Sudden wealth is a blessing to many, but sadly it becomes a burden for too many people and has actually ruined lives. You would think that a large sum of money makes life easy; it allows you to pay off debts, quit a job you don’t like, buy some things you’ve always wanted, and perhaps help out some friends, family members, or favorite causes. All those things are possible and many people who become suddenly wealthy do just that. However, understanding how to manage sudden wealth is far more complex than these initial actions. Consider three examples:

- A middle-aged woman won the lottery and received slightly more than $5 million. Within a couple of years, her wealth was spent, and she found herself living in a trailer.

- A retired man was wrongfully injured in a car accident and won $16 million. In less than one year, he was in debt and living on social security.

- And then there's the young tech entrepreneur who received $20 million from an IPO. Within less than one year, he had lost it all.

These are not isolated occurrences. A large portion of those who come into sudden wealth end up losing it all because of their inability to deal with the large sum of practical, financial, and emotional mental health issues involved. There are numerous emotional and financial challenges that are caused by a financial windfall.

So how do you avoid this fate? Here are seven steps to help manage your newfound wealth.

How to Manage a Sudden Wealth Event

First: Don’t Do Anything Right Now

Receiving a large sum of money is usually unexpected, and the news carries a certain shock value. This wealth will disrupt your life as you’ve known it, and there will be a host of emotional turmoil and decisions to make. The first step to managing sudden wealth is to take some time to process the situation and then prepare for how to handle the decisions. Reading this article is a start.

Second: Keep The Newfound Wealth as Confidential as You Can

While taking time to process and compile your wealth management team (see step 3 below), you should minimize the requests for gifts, loans, investment funding, and outright fraud, which every recipient of sudden wealth will eventually have to deal with. Friends and family often ask for help from someone who has come into a windfall. It’s not necessarily selfish or manipulative, but it can be. It is absolutely normal, and you should keep the number of people “in the know” as small as possible while you prepare.

Third: Get Professional Advice

Any significant amount of money will impact your financial situation and your emotions. Financially, this impacts your cashflow, taxes, and the future direction of your financial life. Emotionally, this impacts your feelings as well as the relationships you have with other people. At a bare minimum, you need a great financial advisor and psychologist.

There are only a handful of financial professionals who are capable of helping you manage sudden wealth events. You should have a professional team consisting of a fiduciary advisor and then a qualified certified public accountant (CPA). A fiduciary advisor is legally obligated to act in your best interest. They are 100% objective and will not try to sell you any products. Plenty of salespeople will eventually find you and pitch one product or another. Let your fiduciary advisor sort through what other financial planning products, if any, you need.

A qualified CPA tax planning professional will actually file your taxes each year. Filing these taxes is too complicated for you or a national chain tax professionals.

The psychologist you choose should have experience with “money psychology.” You’ll have to navigate a range of regular emotions, but you’ll also have to deal with the emotions that large amounts of money suddenly triggers. Money is not just paper with green and black ink on it. Money means different things to different people, and there are often unhealthy attachments or triggers. Sudden Wealth Syndrome (SWS) is a condition that afflicts individuals who come into sudden wealth. SWS can bring feelings of loneliness, isolation, depression, and fear among others. A skilled psychologist will help you identify and resist the unhealthy emotions with new wealth.

Fourth: Confirm Your Value System and Goals

Before you go anywhere, you need to know where that is. Most people have a general idea of who they are and what’s important (their value system), and where they’d like to be in 3, 5, or 20 years (their goals). That general sense can be fine when you don’t have a lot of wealth, but it becomes increasingly inadequate as your wealth grows. When you receive sudden wealth, you must quickly confirm your value system and goals. The best way to do that is to write them down.

Here are the key questions you should ask yourself and then write down the answers:

- What do you want your lifestyle to look like?

- What are your goals?

- What resources do you have to accomplish that (which now includes your sudden wealth)?

- How long do you need your money to last?

- Do you have any favorite causes or charities you want to support?

- What do you want to leave as a legacy?

As you think about your specific goals, focus on the short-term and the long-term. What you want to do now may differ from what you want to do in 20 or more years. If you have a family, your immediate focus will probably be on your kids’ needs, activities, and preparation for college or career. Longer-term, you want to set goals for life when the kids are on their own.

Some short-term goals to consider:

- Do you want to continue in your present job, or is there another one you’d like to pursue?

- Do you want to devote more time to some hobbies or personal interests?

- Do you want to go back to school or volunteer somewhere?

- Are there big purchases you’ve always wanted to make?

- Are there specific gifts you’ve wanted to make or friends/family who you’ve wanted to help?

By thinking these through and writing them down, you can focus on developing a plan to really accomplish them. This also helps you resist making impulsive decisions. This is especially important when it comes to giving a large sum of money away or making big item purchases.

If you already know about a family member or friend you want to help, this is probably not an impulsive decision. You’ve been giving it some thought. Receiving sudden wealth allows you to give where you have not been able to. This can be a worthy goal.

Beyond that, you should establish firm parameters around how much money you will give away each year and stick to that budget. This forces a certain discipline so you make worthwhile, not frivolous, gifts. The odds are you will not be able to meet every request for money. That’s how managing a sudden wealth event poorly leads to disaster.

The same is true for big purchases. If you’ve always wanted a boat, nicer car, second home or larger home, etc., the odds are these aren’t going to be impulsive decisions. And within reason, these are OK; they are one of the blessings of wealth.

Too many large purchases are the other reason sudden wealth disappears. Moderation and discipline are the key components to wise decision-making, and writing down the purchases you want to make helps you determine if they will bless or burden you.

Long-term goals are equally, if not more, important. You know where you are, and after you write down your short-term goals, you know what you want to do over the next several months. But after that, do you just want to go from one set of short-term goals to another? The answer should be obvious.

When deciding how to manage sudden wealth, you need a long-term plan based on your goals. This type of financial plan needs to be comprehensive. It should incorporate cash flow, taxes, insurance, investments, real estate, charitable giving, and estate planning. Anything less leaves you wide open to critical mistakes – ones that can kill you financially and have killed others, as we briefly documented at the beginning of this article. Most people with sudden wealth eventually become worse off than when they started.

Fifth: Implement Your Plan With a Fiduciary Financial Advisor

This may seem like a repeat of the third step above, but it’s not. It is an extension of that third step and much more important. Too many people are tempted to try the do-it-yourself route. That may work with play money or fun money – the type you take to Vegas or commit to an “investment club” with your friends. It’s OK to have some fun, but when you get down to seriously implementing your financial plan, you’ll need a fiduciary financial advisor to help you.

You can work with a great advisor to develop a great financial plan, but implementing it wrong will be a disaster. There are too many critical financial decisions regarding investments, taxes, insurance, etc. Seemingly small mistakes in any of these could have significant and far-reaching consequences that extend beyond your life and impact your family for generations.

By way of a quick example, there will be a handful of people reading this article who could build their own house. But most of us realize that after the architect has designed the plan, we need to hire a good contractor to build the house. And there are, unfortunately, lots of shady or incompetent contractors. But if you find a good one, you’ll get your dream home.

The same is true in the financial realm. There are too many people who advertise themselves as “advisors” but who are just product salespeople. They’ll “analyze” your plan and then sell you all manner of financial products you don’t need, which don’t accomplish your goals. A fiduciary advisor with experience handling substantial wealth and personal finance will help you stay on the right path and achieve your goals.

Sixth: Monitor Your Progress Regularly

One of our key principles here at First Financial Consulting is accountability. If we work with a client to determine reasonable goals, we should be willing to be held accountable for actually helping the client achieve those financial goals. This is most important in investing your sudden wealth. A fiduciary should be willing to provide specific average annual returns they are willing to target. The conversation should not be confined to whether you are a “conservative,” “moderate,” or “aggressive” investor. Those terms mean different things to different people, and they actually mean different things to the same person at different stages in their life.

Instead, you need to insist on identifying a target average annual return and the amount of risk you need to accept to achieve that target. Let’s say, and for discussion purposes only, you adopt an 8% target return. Your advisor should be willing to measure investment performance against that goal. If you’re not monitoring your progress against a specific, concrete goal, you risk repeating the pattern of so many recipients of sudden wealth – failure and bankruptcy!

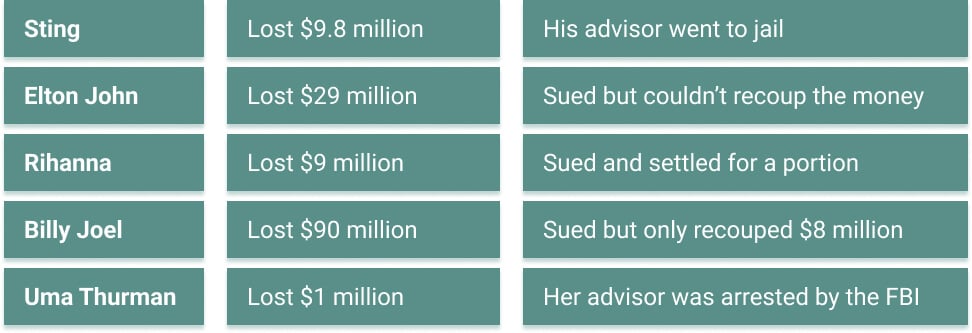

Advisors must be held accountable. Sadly, the list of people whose advisors lost money is long. Just a quick check of “celebrities” who have sued their advisors for mismanagement or outright fraud include:

The list goes on, but the common thread in all of these was the lack of regular monitoring. These celebrities, professional athletes, and many other people who receive sudden wealth, become complacent with their new-found wealth and don’t demand accountability from their advisors.

Seventh (If Necessary): Protect Your Identity

Deciding how to manage this new wealth goes beyond just the financial aspect of dealing with wealth. If you cannot keep your sudden newfound wealth confidential (see second step above), your wealth will attract unsavory attention from con artists, imposters, and potentially even the local news. Several states insist on publishing the names of lottery winners. Other times people express their excitement about receiving a sudden inheritance or winning to too many people.

Whatever the reason, if you feel that too many people know about your situation, you need to take some additional steps to protect your identity. Among the most immediate actions we recommend:

- Change your phone number and make sure the new number is private.

- Change your email address. In fact, open two new ones: a general one for online purchases, necessary enrollments, etc., and a private one for your closest family and friends.

- Change your social media accounts and keep private the ones you can.

- Regularly review activity in your bank accounts.

- Set up credit card alerts for unusual activity.

- Hire a credit monitoring agency.

- Insist on non-disclosure agreements with all your advisors.

- Consider using private security when you go out in public if you’re receiving too much attention.

This list is not exhaustive; there may be other steps you need to take depending on your particular situation and tax considerations, but this is a good place to start if you have concerns about the number of people who know about your sudden wealth.

Need Help Managing Sudden Wealth? We Can Help

First Financial Consulting is a fiduciary advisor, and we pride ourselves on both maintaining our clients’ privacy and accomplishing their goals. We bring objectivity, predictability, and accountability to the sudden wealth management process. Many of our clients were recipients of sudden wealth, and we have been able to help them prosper and keep their unique blessing from becoming a burden. We have over 45+ years of experience. We truly believe we’ve “seen it all,” and if we can help you thrive during this new phase of your life, we’d love to chat with you about our process and unique benefits.

Chris Siraganian is a CERTIFIED FINANCIAL PLANNER™ with First Financial Consulting. Chris helps individuals and families achieve their financial goals and make sense of their financial landscape.

Chris Siraganian is a CERTIFIED FINANCIAL PLANNER™ with First Financial Consulting. Chris helps individuals and families achieve their financial goals and make sense of their financial landscape.