Working with a financial advisor is a crucial part of achieving financial security. A good financial advisor will help you effectively manage your money. They are your partner to build a future that aligns with your unique goals and values.

But how do you know if a financial advisor will fit your goals and financial situation well? What if you’ve never worked with a financial advisor and have no clue where to start?

This task can be a daunting one. However, choosing a financial advisor that best matches your financial situation, needs, and goals can be as easy as asking the right questions. To help point you in the right direction, we’ve compiled this reference guide of 20 questions to ask a financial advisor in the first meeting.

Critical Questions to Ask a Financial Advisor

Before we get to the list of questions to ask a financial advisor in the first meeting, we wanted to acknowledge that some questions are more important than others. The six questions below are critical questions that need to be addressed before you hire any advisor. They will help ensure that you choose the right financial advisor who has your best interests in mind.

Above all else, these questions to ask a financial advisor will help you decipher between a salesperson in sheep’s clothing and a real financial advisor.

1. Are You a Fiduciary?

Not only is this a good question to ask a financial advisor, but it might be the most important one. When searching for financial advisors, you may have come across the term “fiduciary.” This term is often overused by advisors.

It’s important to understand what it means and how to determine if an advisor follows this standard. There are some key differences between a fiduciary and regular financial advisor.

The fiduciary standard was established by the Securities and Exchange Commission (SEC) and requires advisors to prioritize their clients’ interests over their own. This standard is based on the principles of duty, loyalty, and care, aiming to improve the client experience and ensure advisors prioritize their clients’ needs.

However, adhering to this definition is surprisingly easy. Under the fiduciary standard created by the SEC lies something called the suitability standard. This standard allows some “advisors” to operate in a dual capacity – allowing them to recommend financial products as long as the recommendation is a suitable solution for you.

This is NOT the same as recommending a solution that is in your best interest. This is what makes the second question to ask a financial advisor so important.

2. Will your recommendations be solely in my best interest?

It is absolutely critical that they make recommendations in your best interest, and only your best interest. Unfortunately, many “advisors” are glorified sales reps trying to push annuities, insurance, or other financial products. Imagine going to your doctor with concerns about your heart.

Before running any tests, the doctor tries to “sell” you a pacemaker, and you learn that he represents the pacemaker manufacturer. Hopefully, you’d get out of there as fast as possible; you couldn’t trust the “medical” advice because it was a sales pitch.

The same logic applies to financial advice. Ensure that the advisor is truly an advisor who doesn’t sell products. The advisor needs to be committed to providing 100% objective advice.

3. Have you ever been subject to disciplinary action?

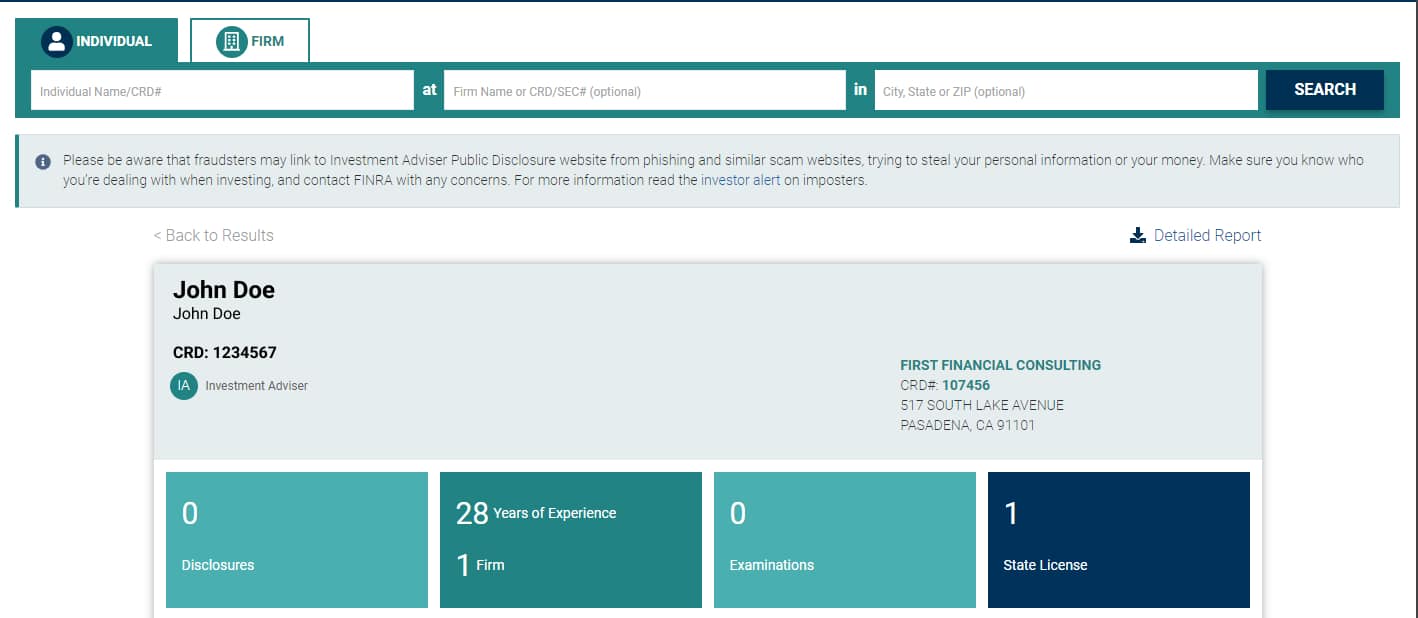

You should also make sure that the advisor has a clean history. The Financial Industry Regulatory Authority (FINRA) allows you to look up an advisor’s background to see if they have any regulatory actions or complaints against them.

A true fiduciary financial advisor should have a clean record. It’s critical to ensure that the advice you receive is in your best interest. To ensure transparency, a good question to ask a financial advisor is about any past complaints they might have.

4. How do you get paid?

Before you work with any advisor, understand exactly how they will be compensated. While we strive to minimize costs, a good financial advisor should be reasonably compensated for the benefits and value they provide.

There’s a difference between working with a fee-based advisor and a fee-only advisor. The latter doesn’t accept any compensation (i.e. sales commission) other than what you pay them.

We identify with each client upfront what services are needed and specifically communicate those costs. Financial planning work is typically charged on an hourly fee basis, and investment management is charged on a decreasing percentage scale as the account value grows.

First Financial Consulting does NOT sell any financial product or receive any commission or compensation from a third party. We provide 100% objective advice untainted by commissions, awards, prizes, or any other form of remuneration that would taint our fiduciary duty and commitment.

5. What credentials should an advisor have?

There are no official designations of “advisor,” “financial advisor,” or “wealth manager.” Unfortunately, it is a title that almost anyone, including product sales reps, can put on their business card or website. That doesn’t mean there aren’t credentials that a true advisor should achieve.

Several certifications provide evidence that the advisor has studied and mastered a body of knowledge, giving them the expertise to become a true, professional advisor. Asking this question to a financial advisor will help you determine if they have the expertise to help you.

At First Financial Consulting, we have found that the certified financial planner (CFP), certified public accountant (CPA), chartered financial analyst (CFA), and master of business administration (MBA) offer the best training, well-rounded focus, and ongoing continuing education requirements to keep us sharp and up to speed.

There are others to be considered, and FINRA provides a detailed list, but we consider the CFP, CPA, CFA, and MBA to represent the crème of the crop. In all cases, though, you should be working with an accredited individual employed by a firm that supports and values the effort required to attain and maintain those designations.

6. Where do you keep my money and how can I see it?

If you are working with an advisor long-term, it is very important that you know where your money is, and you need to be able to verify any claims the advisor makes about your balances. When you ask this question to a financial advisor, they should be able to tell you that an independent custodian will domicile the assets.

The advisor should NOT be able to withdraw funds from your account without your explicit prior approval. The independent custodian will send you monthly statements and provide easy online access so you can check on your money at any time.

First Financial Consulting uses several independent custodians. We help clients open accounts at the custodian and transfer assets into those accounts, but the client retains control of the accounts and the assets. This provides much-needed critical protection.

Bernie Madoff got away with his Ponzi scheme primarily because he served as the custodian and financial advisor. He could make up whatever monthly “statement” he needed to convince clients that their money was growing. Only an independent custodian can provide that check and balance.

Questions to Ask a Financial Advisor in First Meeting

Once you find a financial advisor who is fiduciary and has your best interests in mind, it’s time to meet with them.

Going back to what we said before, you should want to work with a transparent advisor who shares your beliefs, values, and goals. Interview them and include these questions to ask a financial advisor in the first meeting.

7. Are you a wealth manager or just a financial advisor?

Wealth managers are financial advisors, but not all financial advisors are wealth managers. That’s not meant to be confusing; wealth managers are a special group of financial advisors who have experience in successfully working with high-net-worth individuals. Generally speaking, a high-net-worth individual is a person “with at least $1 million in liquid financial assets.”

High-net-worth individuals have unique financial circumstances, so this question for a financial advisor should help you determine if they are suitable for you. It’s important to understand what level of services you need. If you are a high-net-worth individual, you must confirm that your advisor is also a qualified and successful wealth manager like First Financial Consulting.

8. Will your recommendations be confined to just one area, or are they comprehensive?

There are times when you just need advice in one specific area of personal finance. That’s fine. But more often than not – and especially important for wealth planning – you need holistic advice that considers all aspects of your financial situation. The key financial planning services you need as a high-net-worth individual include:

- Investment management

- Risk management

- Retirement planning

- Tax planning

- Estate planning

- Trust services

- Philanthropic planning

Most people need help in several of these areas. Financial planning for high-net-worth individuals need to include all these areas; each is key to preserving and growing your wealth and passing it on to your heirs and favored causes.

Ask your advisor how holistic they are and how much experience they have in each area. It is a good question to ask a financial advisor because it is not sufficient to just “touch” on an area. Advice needs to be thorough, which is something we have been doing for our entire 40+ year history.

9. Can I be sure I won’t run out of money?

If there is any hesitation in the answer to this question for financial advisors, run – don’t walk – to the nearest exit and find another advisor. This idea is the lynchpin of all financial advice. While you’re working, it is easy to rationalize that “I have time to make more money if necessary,” but in retirement, there is a point at which you will not be able to jump back in and make more money.

You need absolute confidence that your assets will meet your needs for the entirety of your life, that the assets will keep pace with inflation, and that your legacy goals will be met. Ask your financial advisor why they are confident you won’t run out of money; don’t just take their word for it.

First Financial Consulting has a proprietary system for determining how our clients will meet all their financial goals; we have provided hundreds of clients over the years with rock-solid confidence that they will not run out of money.

10. How long do your clients stay with you?

Working with a financial advisor typically spans several years. For most of our clients, it has covered decades, and in many instances, we continue to work with their heirs. You should ask your advisor how long they have been in business, whether they’ve built up strong long-term relationships with clients, and how many clients have stayed with them over the years.

If you don’t have an advisor who is successful over the long term, you don’t really have a good advisor. As a general rule of thumb, a great advisor will have worked with the majority of their clients for at least ten years. And don’t be afraid to ask for several referrals to long-term clients. Here again, a little proof goes a long way when you ask this question of a potential financial advisor.

11. How many clients do you have?

This is a good question to ask a financial advisor because it is important to better understand the advisor’s workload and availability. What happens if there is an emergency or you want to schedule a meeting during a naturally busy time of year? If the advisor has too much work on their plate, chances are, you won’t be their highest priority.

12. What is your investment philosophy about active investment management?

We believe that you should always use professional investment management. If you are not a money manager yourself, you will not be able to compete effectively against the professionals who “live, breath, eat, and sleep” investment strategy. You don’t serve as your own doctor; don’t try to manage your own accounts. This is an excellent question to ask your financial advisor because it gives you a deeper understanding of their specific and unique approach.

There are two types of professional investment managers: passive managers and active managers.

Passive managers are tasked with duplicating and mimicking an investment index. For example, a large-cap value manager will mimic that index. Investing in a fund like this gives you broad-based, diversified exposure to this category of investments. You will essentially earn the same return over time as the index does.

Active managers are tasked with beating the index by either investing and earning more or taking on less risk. They should still invest in the same stocks and bonds as the index but have a successful track record of adding return or reducing risk.

At First Financial Consulting, we believe there can be a place for both passive and/or active management. We work with our clients to determine which is best suited to meet their specific investment goals.

13. Do you believe you can “beat” the market?

This is a loaded question to ask a financial advisor in the first meeting in the sense that “beating” can mean different things. Most people assume it means consistently earning more than the stock market. You and your advisor need to share the same investing philosophy on this topic. If you want to “beat” the stock market, and your advisor doesn’t believe this is possible, you’re using the wrong advisor.

We believe it is possible to achieve our clients’ reasonable goals for investment performance. We do not believe it is possible to consistently “beat” the stock market. These are different goals.

We work with clients to establish a reasonable target return and then manage the investment portfolio to achieve those goals. That is how we measure our success: are we achieving the client’s goals.

We most often use passive managers, but in specific circumstances in specific investment categories, we believe that an active manager will add value.

14. Do you guarantee a specific investment return?

If a financial advisor tells you that they can guarantee a rate of return, you should run in the opposite direction. Nothing in investing is guaranteed. The financial markets can be impacted by numerous different factors, many of which are outside the control of the advisor. Claiming that you can guarantee a specific investment return is a red flag that usually indicates fraud or the sale of investment products.

15. How often will I hear from you?

Communication is critical, and your advisor needs to match your expectations. Don’t be afraid to ask how often they will initiate contact with you. And don’t be afraid to tell them what you expect. Your financial future is shaped by their work, so it is important to ask a financial advisor how communication works.

If the advisor hesitates at all in agreeing to meet your needs, the odds are that they will eventually fall short.

As a wealth manager, First Financial Consulting is very purposeful in communicating with clients on at least a quarterly basis. In terms of heightened economic uncertainty, we communicate even more frequently.

16. How often will you update my financial plan?

A holistic financial or retirement plan is an important tool and is indispensable for high-net-worth individuals. However, it is not a “set-it-and-forget-it” plan. It needs to be updated regularly. How often it is updated will depend on the client’s financial needs.

At a minimum, you should know that your advisor will talk to you about updating the plan every 2-3 years. This is another area where you should communicate your expectations clearly. You can also check out our list of questions to ask a financial advisor about retirement.

17. When I call to ask a question, will I talk to you?

When you have questions, you deserve a prompt and accurate answer from someone who knows your financial circumstances. You should expect to hear from the advisor if your question concerns performance or planning issues. If your question is more operational in nature (how do I make a withdrawal), you might be better off talking to the staff person who handles those items.

As a follow up question, ask your advisor how they have organized their teams. There is no “right” answer here, but you need to get an answer to know who to call or email.

At First Financial Consulting, our advisors and staff are organized to effectively address client needs, concerns, and questions. And every client is introduced to the team members who will handle all these issues. We pride ourselves on truly “knowing” our clients and our clients “knowing” us.

18. How do you minimize costs?

A fiduciary will always try to reduce your costs because it is in your best interest to do so. This is a great question to ask a financial advisor because it helps you to understand how they operate. Because First Financial Consulting also sets specific target return goals for our clients, it is also in our best interest to reduce fees so we can achieve these goals.

There are different types of costs – transaction fees, mutual fund fees, taxes, etc. – and we are very conscious of minimizing costs in all areas. We would be happy to share with you in greater detail how we minimize extraneous costs, and this is a conversation you should have with any advisor you use or are considering.

19. Do you have a minimum asset requirement?

As part of the fee discussion above, you must understand whether your advisor is set up to handle your situation. While we do not have a specific minimum account requirement, most of our clients require holistic, comprehensive services that usually cost an average flat fee of $5,000/yr.

20. How long have you been an advisor and wealth manager?

First Financial Consulting has served clients since 1975 in both capacities: as a financial advisor and as a wealth manager for high-net-worth clients. We believe you should choose an advisor or wealth manager who has sufficient experience and history. This way, you are confident they can handle the intricacies and complexities of your situation. Not all history is the same, so ask about the advisor’s specific experience in the areas you need assistance.

Why First Financial Consulting is the Best Choice to be your Advisor

We have worked very hard over many years to establish and maintain a truly unique firm dedicated to helping clients achieve their goals. We are wealth managers in the very best sense of the word, providing holistic and effective advice in all critical service areas.

As fiduciaries, we are 100% objective and zealous in protecting that reputation. Our interactions with clients are focused on regular and frequent communication. We aim to give every client the confidence they are on track to achieving their dreams.

We believe we are especially well suited to offer wealth management services to high-net-worth individuals. We would truly love to begin a conversation with you about your specific situation, goals, and concerns.

Christian is an advisor with First Financial Consulting. He uses a comprehensive planning approach to help individuals and families accumulate, distribute, and protect their wealth throughout all stages of life.

Christian is an advisor with First Financial Consulting. He uses a comprehensive planning approach to help individuals and families accumulate, distribute, and protect their wealth throughout all stages of life.

FAQs | Questions to Ask a Financial Advisor in First Meeting

The answer to this question completely depends on the advisor. At First Financial Consulting, we don't typically request documents in the first meeting. Again, this first meeting is meant for us to get to know one another.

Feel free to always bring any documentation you think might be helpful. If you have any questions about bringing something beforehand, please don't hesitate to ask.

The first meeting with a financial advisor is a crucial step in laying the groundwork for a successful relationship. It helps both you and the advisor gather information, assess the advisor's expertise and approach. It also ensures that you are working with a professional who can help you navigate your financial journey effectively.

First and foremost, ensure that you work with a fiduciary, fee-only financial advisor. Someone who is legally required to keep your interests above their own.

Once that's out of the way, ask about the advisor's credentials, experience, and professional affiliations. Look for designations like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA). This ensures they have undergone rigorous training and adhere to ethical standards.

Financial advisors typically charge differently depending on the type of work. Financial planning work is typically charged on an hourly basis or flat fee. Investment management is typically charged as a percentage of assets under management - scaling down as the account value grows.

Understanding the advisor's investment philosophy is essential to ensure it aligns with your risk tolerance and financial goals. Ask the advisor about their approach to asset allocation, diversification, and risk management.

The frequency at which a financial advisor communicates with you depends on a number of factors. As a general rule of thumb, your advisor should communicate with you whenever a serious change is needed in your financial plan of investment portfolio. Generally, we suggest one touch point per quarter.

A financial plan should be updated regularly. How often it is updated will depend on the client’s needs. At a minimum, you should know that your advisor will talk to you about updating the plan every 2-3 years.

You should always work with someone who has your best interests in mind. A fiduciary advisor is legally required to do just that. A fiduciary advisor will never sell financial products and will always ensure that their recommendations are in your best interest.