High-income earners have a target on their backs, and you may be one of them. The IRS has a strategy in force to target and squeeze high-income earners. The surprise here is that they draw the demarcation line much lower than most people realize.

You are probably in their crosshairs if you’re making north of $200K per year. The good news is there are several tax strategies for high-income earners which can significantly reduce your income tax burden.

Want to get expert tax advice for retirement? Book a free consultation with a fiduciary advisor to see if any of these tax strategies apply to your situation.

Key Takeaways

- High-income earners can benefit significantly from proactive tax planning strategies that aim to minimize taxable income and optimize overall financial health.

- Effective tax strategies are essential for high-income earners to ensure that their financial plans are not only optimized for the present but also sustainable in the long term. Aligning tax strategies with broader financial goals involves managing both current and future tax liabilities in a way that supports growth and stability

- Working with a fiduciary is key, as they provide objective insight into complex tax scenarios. Fiduciary advisors can incorporate these insights into your financial plan and adjust strategies as needed to keep inline with your overall financial goals.

Think about your basic tax return, and you get some insights of where to look to reduce your federal income taxes. The IRS approach is fairly simple in concept. The 1040 form instructs you to list your income, then subtract deductions, use the resulting “taxable income” line to determine your tax rate, and then sometimes allows you to apply some credits toward the tax. In practice, however, this simple concept can be very complex.

- Not all income is treated the same; you may have earned taxable income, passive income, non-taxable income and/or deferred income.

- Not all deductions are the same; there are above-the-line deductions, below-the-line deductions & conditional deductions.

- The income tax rate differs depending on your “tax bracket,” which in any given year can be a bit arbitrary.

Here’s a quick reference guide for the 2024 breakdown of federal tax rates:

| Taxable Income (Single) | Taxable Income (Married, Filling Jointly) | Tax Rate |

|---|---|---|

| Less than $11,601 | Less than $23,201 | 10% |

| $11,601 to $47,150 | $23,201 to $94,300 | 12% |

| $47,151 to $100,525 | $94,301 to $201,050 | 22% |

| $100,526 to $191,950 | $201,051 to $383,900 | 24% |

| $191,951 to $243,725 | $383,901 to $487,450 | 32% |

| $243,726 to $609,350 | $487,451 to $731,200 | 35% |

| $609,351 or more | $731,201 or more | 37% |

To these rates, you may also have to add capital gains taxes as shown below:

| Filing Status | 0% Rate | 15% Rate | 20% Rate |

|---|---|---|---|

| Single | Less than $47,026 | $47,026 to $518,900 | $518,901 or more |

| Married (Filing Jointly) | Less than $94,051 | $94,051 to $583,750 | $583,751 or more |

| Married (Filing Separately) | Less than $47,026 | $47,026 to $291,850 | $291,851 or more |

| Head of Household | Less than $63,001 | $63,001 to $551,350 | $551,351 or more |

And then, depending on where you live, you may have to add state income tax rates and capital gains taxes. To illustrate just how bad this gets, we’ll use a high-tax state like California. At the upper ends of the income ranges above, your combined tax rate could be higher than 55%, including the extra Medicare investment tax.

Understanding how to reduce your taxable income as a high earner is rarely a case of applying just one tax strategy. The reality is that utilizing high income tax planning requires some combination of tools and strategies. Some of these techniques can trigger an immediate tax. Others can reduce taxable income and will reduce your lifetime tax bill.

To determine what tax reduction strategy is right for you, contact a fiduciary advisor to walk through your unique situation. Keep reading for an in-depth list of several key tax saving strategies for high-income earners that can effectively lower your taxes.

Tax Strategies for Reducing Your Lifetime Tax Bill

Maximize Contributions to Deductible Tax-Deferred Accounts

These include IRAs, 401(K)s, SEPs, and other similar “qualified” retirement accounts. While the laws governing the maximum contributions are inconsistent, to say the least, the common principle is that you may deduct from your taxable income the amount of your contribution and then grow the assets tax-free until you withdraw them.

The deductible amount ranges from a low of $6,500 per person to an approximate high end of $30,000. If you own your own company, you can also contribute an additional amount – roughly $43,500 per person.

A separate category of these types of accounts is the defined benefit plan. This plan is entirely employer-funded, but if you own a business, it could be a valuable tool to reduce your tax burden. Depending on your age, the maximum tax-deductible contribution would range from $75,600 to slightly more than $214,000.

Use Roth Conversions Wisely and Regularly

Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income earners on this list. However, the tax benefits can be huge. Yes, the roth conversion triggers a tax (withdrawals from IRAs, etc., are taxable), but you may be able to dramatically reduce the amount of tax you pay over your lifetime.

Money in a Roth grows tax-free, and withdrawals are tax-free. So any money you move into a Roth will be tax-free in the future. If you manage Roth conversions each year so that they don’t push you into a higher tax bracket, you would be able to convert funds and pay a lower tax now than you will in the future when you withdraw them for living expenses.

The amount you convert each year will change based on that year’s projected total taxable income, but over time you can build significant tax-free wealth for future needs and/or your heirs. Remember that your IRA is subject to required minimum withdrawals at some point. As time marches on, those RMDs grow. Moving money into a Roth over the years will reduce total lifetime taxes. This tax-saving strategy high-income earners requires planning and foresight.

Contribute to a Health Savings Account

Health Savings Accounts (HSAs) offer three forms of tax protection:

1. Your contributions are tax-deductible.

2. The money inside the account grows tax-free.

3. Withdrawals are tax-free so long as they are made for qualified medical expenses before age 65, or for any reason after age 65. This recent change can be very valuable to a high-income earner who can pay for medical expenses from other cash flows.

4. The secret is to invest the money in the account. Most people simply open a Health Savings Account at a bank and leave the funds in a money market account because they anticipate using them for qualified medical expenses. But if you contribute the maximum amount each year, invest aggressively, and leave the money in the account through age 65, you can build up a very significant source of tax-free income. There are contribution limits, but if you start early enough, this is a very valuable strategy.

Superfund a Cash Value Life Insurance Policy

Cash value life insurance is a type of permanent life insurance that offers investment features. Assuming you have a good policy construction from a strong insurance carrier, the tax laws afford you substantial tax savings in future years.

Most cash value insurance policies charge a premium that is sufficient to cover the “cost” of the insurance and build up a little bit of cash value. But if you superfund it – contribute more than is needed – you can build up a substantial cash value, which can grow tax-free.

Many of these policies offer good investment options so you can control the amount of growth. When you need the money, withdrawals can be structured to be tax-free. This takes some planning to avoid triggering a tax, but the benefits can be well worth the effort.

High-Income Tax Planning Using Charitable Giving Strategies

Qualified Charitable Contributions

A qualified charitable contribution is a distribution from an IRA paid directly to a qualified charity. You must be over the RMD age, but this deduction allows you to directly reduce your adjusted gross income.

This is especially relevant to high-income earners; according to a 2023 study by Bank of America, 85% of affluent households gave to charitable organizations with the average gift level rising 19% from pre-pandemic levels. Study after study has shown that charitable gifts grow in importance as taxable income grows. If you’re going to give, this can be one of the most efficient tax-saving strategy for high-income earners to make your donations.

Donate Highly Appreciated Stock

Tax saving strategies for high-income earners don’t always have to be complicated. Another effective and simple technique is to gift stock directly to a charity.

If you own stock or any investment that has appreciated significantly over the years, you may be looking at a substantial capital gains tax. Those taxes can be avoided entirely if you give the stock to the charity and let the charity sell the stock.

The charity will not pay any taxes on the sale, will be able to use 100% of the proceeds, and you will maximize your gift tax exemption and get the best tax deduction as a high-earner.

Contribute to a Donor-Advised Fund

A donor-advised fund is a slightly more sophisticated and flexible approach to donating a significant amount of money. The key difference is that you receive the tax break in the year you make the donation, but you don’t have to actually give all the money to charity in any one year.

The concept behind this high-income tax strategy is simple. You establish a donor-advised fund account and then gift cash, stock, etc., into the account. If the gift is highly appreciated stock, you again escape the capital gains tax.

Most brokerage firms, like Schwab, let you direct how you want the money invested so it will grow over time. None of the income or gains in the account will be taxed. You then direct the brokerage firm where to make the gift each year. You can give away a minimal amount or a lot each year; it’s your choice.

Utilize a Charitable Remainder Trust or a Charitable Lead Trust

Although a bit more complex, a charitable trust might be extremely valuable to you. Both trusts are similar to a donor-advised fund in that you gift assets to receive a charitable deduction and pick the charities you want to give to. What sets them apart as a tax strategy for high-income earners is the additional benefits which may be worth the cost of setting up the trusts.

Mechanically, you set up a trust which will benefit a charity or foundation of your choice. You donate to that trust cash or appreciated assets and receive a tax break. The tax savings do change based on the type of gift you make and your AGI (adjusted gross income level), but these can still be substantial. Here’s where the additional benefits come into play.

In a Charitable Remainder Trust, you receive an income stream from the trust for several years or life, and the charity you have selected receives the remaining balance at the end of this term.

In a Charitable Lead Trust, the charity you pick receives the income stream, and your beneficiaries receive the remaining balance at the end of the selected term.

Change the Timing of Your Income

These two simple ways to reduce your taxable income for high earners. High income earners are more likely to have inconsistent income, so these high income tax strategies can help you mitigate the risks that come with a sudden surge in income.

Decrease Taxable Income by Contributing to a Deferred Compensation Plan

An employer can set up deferred compensation plans to offer high-income earning executives the opportunity to defer up to $30,000 of taxable income and avoid tax in that year. These accounts can be set up with investment options, and the benefit of tax-free growth over decades can be substantial. This is simple way to reduce taxable income for high income earners.

At retirement, you will have to arrange to withdraw the money from the account over a specified number of years. When you take withdrawals, they become taxable income, but you have the flexibility to manage your income over 10+ years. You can manage your tax liability by timing your taxable income (taking it all in one year when your tax rate is low or extending it out over lots of years).

Ask Your Employer to Defer Income for a Year

In some cases, employers may be willing to defer income for a year. This technique is simple and is especially good if you’re going to receive a substantial year-end bonus. As you consider tax strategies for high-income earners, it’s important to remember that your income tax is determined by how large your net taxable income is in any given year.

If your boss is willing to “push” a bonus payment from a year when your income is already large to one when it will be smaller, you may be able to reduce the overall tax you pay because you’ll have a lower tax rate in the second year. While you can’t do this every year, it can be very useful in years where there are spikes in your income.

Take Control of Capital Gains

These particular high-income tax planning strategies are especially important if you have found that you’re now getting more income than before. If you also have an irregular income, this can help you to reduce your taxable income as a high earner.

Consider a 1031 Exchange

A 1031 exchange is a technique that allows you to sell a highly appreciated property, defer the capital gains tax, and acquire a replacement property with your sale proceeds. In a traditional situation, you would have to sell the first property, pay any capital gains taxes, and only use the net proceeds (which could be 20% to 35% lower) to purchase the next property.

If structured properly, the 1031 exchange process allows you a reasonable time period to identify and purchase the replacement property and defer the capital gains taxes. You can do this as often as you want, replacing one property with a second property, and then selling and replacing that property with another, etc.

There is no limit, but at some point, if you sell for cash, you will then have to calculate the deferred capital gains tax. Still, income tax brackets and capital gains tax rates change over time. It is possible that in some future year, you would pay a lower rate on capital gains than you would today. Timing is everything with this method to reduce taxable income for high earners.

Manage Your Asset Allocation

Ultimately, your asset allocation – how much you invest in bonds, stocks, real estate, etc. – will determine your long-term return and risk. These should always be designed to match your financial goals, but you can also employ tactical tax planning strategies for high income earners within the overall allocation. It’s one thing to determine how much to invest in bonds or stocks, for example. It is equally important to decide how you’ll invest in those bonds or stocks.

Everyone knows about tax-exempt bonds. They usually offer a lower interest payment, but that payment is either single or double tax-free. Balancing your bond allocation between tax-exempt and “regular” bonds is important.

Sadly, there is no such thing as tax-exempt stocks. You can still reduce the tax consequences of your stock investments by using tax-efficient ETFs and index mutual funds. These securities have very low turnover, and turnover is usually what causes capital gains.

You can also plan when to recognize capital gains as part of your tax-saving strategy for high-income earners. At some point, you will have to sell some bonds or stocks – usually for one of three reasons:

1. Rebalancing (which is very important)

2. Creating liquidity for a withdrawal

3. Replacing a bad fund manager

If you sell the bonds or stocks with an eye toward your overall income level in any given year, you might be able to pick the year when your tax rate will be lower than another year.

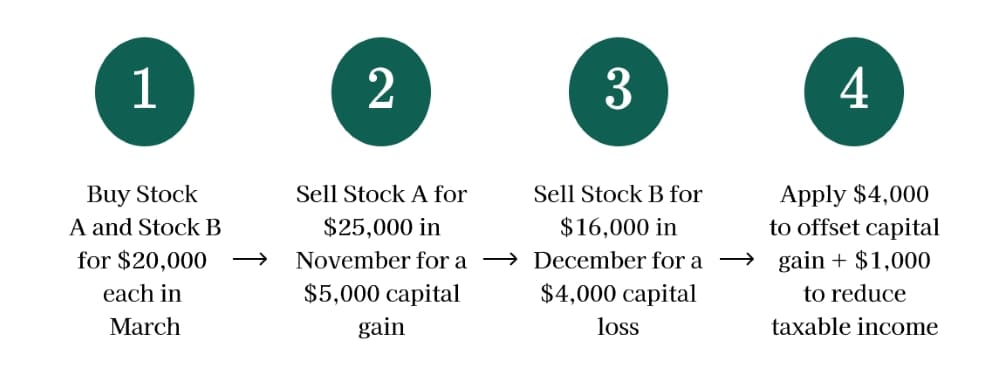

Tax loss harvesting is also a simple strategy that is often ignored. Sometimes, selling a stock or bond makes sense even if you don’t need to rebalance, create liquidity or replace a manager. If the market takes a major downturn, you can sell some of your holdings to create a “tax loss.”

The theory would be to sell the stock (for example) and immediately replace it with similar stock. This “harvests” the loss to reduce your taxes but does not alter your long-term allocation strategy; you get your cake and can eat it too. See the example below:

Critical Tax Deductions to Consider

You should be eager to maximize your tax efficiency and get the most out of your deductions. While CPAs excel at concrete calculations, they might not always be proactive in exploring all your options.

Don’t be afraid to push them for advice on how to save more on taxes and advocate for a more forward-thinking approach. What didn’t work last year could be beneficial this year, so ask the right questions to steer them towards planning for your future financial success.

These are some of the best tax deductions for high earners to consider.

Itemized Tax Deductions to Consider

There are also some other tax deductions available to you as part of your high income tax strategies. As discussed previously, they fall into several categories.

Above-the-line tax deductions reduce your adjusted gross income (AGI), and they are always allowed. We’ve covered some of them already, such as IRA and Health Savings Account contributions.

Below-the-line tax deductions are subtracted from your adjusted gross income to determine your taxable income. Not all of these are allowed all the time; many are “conditional,” meaning that you must meet some conditions to use the deduction.

The most common condition is the standard deduction level. Each year the IRS stipulates the standard deduction limit, and you cannot deduct your extra expenses unless they exceed the limit. These are your itemized deductions, which are harder for high-income earners to achieve than in past years.

Time Your Medical Expenses Where Possible

Medical expenses are deductible if they exceed a certain level of your adjusted gross income (AGI). Again, the IRS establishes that level each year. To the extent that your medical procedures and costs are elective and not life-critical, you can decide to postpone or accelerate procedures to maximize the deduction.

Manage Your Mortgage Expense

Mortgage costs have become a political football. The rules were changed just recently but may be changing again. At the heart of the debate is whether the mortgage expense deduction will be limited.

The 2017 Tax Cuts And Jobs Act (TCJA) limited the deduction to the interest on home mortgage. However, there is talk in DC of amending this so it will vary.

What’s sometimes missing in this discussion is that the limit is placed on home mortgages, not all mortgages. Loans taken out for investment purposes are still considered deductible against the taxable income of the investment. This opens several financial planning possibilities based on the property you own.

To make a complicated issue easier to understand, it’s entirely possible that a mortgage on your primary home would not be deductible, but that same loan made against a rental property would be deductible. Where you place the mortgage, and the purpose of the loan are very important factors in determining what and how much you can deduct.

Utilize Family Gifting

Superfund a 529 Plan

Tax law covering 529 plans was recently changed and has become a bit more complicated, but the potential benefits are arguably even better. These plans offer substantial tax benefits to parents or grandparents who want to pay for their kids’ or grandkids’ education. The money you contribute is not tax deductible at the federal income tax level but may be deductible in your state and local taxes.

The benefits come in future years. The money in a 529 account grows tax-free and remains tax-free so long as you withdraw it for qualified education expenses. 529 plans now include tuition for private elementary school or high school, in addition to college expenses. There may be contribution limits in your state, but if not, the contributions are unlimited.

Beyond that – assuming your state does not have a restriction – you can contribute more and deduct it from your lifetime estate tax exemption.

If you’ve already decided to fund your child’s or your grandchild’s education, why do this with after-tax dollars? For example, if you’re in the highest combined tax rates, you’d have to earn $43.K to have $20K remaining for tuition.

Instead, paying education expenses with tax-free dollars provides a huge benefit, conceivably for multiple generations. If you make a sizeable contribution, you would simply roll any remaining balance to the next generation after your kids have used the funds.

Get Your Documentation Together

With increased resources and scrutiny, they’re keeping a closer eye on tax planning and compliance. While you might not have been considered a high income earner before, you might be now that the threshold has lowered. The IRS won’t expose what this threshold is, but will more resources, more people will be under the microscope. It’s time to get your documentation in order because slipping through the cracks isn’t a practical way to reduce taxable income for high earners.

Be proactive in maintaining your documents as the IRS will expect you to support your claims with evidence. Test yourself by trying to access records from seven years ago. If you struggle, it’s time to get organized and ensure you’re prepared for any inquiries.

Pick Your Ways to Reduce Taxable Income Wisely

These tax planning strategies for high-income earners can be instrumental in reducing or deferring your taxes. Taxes – or at least the amount of taxes you pay – are not as inevitable as the IRS would have you believe. You are in control, and with a little wise counsel, you should be able to build the right tax plan for your needs.

Unfortunately, there are some tax preparers who may not analyze these against your specific needs, and there are too many “advisors” who are really just selling you a financial product.

The first group may miss some significant tax deductions you could take. The second group could sell you a product that won’t offer the full tax benefit they promise.

It’s also important to note that some of these tax strategies for high-income earners may not apply to your unique situation. Some will incur an immediate tax; others will reduce your tax burden in the future.

The trick is to find a 100% objective advisor who can help analyze your specific situation and goals and then assess what combination of techniques will be best for you, your family, and your heirs. We at First Financial Consulting meet the fiduciary standard, providing 100% objective advice to our clients, and we would be happy to explore your situation in a complimentary consultation.

Greg is a Principal at First Financial Consulting. He has over 35 years of experience providing tax planning for high-net-worth clients and is committed to providing 100% objective advice to his clients.

Greg is a Principal at First Financial Consulting. He has over 35 years of experience providing tax planning for high-net-worth clients and is committed to providing 100% objective advice to his clients.

FAQs | Tax Strategies for High-Income Earners

High income earners are typically placed in higher tax brackets. Implementing effective tax strategies can help them retain more of their earnings and preserve their wealth.

Any number of strategies from the article above are tried-and-true ways to reduce taxes. It's also critical to work with a fiduciary, fee-only financial advisor who can better suggest strategies for your situation.

The best strategy for you will entirely depend on your unique financial situation. A fiduciary, fee-only financial advisor will be able to analysis your situation and provide the best strategy moving forward.

Absolutely. All of these tax strategies for high income earners are completely legal and by the book. However, we still suggest working with a qualified tax professional to ensure compliance with the law.

Yes, tax strategies can vary depending on the source of income. For instance, strategies for earned income (salaries, bonuses) may differ from those for investment income (dividends, capital gains) or business income. A comprehensive tax plan should take all income sources into account.

Absolutely. High income tax strategies can be integrated into estate planning to minimize estate taxes, gift taxes, and generation-skipping transfer taxes. Techniques like gifting, creating trusts, and establishing family limited partnerships can all be employed to transfer wealth efficiently.