Diversification is a common buzzword in the world of investing, but how does it help you? Why is diversification important for risk management? The simple answer is that diversification provides a safety net that protects your portfolio from volatility and risk. Diversification also helps you achieve your investment goals and can serve as a great tool to reduce taxes. We’ll explore each of those in this blog post as we dive into the importance of diversification for risk management.

Key Takeaways

- Diversification in investing means spreading out risk across various asset classes such as stocks, bonds, and cash, and is influenced by factors like time horizon and risk tolerance.

- A diversified portfolio can act as a protective shield against market uncertainties, aiming to balance risk and improve potential returns by not being overly concentrated in any one investment.

- Effective diversification requires quality over quantity in selecting the right mix of investments, and should avoid excessive diversification which can lead to reduced focus and average returns.

The Concept Of Diversification Explained

Think of your portfolio as a pie already sliced into pieces. Diversification is simply the process of creating those slices, each representing a different stock, bond, industry, or asset category. How you decide to slice up that pie is important. If you do it correctly, diversification will help your portfolio perform better. If you don’t diversify correctly, it may not help at all.

Successful diversification creates a mix of distinct investments. If the investments are not distinct enough from one another, then you can’t limit your risk. For example, if you buy five stocks instead of just one, you might believe you have “diversified” your portfolio. While it’s true that expanding your selection to five stocks reduces your exposure to the risk of just one stock, this expansion does not adequately reduce your risk. The benefit is minimal.

Even if you expanded this to 50 or 60 stocks, you would still only enjoy a partial benefit. If all those stocks are in the same industry or the same category, then you would be limited to how that one industry or one category performs. This strategy does not reduce your risk nor allow you to reap the benefits when different investment categories do well. Your future rises or falls based on the one category you’ve chosen. Diversification is beneficial only when it’s spread over an appropriately wide range.

Why is Diversification Important?

A well diversified investment portfolio is essential because it reduces the risk of significant losses by spreading investments across various asset classes and sectors. This strategy ensures that poor performance in one area doesn’t heavily impact your overall portfolio.

It also helps in capturing growth opportunities across different market conditions, leading to more consistent returns over time. By diversifying, you protect your investments from market volatility and increase the chances of achieving long-term financial goals.

How Diversification Protects Investors

Diversifying across the proper categories not only reduces your risk of loss but also improves portfolio returns. These are two crystal clear ways in which diversification protects investors. We have over 200+ years of performance history for several key asset categories. This data allows us a great deal of predictive capability to determine how these asset categories will perform regarding average returns and volatility. We, therefore, can mix these categories in different combinations – referred to as allocations – to control risk and enhance returns over time.

While it is not an exact science, the predictive capability is still very strong; we cannot be accurate down to a decimal point, but we can be very accurate within an acceptable range.

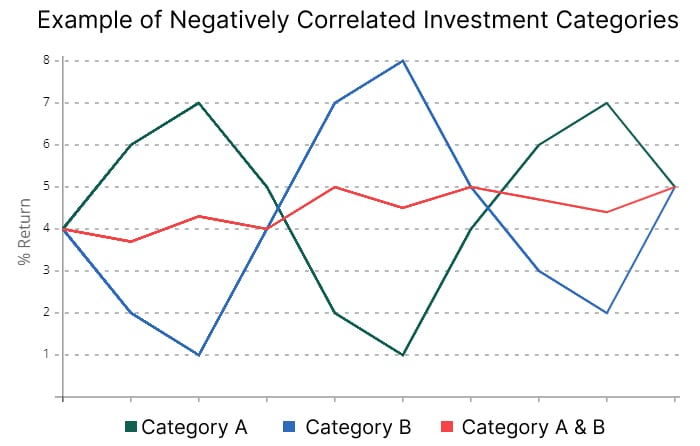

What makes this work is the concept of correlation. Because of the history we have, we know which investment categories tend to move in the same direction at the same time. This process is known as positive correlation. We also know which investment categories tend to move in opposite directions. This process is known as negative correlation.

The greater the negative correlation, the better diversification will be. Let’s look at an example of two investment categories (A & B) which are perfectly negatively correlated. When A is up, B will be down at exactly the same time. And then, when A is down, B will be up. All investment categories will experience both ups and downs. This fact is inevitable. Mixing two investment categories together, which are perfectly negatively correlated, allows you to mitigate the volatility of the entire portfolio.

If you invested in just category A, your portfolio would increase by the same amount as the category. When category A goes down, your portfolio will decrease by the same amount as the category. In our example, if you combine category B with category A, then when A is going down, B is going up, and your combined portfolio will stay somewhere in the middle. The volatility of one offsets the volatility of the other, and the investor can benefit.

Knowing the correlations between investment categories is extremely important. Not all investment categories correlate perfectly, either positively or negatively. However, we can usually measure degrees of correlation. This is where the real science of diversification kicks in.

The Importance Of Portfolio Diversification

The importance of portfolio diversification derives from understanding the degrees of correlation, the expected returns of each investment category, and the proper mixing of categories to truly diversify. To attain this understanding, we must use investment categories that have long enough measurable track records to determine what their average return is likely to be and how they will correlate with all the other investment categories.

Sadly, there is a lot of marketing hype in the investment industry trumpeting “new” categories. However, these “new” categories are not distinct enough from other investment categories to be predictive in any sense.

Remember, just mixing things together isn’t diversification. You must mix distinct investment categories. That distinctiveness is critically important.

You must also mix these distinct investment categories in the proper proportions. This process is not a simple case of taking five investment categories and dividing your assets evenly among them. If you did that, you would put 20% in each category, but that does not truly reflect the positive and negative correlations or the expected returns.

Instead of just putting an equal percentage into each investment category, you should put a smaller portion in the positively correlated categories and a larger portion in the negatively correlated categories. Correctly done like this, diversification becomes dramatically important in reducing volatility and, in many instances, augmenting overall returns over the long term.

At a bare minimum, diversification should include the following investment categories: equities, fixed income, and alternatives such as real estate. But if you limit the diversification choices to just these broad categories, your results will be sub-optimal. You will have diversified away some of your risks but left more on the table that you could have mitigated.

Taking it further to the point where most portfolios can be effectively and efficiently diversified, you should include the following subcategories:

- Within Equities: you should diversify among large U.S. growth stocks, large U.S. value stocks, small-cap stocks, international developed world stocks, and international emerging market stocks.

- Within Fixed Income: you should diversify among long-term bonds and short-term bonds.

Including all the subcategories, you should diversify across at least eight distinct investment categories in proportions that truly reflect each category’s expected returns, volatility, and correlation coefficients.

A lot of math and statistical analysis is required to properly diversify and achieve its benefits. This analysis is well beyond the scope of this blog article, but for a more in-depth and “in-the-weeds” discussion, you can visit the following Harvard study.

Having the computer capabilities we do today is why diversification is essential in investments in the modern era. Before the advent of the computer, we could use some common sense to tell us that mixing broad categories together would help a portfolio. The old adage of not putting all your eggs in one basket gained common sense status because people widely recognized it as prudent and beneficial.

When mainframe computers came online, only the very large and truly sophisticated institutional portfolios of major Fortune 500-type firms could take advantage of the science. Today, desktop and laptop computers have expanded this availability to almost every investment portfolio.

The Outer Boundaries of Diversification

As mentioned above, effective diversification relies on knowing which distinct investment categories to use and how to use them. In turn, this relies on long-term data to determine each category’s distinctiveness and predictability of returns and volatility. Because of this, your investment allocation should remain largely unchanged despite market conditions.

Numerous studies demonstrate the inevitable failure of market timing (the purposeful changing of your allocation to catch the rises and avoid the falls in investment categories). But that doesn’t mean you can’t further diversify a portfolio in different market conditions. It just means you shouldn’t do it at the broad category level (stocks & bonds) or at the subcategory level (listed above). These should be left intact through all market swings.

Within these subcategories, there are decisions to make about which industries may be affected by a downturn in the overall economy or by certain world or political events. However, be warned! These decisions are beyond most investors’ experience and training level and should be left to 100% objective fiduciary advisors – advisors who are legally and morally bound to act only in the client’s best interest.

The Broader Impacts Of Diversification

The impact of diversification goes beyond the performance of individual portfolios; it profoundly impacts investors’ journeys towards their financial goals and benefits the broader financial system.

At the individual investor level, diversification can dramatically help you achieve your financial goals and dreams. By managing risk and ensuring a more stable return on investments, diversification can build predictability into your financial plan and help restrain the worst emotional impulses that arise during tough market cycles. Because of the broad predictability of well-executed portfolio diversification, your financial or retirement plan becomes more reliable.

For example, if you have $500,000 today and determine that you need $2 million tomorrow to maintain your retirement lifestyle, but you don’t know how much you can earn in your portfolio, how would you ever be able to develop a plan to get there? Because diversification works, we can determine with high degrees of accuracy what level of investment return you should be able to earn with different investment allocations. If your investment diversification strategy gives you a high degree of confidence that you can earn an 8% average annual return over a reasonable time period, then you can figure out when you can retire.

To successfully retire – or accomplish any financial goal – you need to know where you’re starting from, where you need to go, and how much your portfolio should be able to earn. Diversification allows you to manage your portfolio toward that goal. It helps you build that retirement nest egg, save for your child’s education, or even finance a dream vacation. Whatever your dreams and goals are, successful investment diversification is key to accomplishing them.

In a broader sense, investment diversification also helps you by its effect on the broader financial system. By reducing individual investment risks and promoting more balanced growth, diversification contributes to the financial system’s stability as a whole. In this way, diversification serves as a shock absorber, dampening the ripple effects of market fluctuations, which often cause individual investors to make the wrong emotional decision at the wrong time in the market.

This is not to say that effective investment diversification is easy. It’s not. This blog has only hinted at the potential pitfalls of improper diversification and the complicated analysis needed to diversify your portfolio correctly. Careful planning and guidance are necessary when designing and implementing diversification. This is where an objective fiduciary financial advisor can help by:

- Guiding you in creating a diversified portfolio that aligns with your financial goals and risk tolerance

- Helping you navigate the complexities of different potential investment categories

- Managing risks

- Making informed investment decisions

Remember, diversification is not just about spreading your investments but also about spreading them wisely. Proper diversification and asset allocation are critical for successful diversification. Diversification done correctly can help you withstand market downturns and stay on course toward your financial goals even during the most challenging times.

Common Misconceptions and Challenges

Despite being widely appreciated (everyone seems to be for it even if they don’t know how to do it correctly), diversification is afflicted by several misconceptions and challenges. One common misunderstanding is that “if some is good, more is better.” It is possible to over-diversify or own too many investments.

While proper diversification reduces risk and augments returns, overdoing it can lead to “diworsification,” a term coined by legendary investor Peter Lynch. In his analysis, Mr. Lynch concluded that too much diversification actually starts burdening portfolios and leads to lower returns.

A common challenge to effectively diversifying is controlling the costs and reducing the complexity associated with diversification. For instance, investing in too many mutual funds within the same category can lead to increased costs and due diligence without significantly enhancing the benefits of diversification. Similarly, investing in an excessive number of individual stocks can lead to a complicated tax situation where mistakes can lead to reduced after-tax returns.

By extension, a major risk of over-diversification is that it reduces a portfolio’s returns without meaningfully reducing its risk. Excessive diversification can also dilute your focus from high-conviction ideas and limit your upside potential. Therefore, striking a balance between diversification and concentration is vital for optimizing risk-adjusted returns and effectively managing risk.

Remember, diversification is not about quantity but quality. The goal is not to own as many investments as possible. Instead, your goal should be to own the right mix of investments to help you achieve your financial goals while managing risk. So, while diversification is important, it’s equally crucial to avoid over-diversification and maintain focus on your investment strategy.

Practical Tips for Implementing Diversification

We’ve come a long way in discussing the concept, significance, and common misconceptions of diversification, so let’s explore some practical tips for its implementation. Here are some tips for successfully designing and implementing diversification:

Start by engaging an experienced fiduciary advisor to identify the right allocation mix to accomplish your goals within your risk tolerance and timeframe. Remember, the concept is straightforward, but the category selection criteria and the analysis required are complicated.

Employ the most cost-effective investment options available to control costs. While your starting point should be index funds and ETFs, don’t be afraid to include some active managers if objective and reliable analysis indicates their performance will be better. Index funds and ETFs are investment vehicles that allow you to invest in broad indexes that match the investment categories needed in your diversification plan. Some active fund managers may be able to beat the market for periods of time, net of their fees, in ways that augment your portfolio performance.

Finally, it’s essential to review and rebalance your portfolio regularly. The key to maintaining diversification is regular monitoring and adjustment of your portfolio to keep it in alignment with your financial goals and risk tolerance. This process involves periodically reviewing your portfolio and making necessary adjustments to maintain your desired asset allocation level. Remember, diversification is not a set-and-forget strategy but a continuous process that requires regular monitoring and adjustment.

There’s No Better Time To Start Than Now

No matter where you are in your journey – just starting out, somewhere in the middle, or already retired and relying on your portfolio – effectively diversifying your investment portfolio will help you attain and/or maintain your portfolio goals and your broader financial goals. But please, do not try to develop a diversification strategy yourself or use one of the online one-size-fits-all tools. Portfolio diversification is too complicated, and the potential risks are too severe to make amateur mistakes. Consult a professional.

First Financial Consulting has 45+ years of experience as a fee-only, 100% objective fiduciary advisor. We have helped hundreds of clients develop the right investment diversification plan for their specific situations and individual goals. We’re proud of our clients’ success, and we’d love to begin a conversation with you.

As they say, it all starts with a conversation, and initial consultations are complimentary. Please give us a call, send us an email, or use the link below to schedule your complimentary consultation.

Greg Welborn is a Principal at First Financial Consulting. He has more than 35 years’ experience in providing 100% objective advice, always focusing on the client’s best interests.

Greg Welborn is a Principal at First Financial Consulting. He has more than 35 years’ experience in providing 100% objective advice, always focusing on the client’s best interests.

FAQs | Importance of Diversification for Risk Management

Diversification is crucial in risk management because it spreads your investments across various assets, reducing the overall risk of your portfolio. By not relying on a single asset or investment, you protect yourself from significant losses if one particular investment underperforms. This balanced approach ensures that your portfolio is more stable and resilient against market fluctuations.

Diversification protects investors against market volatility by ensuring that your investments are not concentrated in one area that could be affected by the same economic or market event. For instance, if one sector or region experiences a downturn, other diversified investments may perform well, balancing the portfolio and reducing the impact of market swings on your overall returns.

Start by engaging an experienced fiduciary advisor to identify the right allocation mix to accomplish your goals within your risk tolerance and timeframe. Remember, the concept is straightforward, but the category selection criteria and the analysis required are complicated.

Effective portfolio diversification involves spreading your investments across different asset classes, such as stocks, bonds, and real estate. Additionally, diversifying within these classes by including various sectors, industries, and geographical regions further reduces risk.

Finally, it’s essential to review and rebalance your portfolio regularly. The key to maintaining diversification is regular monitoring and adjustment of your portfolio to keep it in alignment with your financial goals and risk tolerance.

While diversification significantly reduces the risk of major losses, it cannot completely eliminate it. No investment strategy can guarantee against loss, but diversification can lower the likelihood of severe losses by spreading risk across different investments. It’s a key strategy for managing uncertainty and protecting your portfolio from extreme downturns in any single area.

Regularly reviewing and adjusting your diversified portfolio is essential to ensure it continues to align with your financial goals and risk tolerance. Typically, this should be done annually or whenever you experience significant life changes, such as retirement, a job change, or a major purchase. Regular adjustments help maintain the balance in your portfolio, ensuring it remains optimized for your evolving financial situation.