Everyone seems to be asking this question; at least that’s the conclusion you draw if you look at the quantity of Google searches – where to invest for the rest of 2019? Out of curiosity, we did a little research to see what might be “hot” or “trending”, and this blog post topic is what inquiring minds want to know. The question is easy; the answer is much different than you would ever believe.

One hint is that this question always assumes some starting point. Right now, it’s what to do for “the rest of 2019”. People look at what happened in the first half of 2019 and believe we can predict the next half of the year. Go back 18 months or so, and the question would have been what to do for “2018”. People were looking at what had happened in 2017 and were trying to predict 2018. In other words, people are always looking at what just happened and asking from there what should be done in reaction.

Healthcare Stock and Cannabis?

That same Google search we mentioned actually resulted in some pretty comical responses. Our first two responses on the Google results were 1) invest in healthcare stocks, and 2) invest in cannabis. You can’t make this stuff up. On the one hand, some analyst says we should invest in companies that seek to improve our health, and on the other hand, another analyst says we should invest in stuff which can hurt our health.

For those of you who may be inclined to embrace the invest-in-cannabis mantra, you’ll love the second line of this recommendation – “it’s like investing in alcohol post-prohibition”. Well, what if we rephrase it to read, “it’s like investing in pharmaceuticals pre opioid addiction crisis”? You’ll get a different answer. A lot of companies made substantial profits pushing opioids, only now to face mounting lawsuits and federal criminal investigations. Strong profits in the past do not necessarily mean strong profits in the future.

Market Commentators

Some of the other recommendations from the search are as follows:

- Kiplinger’s Magazine advises investing in emerging markets and Japan, but with an article later in the magazine recommending you avoid stocks and invest in bonds instead.

- Forbes recommends advising in “the stock market” (wow, that’s helpful), real estate and “peer-to-peer lending”.

- Merrill Lynch (which gets credit for self-interested honesty) recommends “investing with them”. At least we know where they are coming from.

As you can see, there are as many answers as there are analysts and market commentators. There is no true conventional wisdom here. There never has been, nor will there ever be. Simply put, nobody has ever been able to consistently predict where to invest tomorrow based on what happened in the immediate past. There’s just no predictable pattern or sophisticated algorithm to provide us with an accurate answer.

Think about it from a commonsense perspective. Have you ever seen an article in any of these magazines which says, “last year we predicted XXXX and this is how our recommendation played out”? Maybe you’ll find one, but by and large, nobody holds these market prognosticators accountable to what they said last time they made a prediction.

Periodic Table of Investment Returns

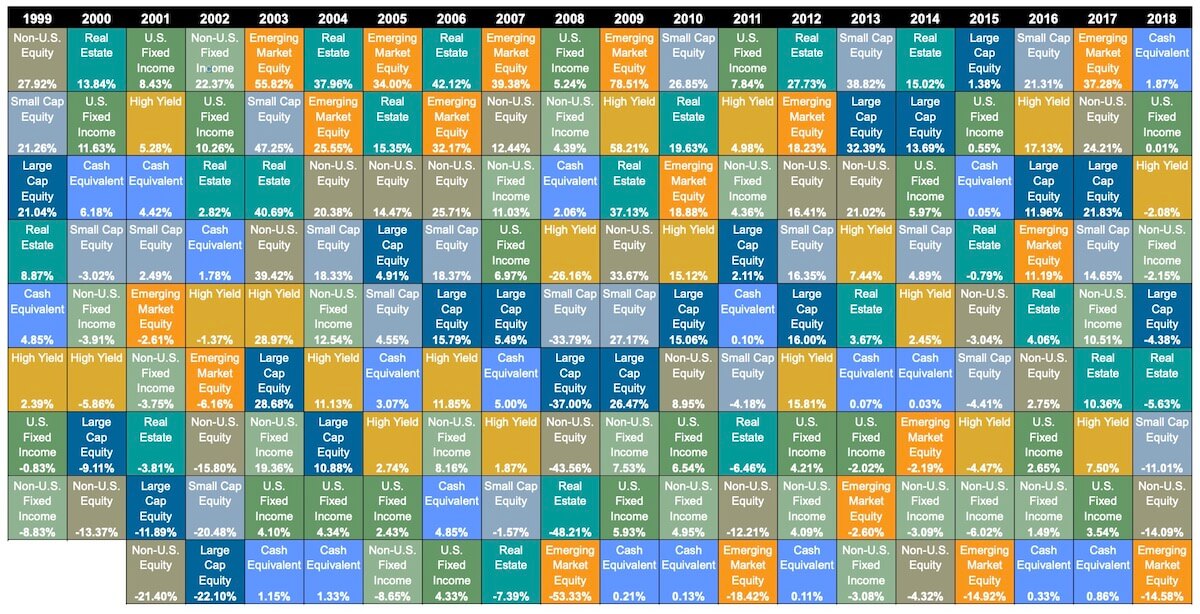

If you want a more analytically rigorous reason why there is no reliable answer to what to do based on what just happened, we refer you to the following “periodic table of investment returns”, produced by Callan Associates.

The value of this chart is not in each year’s ranking. The value of the chart is showing what happens to any given year’s leader going forward. To demonstrate that, look at 2009. This is the year in which the last recession ended, but the first quarter was miserable. Notice that Emerging Market Equity (in orange) was the top dog, earning +78.51%. But next year, it sank, then sank again to last place in 2011 when it lost – 18.42%. It didn’t regain top dog status until 2017, which is 8 years later.

If you had invested in 2009’s winner – expecting that it would continue – you would have been sorely disappointed. The chart is color-coded so you can trace the performance of various sectors over time. It’s pretty clear that there is NO basis for using one year’s performance to predict the next year’s performance for any category or sector. There never has been, and there never will be.

Honest Advice

The next time you hear or read anyone trying to tell you what to invest in going forward, because of what just happened, please remember that they are selling something, not giving honest advice.

Honest advice isn’t sexy, it doesn’t draw headlines, it doesn’t sell advertising space; it can actually be pretty boring. But it IS honest, and honesty demands that we recognize that investing is a long-term game which uses long-term averages to determine what rates of return are achievable and what volatility is associated with each level of return.

As random as the annual returns appear in the periodic table, the long-term returns for each category are actually fairly predictable. So too is the volatility of each category. We have the ability to reasonably project the long-term return and volatility of each category. Therefore, we can project what various mixes of investment categories will generate.

In other words, we may not be able to tell you what “stocks” will do next year, or what “bonds” will do next year, BUT we can tell you what they are very likely to do over 15 or 20 years, so we can tell you what a 50%-50% split will do, or what a 60%-40% split will do, etc.

Long-Term

Successful investing for the future does not in any way depend on what happened last week, month, or year. But it is based on what the long-term trajectory of each investment category is and what mixing them together will generate. Where should you invest for the remainder of 2019? Honestly, you should invest something in a diversified portfolio of different categories and sectors. Don’t try to figure out this year from last year.

If we can help you determine what you need to earn in order to achieve your financial goals and dreams or to help you control the risk in your portfolio, we’d love to chat. The conversation – even the initial meeting with one of our advisors – won’t cost you a dime. But the results will be invaluable. We’re here to help.