Investing can be a powerful tool for building wealth, but it comes with its pitfalls—especially for new or casual investors. We’ve seen many investors fall victim to common mistakes like:

- Lack of diversification

- Emotional decision-making

- Trying to beat the market

- Overconcentration

- Ignoring fees

- Not rebalancing your portfolio

- Failing to account for tax efficiency

- Not seeking professional guidance

These investing mistakes can hinder long-term success and even derail the most seasoned investment portfolio.

The good news? With awareness and proper planning, you can avoid these mistakes. In this article, we’ll dive into the eight biggest mistakes investors make and provide actionable strategies to help you build a stronger, more resilient portfolio. By steering clear of these errors, you’ll be on a smoother path to financial success.

Key Takeaways

- Many common investor errors can derail your financial goals. Understanding these mistakes is the first step to avoiding them.

- Focusing on a well-thought-out plan that ignores short-term market volatility is key to building a resilient investment portfolio.

- Engaging with a financial advisor can help you avoid costly errors and improve portfolio performance through expert advice on risk management, fees, and tax efficiency.

Lack of Diversification in Investment Portfolio

One of the most common mistakes in investing strategies is failing to properly diversify an investment portfolio. This is a critical breakdown in tactics. Diversification enables investors to mitigate potential risks and preserve the portfolio during a downturn.

Consider the proverb, “Don’t put all your eggs in one basket.” You wouldn’t want to put all of your investment in one company or industry. Doing so would endanger your investment. If that company or industry faces a downturn, so would your entire portfolio.

Instead, you should use diverse asset types and industries. Mutual funds and index funds are two examples of already-diversified assets. But there’s no reason to stop there. You can properly diversify your portfolio by mixing asset classes, such as stocks, bonds, fixed income, real estate, and other types.

How much of a difference does diversification make? Quite a bit. A recent study found that the annualized return of a diversified portfolio is at least 2x higher.

Emotional Decision-Making and Market Volatility

Market volatility—when asset value rapidly changes—can elicit emotional decision-making. For example, when a particular stock skyrockets, it can be tempting to buy more stock before another price increase. And when a bond declines in value after an interest rate hike, it’s incredibly challenging to ignore the impulse to sell. But these decisions are mired in emotion, not strategy.

Emotional decision-making can significantly harm your portfolio. A 2021 report found that 66% of investors regretted emotional-fueled investment decisions. Furthermore, 58% of investors said keeping emotions out of the process improves outcomes. But it isn’t always easy to do so.

Let’s continue with the bond example. When the Federal Reserve raised interest rates, many investors wanted to sell their bonds, which appeared to lose value. However, the investors did not lose value by holding the bonds. If they sold those bonds, then they lost the principle. Meanwhile, holding those bonds until maturity would have allowed them to retain their principal and continue accruing interest.

How can you avoid this costly pitfall? There are a few tactics you can use to reduce emotional decision-making and maintain your portfolio’s integrity:

- Create a clear investment plan and stick to it

- Understand that market volatility is normal and it’s possible to ride out changes

- Automate investments

- Work with a financial advisor to stick to your investment plan or get advice before investing

- Select assets that match your risk tolerance profile

- Diversify your portfolio

- Avoid chasing the market

Market Timing and Chasing Trends

It’s impossible to time the market. Attempting to either beat the market or chase trends can result in several risks. This approach opens you up to emotional decision-making, buying high and selling low, or even missing out on potential gains. There’s a reason that 80% of day traders quit within two years, according to a 2010 paper, Do Day Traders Rationally Learn About Their Ability?

Most investors benefit from a long-term approach rather than depend on short-term investing strategies. Long-term strategies typically ignore daily or weekly market shifts or trends. This enables investors to ignore assets that may be overvalued while limiting the opportunities for emotional decision-making.

The emotional decision-making inherent in market timing can have profoundly negative consequences. Numerous studies have documented the damage market timing does to portfolios, but one stands out.

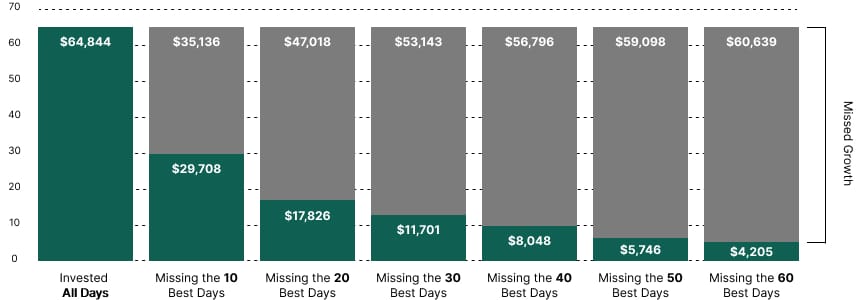

Over a 20-year period of time (from January 2003 to December 2022), a $10,000 investment in the S&P 500 would have grown to $64,844.

If you had tried to time the market and missed just 10 of the best trading days, you would have lost $35,136 of the gain from staying fully invested. Ten days represent only 0.19% of the time; that’s a very small margin of error.

If you had missed 60 of the best trading days, your $10,000 investment would actually have lost value; you would have ended up with only $4,205 of the original $10K. Here again, those 60 days represent a very small 1.1% margin of error.

Market timing’s emotional approach fails because the margin for error is so critically small that it cannot be overcome, except for blind luck, and that’s no way to manage an investment portfolio.

Overconcentration and No Risk Management

Another common pitfall, often related to a need for more diversification, is overconcentration. Overconcentration describes a portfolio that contains assets in too few individual stocks or sectors. This can lead to significant losses if any one stock or sector underperforms.

This problem can be easily fixed by practicing risk management strategies, such as diversifying or hedging. Risk management can mitigate potential threads in your portfolio in multiple ways. For example, you can set stop-loss orders or invest in multiple asset classes.

Ignoring Investment Costs and Fees

Investment costs can eat away at your profit and lower your overall return. Generally, there are a few fees that you want to keep as low as possible:

- The expense ratio

- 12b-1 fees

- Front-load or back-load fees

Most mutual fund investments come with an expense ratio, which is a percentage of your return. For example, your fee might be 0.5% or 0.05%. The lower this is, the more money you make.

Another common fee is the 12b-1 fee, which is a marketing and distribution fee for mutual funds. Front-load fees are one-time fees paid when an asset is bought, and a back-load fee is paid when it is sold. On many brokerage platforms, it’s possible to filter investments for no 12b-1 fee and no front-load or back-load fees when searching for investments on many brokerage platforms.

Another common fee is what you pay your advisor. Some financial advisors advertise “no fee.” However, that’s not entirely true. These “financial advisors” earn commissions based on your investments. In contrast, “fee-only” advisors, commonly known as fiduciaries, do not earn a commission.

While fiduciaries often have a 1% fee, they often have access to higher-quality investments with low fees and reasonable returns. They are also obligated to adhere to your best interests. Fiduciaries grow when you grow, ensuring you get the best investment advice possible at an affordable fee.

The key difference between the fiduciary’s fee and the other fees is the value you receive. A good fiduciary should actually help you achieve your goals, and studies by Vanguard have shown that this can represent as much as 3% per year improved performance. The 12b-1, front-load & back-load fees are sales compensation. You don’t need a salesperson to find good investments, so paying these sales commissions is unnecessary.

Not Rebalancing a Diversified Portfolio

Over time, your portfolio asset allocations change. That’s where rebalancing comes in.

Quarterly or annual rebalancing ensures that your portfolio always aligns with your risk tolerance and investment plan. It helps investors maintain their target asset allocation and reduce risk.

There are “automatic” ways to rebalance a portfolio, but too many of them are too rigid or poorly executed. Instead, a simpler and more consistent way is to use index funds and ETFs in set percentages (your allocation) and then regularly rebalance those index funds or ETFs to your allocation percentage. One of the worst ways to implement proper rebalancing is to use individual stocks and bonds. It simply becomes too complicated to rebalance more than a handful of funds or ETFs.

Failing to Account for Tax Efficiency and Risk Capacity

It’s common to confuse risk tolerance for risk capacity. Risk tolerance relates to an investor’s emotional and psychological comfort with risk. Meanwhile, risk capacity strictly refers to whether an investor can financially handle a risk.

These two terms are confusing, and the lack of understanding around risk capacity often results in poor tax efficiency.

Most investments incur taxes. Investors who fail to consider their post-tax profits may end up investing in tax-heavy investments, thus hindering their returns.

In contrast, focusing on tax-efficient investments and funds can help mitigate tax burdens and ensure each dollar invested goes further.

Not Seeking Professional Guidance

Finally, one of the most significant pitfalls investors face is failing to seek professional advice. Trying to do it all can result in emotional decision-making, irregular investments, a lack of diversification, and several other portfolio issues.

There are many benefits to professional guidance, such as:

- Customized investment advice

- Financial planning support

- Legacy planning support

- Greater confidence in a successful outcome

- Benefits of financial and retirement advice

- Avoid common mistakes

- Valuable insights into the market

Designing a Better Portfolio

From lack of diversification to emotional decision-making and ignoring tax efficiency, investors can easily stress their portfolios and hinder their financial goals. But it’s easier than ever to avoid these mistakes in investing.

Maintaining a basic financial education and regularly checking in on your portfolio can reduce potential stress. Knowing your risk tolerance and risk capacity can further benefit your efforts. Finally, seeking professional guidance from an advisor can help you navigate the market on good and bad days alike.

But it can take a little legwork to find an advisor that fits well with your goals. Discover 20 key questions to ask your financial advisor before you hand over your portfolio information.

Greg Welborn is a Principal at First Financial Consulting. He works with high-net-worth individuals and privately-owned businesses on financial planning issues including investment, retirement, and tax planning, among others.