns the insurance policy and the death benefit, they are not included in your estate. This further reduces your estate and, therefore, your potential estate taxes.

4. How To Avoid Estate Tax With a Qualified Personal Residence Trust

You can place your personal residence in a special trust and name your heirs as the beneficiary of that trust. You get to stay in the home rent-free for a certain number of years (you get to determine how many years). At the end of this term, the heirs become the owners of the residence. You can still live in the house after the end of the term, but you’d have to pay rent to the heirs.

This is a good technique for several reasons. The first is related to the concept of a value discount. Let’s say you have a $1 million house. If you simply give your house away, you have reduced your estate by $1 million. However, that means that you have also used $1 million of your lifetime exemption.

Instead, if you “gift” your house in a trust – which has the restriction that you get to live in the house for free for some number of years – the value of the house is discounted because the new owners (your heirs) cannot use the house until the term is over. An appraiser determines the fair market value of the discount, but let’s assume it’s 20%. Here’s the benefit:

Notice what just happened. You reduced your estate by $1,000,000, but you only used up $800,000 of your lifetime exemption. This technique allows you $200,000 more to give away rather than simply giving the house to your heirs.

5. Gift Minority Shares

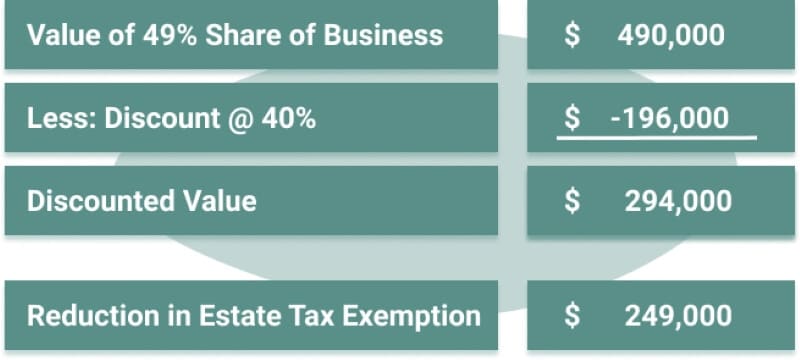

What else should I consider when determining how to avoid estate tax? Look no further than your business. If you own a business and give away a minority interest in the business, you get to discount the value of the gift. This technique relies on the same “discounting” concept mentioned above. Pretend you own a $1,000,000 business, and let’s assume that the minority interest discount is 40%. Now let’s assume you give away 49% of the business to one of your kids:

Notice what happened here. This time you gave away $490,000 to your child (who was going to take over the business anyway), but you only used up $249,000 of your lifetime federal estate tax exemption.

6. How To Avoid Estate Tax With a Family Limited Partnership

Family Limited Partnerships use minority shares exactly the same way, except you don’t have an existing business to make it work. You can use almost any “investment” asset, like investment real estate, that can be managed like a business.

When determining how to avoid estate tax, this process can be a bit complicated. You create a limited partnership among the family, you place a $1,000,000 investment property into the partnership, and at the start, you own 100% of all the shares. Then, you keep 2% of the partnership as general partnership shares, but you give away 98% of the partnership in limited partnership shares.

The general partner (you) keeps control of the partnership. The limited partners (typically your heirs) own more of the partnership than you do, but they have numerous restrictions on what they can do with their shares. Because of those restrictions, you get a discount on the amount you’re gifting. The discount can be as high as the 40% mentioned above, and the math works the same way.

7. Use Charitable Trusts

Whether or not you are charitably inclined, using charitable trusts can be very helpful when determining how to avoid estate taxes. There are two types of charitable trusts – remainder trusts and lead trusts. In both cases, you donate assets into a trust. You then invest those assets to generate an income stream.

In a lead trust, the charity enjoys the income from the asset for a period of years, and at the end of that term, your heirs receive the asset. This can be especially helpful in reducing income and capital gains taxes if the donated asset is highly appreciated.

In a remainder trust, you receive the income benefit for the term of years chosen, and at the end, the assets are given to the charity. You receive significant income tax benefits during the term, and if that income stream is properly invested, you can replace the asset value being donated to the charity.

8. Establish a Grantor Annuity Trust

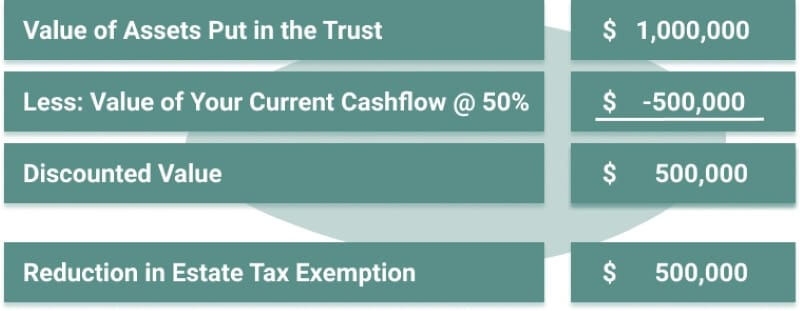

Grantor Annuity Trusts allow you to again discount the value of the asset being gifted to your heirs and provides current cash flow for you. You establish a trust with your heirs as beneficiaries. You then transfer an investment asset into the trust in return for promised payments over several years. At the end of those years, the asset goes to your heirs.

The value of the gift is calculated by taking the asset’s value and subtracting the value of the cash flow you receive over time. This is where “discounting” comes into play. Because you keep the cash flow, the value being given is reduced. It’s a complicated calculation, but assume that the value of your cash flow equals 50% of the asset’s value. Here’s the math:

Once again, you’ve given $1,000,000 to your heirs but have only used up $500,000 of your lifetime federal estate tax exemption.

9. Leave Assets In Trust To Reduce Estate Taxes For Future Generations

In each of the examples above, the focus was on determining how to avoid estate tax, and these techniques can be very successful in doing that. But at the end of each of these techniques, your heirs own the asset, and the asset becomes part of their net worth. When they pass away, these assets could generate a significant estate tax for the grandkids.

On the other hand, if the assets used in any of these techniques are kept in a trust for the benefit of your kids and grandkids, estate taxes and their evil cousin, generation-skipping taxes, can be avoided for multiple generations. This is true even if the assets appreciate significantly over the years. The tax benefits over several generations can be astronomical.

10. Combine These Techniques for Maximum Benefits

While each of these techniques is valuable in its own right and can be increased by continuing to keep the assets in trusts, an even larger benefit is provided when you properly combine these techniques. The benefits of one can add to the benefits of another technique. These added benefits can also be projected to future generations by using the generation-skipping tax laws to their full advantage.

Estate Planning Is Complicated And Requires Proper Advice

As you’ve most likely noticed, many of these techniques will reduce your cash flow during life. For many high net worth individuals, this is the reason they stop the process with just a will and a living trust. They assume that each technique will affect their cash flow the same way. In reality, that’s not true.

How much cash flow is lost depends on the assets you place into each technique and the combinations of methods you use. With proper analysis, you can identify the best trade-off between your cash flow and federal estate tax reductions for your family.

In our estate planning work with clients as a fiduciary, we determine what cash flow is needed for retirement, what cash flow is being generated by each asset, which assets offer the greatest potential tax discounting, and ultimately which techniques will reduce estate taxes without compromising cash flow needed for retirement.

We cannot stress enough the importance of doing this correctly. Recently Forbes Magazine wrote about the need to do this analysis – something they call “mathing out strategies.

If you’re entering into retirement or are already there, we highly recommend you update your estate plan and create an estate planning checklist. Whatever planning you did when you were in your 40s or 50s might have been just fine for that stage of life. But with the impending reduction in the estate tax exemptions, now is the time to focus on this critical piece for the benefit of your kids and grandkids.

We’d love to help you with this critical work; it’s one of our specialties, and we have decades of experience in working with high-net-worth clients. We don’t sell products; we provide solutions. Being 100% objective means you can count on us to make an objective determination of where you are, where you need to go, how you can get there, and how to balance your retirement needs with your desire to leave a meaningful legacy for future generations. You can schedule a complimentary introductory appointment to begin potentially some of the most important work of your life.

Christian is an advisor with First Financial Consulting. He uses a comprehensive planning approach to help individuals and families accumulate, distribute, and protect their wealth throughout all stages of life.

Christian is an advisor with First Financial Consulting. He uses a comprehensive planning approach to help individuals and families accumulate, distribute, and protect their wealth throughout all stages of life.

FAQs | How to Avoid Estate Tax

The estate tax is a tax charged on your net worth when you pass your assets on to your kids. Also known as the inheritance tax or death tax, this tax is imposed on the transfer of assets to beneficiaries and heirs, based on the value of the assets and the relationship between the deceased and the recipient.

Avoiding estate tax requires careful estate planning. While it may not always be possible to completely avoid all taxes, there are strategies that can help minimize its impact on your estate. Our recommended techniques include:

- Gifting Money to Your Kids

- Purchasing Life Insurance

- Utilizing a Life Insurance Trust

- Establish a Qualified Personal Residence Trust

- Gift Minority Shares in Your Business

- Leverage the Power of a Family Limited Partnership

- Utilize Charitable Trusts

- Establish a Grantor Annuity Trust

No, estate taxes are not the same in all states. Some states have their own estate tax laws, and the threshold for taxation and tax rates may vary. One thing to note, federal estate tax rates are independent from state level taxes.

For 2025, the estate tax exemption stands at $13,990,000 for individuals and $27,980,000 for married couples. You can find the latest estate tax exemption on the IRS' website.

While setting up a trust can be a valuable estate planning tool, completely avoiding estate tax may not always be possible, especially for larger estates. Certain types of trusts, like irrevocable life insurance trusts and charitable trusts, can help minimize estate tax liability, but it's essential to work with a knowledgeable estate planning professional to determine the best strategies for your specific financial situation.