With over $36 trillion in wealth expected to transfer from American retirees to their beneficiaries, it’s surprising that only 32% of Americans have an estate plan in place. Many avoid the process due to misconceptions such as not having enough assets, procrastination, or concerns about cost. However, creating an estate plan is essential for everyone, no matter your financial situation.

An estate plan is a powerful tool to ensure your assets are distributed according to your wishes, while also easing the emotional and financial burden on your loved ones. It can help avoid the complexities of probate, minimize family disputes, and preserve your legacy.

Whether you’re new to estate planning or updating an existing plan, following a clear checklist will help you organize your documents, make informed decisions, and work toward a smooth transition for your beneficiaries. From drafting wills and trusts to selecting key decision-makers and minimizing taxes, a comprehensive estate planning checklist will ensure you’ve covered all the necessary steps for long-term peace of mind.

Key Takeaways

- Estate planning is more comprehensive than writing a will and can include one or more trusts, powers of attorney, and succession planning.

- Maintaining an estate plan can reduce stress for your loved one, preserve your legacy, and avoid probate.

- Financial advisors specializing in estate planning can provide strategic advice for navigating complex estates and save you significant legal costs.

First: Understanding Estate Planning

Estate planning is the process of organizing your affairs in the event of your death. Typically, this is done to ensure loved ones – people and pets – are cared for. In some cases, your estate plan may also be used to facilitate end-of-life care in the event of your incapacitation. Incapacitation is a broad definition but generally refers to a state in which a person cannot make informed decisions – such as living with Alzheimer’s or the effects of a stroke.

The estate planning process involves creating a comprehensive plan using wills, trusts, powers of attorney, and other key estate planning documents.

While not as labor-intensive as your financial plan, estate plans are also long-term, ongoing plans that need to be reviewed over time. It’s critically important to update your estate plan regularly to reflect changes in your life and/or changes in estate tax law.

Gathering Information and Estate Planning Documents

The first thing to do is to take an inventory of your assets. These assets can include real estate, vehicles, and personal property. You’ll want to have a list of your bank, investment, and retirement accounts.

Traditionally, most write this down using pen and paper. However, it may be easier to use a spreadsheet or online tool.

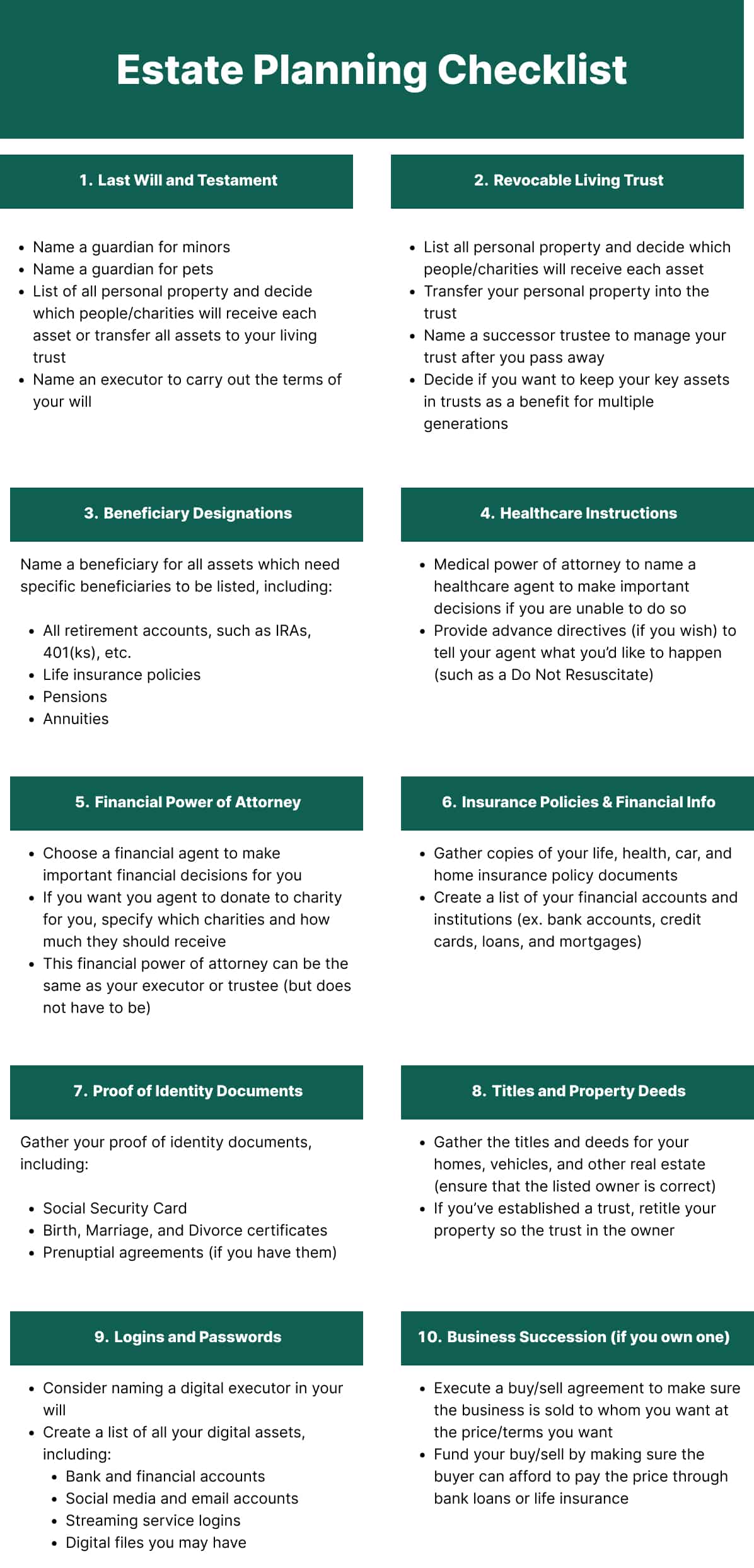

Estate Planning Checklist: Key Documents You Need

The estate planning checklist below provides a more in depth overview of what estate planning documents you’ll need throughout the process.

Next, you’ll want to gather key family information. For family and friends listed in your estate plan, you’ll want to list their:

- Names

- Phone numbers

- Emails

- Addresses

- Relationship and beneficiary information

Draft Essential Estate Planning Documents

A comprehensive estate plan has three basic components: wills, trusts, and powers of attorney.

Contrary to popular belief, your estate plan does not end with the will. Instead, the will is the starting point of your estate plan. It will outline how you want to distribute the assets you own in your name after your death.

A more robust estate plan will include at least one trust to handle the assets you own through that trust. A trust is a more extensive version of a will that becomes appropriate when your net worth exceeds the probate limit. Not only does it offer more flexibility and control of your estate, but it also helps to avoid costly and cumbersome probate courts. A trust may also minimize taxes.

Larger and more complex net worths may require additional trusts to help minimize taxes and provide additional benefits to your heirs.

Finally, you’ll need to draft two powers of attorney – a medical power of attorney to ensure your healthcare wishes are respected and a financial power of attorney to ensure your financial wishes are respected. The person you choose to have as your power of attorney may be a close friend, family member, or advisor.

Ideally, this person will be trustworthy, live nearby, and be communicative and assertive. They may face pressure from others to go against your wishes – they should be strong enough to hold their ground. You can also choose different people for these roles. The person helping with healthcare issues does not need to be the same one who handles financial decisions.

Choose Decision-Makers and Beneficiaries

Selecting a responsible estate administrator is critical to the success of your estate planning. This individual will serve as your estate executor and/or trustee. It’s common to name a close friend and family member you trust to fulfill your wishes. This person, however, should also have the ability to execute your estate and should have access to your estate planning documents.

For the more robust or complex estates, you may use multiple trustees (co-trustees) and several layers of trustees. For example, you may want to have a family member or friend serve as your trustee and a professional co-trustee to help with some of the financial, investment, and tax decisions. You should also consider who would replace these co-trustees should they resign, become unable to serve, or need to be removed because of malfeasance.

As your net worth and estate increase in value, you can very quickly hit the level where co-trustees and successor trustees become imperative for your estate’s smooth administration and management. Failing to anticipate this is a common mistake for high-net-worth families.

Next, you’ll want to designate beneficiaries for your life insurance policies, retirement accounts, and other financial assets. Here also, you may need to go several layers down and consider naming contingent beneficiaries if your primary beneficiaries pass away before you or if they decline your assets.

Beneficiary designations have a significant impact on your estate plan. These designations may take precedence over what’s specified in your will. While in most instances, you will want to avoid naming your estate as a beneficiary, sometimes it makes sense to name your trust as a beneficiary.

You’ll also want to review and update your beneficiary designations regularly.

Estate Planning for Specific Situations

Some instances require additional considerations. Estate planning for business owners and tax mitigation both need extra attention.

Estate Planning for Business Owners

Business owners often require additional estate planning steps, such as succession planning and a business valuation. Remember that who owns your business can be different than who runs it. Succession planning needs to deal with both of these roles. You might want family members to own all or part of your business, but they may not have the ability or desire to manage it when you pass away.

If your business value is substantial, you may want to consider drafting a buy-sell agreement to ensure the smooth transfer of ownership. A buy-sell agreement is a contract that explains exactly what should happen if an owner leaves the business.

You should also consider developing a funding plan for the buy-sell agreement. As important as it is to nail down who will buy your share of your business if you pass away, it’s even more important to ensure that person has the financial assets or bank lines of credit to afford to buy the business.

Here, you’ll also want to regularly update these plans to adjust for changes in the business’ value, tax laws, and regulations, as well as to ensure the financial arrangements keep up with the changes in business value.

Minimizing Estate Taxes

Estate taxes can be a significant burden and cut into your legacy. At certain times in our country’s history, the estate tax forced families to sell farms and businesses that had been in the family for generations. In these cases, the families did not have sufficient liquid assets to pay the tax and had to sell to raise that cash.

Typically, some assets are excluded from the estate tax, and the balance after that exclusion is subject to the tax. The brief recap below shows how the exemption amount and tax rate have changed in recent history.

| Year | Exclusion | Max Tax Rate |

|---|---|---|

| 2001 | $675,000 | 55% |

| 2003 | $1 Million | 49% |

| 2008 | $2 Million | 45% |

| 2010 | Repealed | 0% |

| 2011 | $5 Million | 35% |

| 2018 | $11.1 Million | 40% |

| 2024 | $13.6 Million | 40% |

| 2025 | $13.9 Million | 40% |

If you are subject to this tax, estate tax planning becomes a critical component of your overall estate plan. Even if you are not subject to this tax today, keep in mind that future growth in your asset values could put you over the top in the future.

One of the keys to successful estate planning is planning with the right future in mind. This is where an experienced team of financial advisors and an estate planning attorney can provide tremendous benefits and help you avoid estate taxes and potentially avoid the death tax.

Attorneys know the law, but a key advisor knows your assets, cash flow, and legacy plans and can help you project what your future net worth is going to look like at various points in the future. While today is important, tomorrow is more important when it comes to effective estate tax planning.

An experienced team can help you take advantage of various state exemptions and deductions that may reduce your tax liability. They will also look at other strategies to help reduce your estate tax and/or prevent future growth in your estate from becoming taxed.

Among techniques your team should consider are leaving your assets to a surviving spouse, lifetime annual and exemption gifts, residence trusts, structured private annuities, limited partnerships, insurance trusts, and charitable trusts, to name just a few. Your advisor will propose the strategies that best fit your specific situation.

Reviewing and Updating Your Estate Plan

It’s common to review your estate plan at least once every 2-3 years. Significant life events, such as a marriage, divorce, or new child, can also impact your plan. Another consideration is tax and regulatory changes – which should be reflected in your estate planning to avoid potential penalties, fees, and confusion.

Updating your estate planning documents ensures they remain accurate, effective, and tax-compliant.

Final Thoughts on Estate Planning

Estate planning is essential to providing peace of mind and ensuring your loved ones are taken care of. Because of the complexities of both the estate tax laws and the financial assets most affluent or high-net-worth individuals have, working with a team that includes an estate attorney and a skilled financial advisor generally gives you the best outcome. This estate planning checklist should only serve as a guide.

Successful estate plans reflect both the tax laws and the unique composition of your specific assets, earnings, and cash flow, as well as your specific goals for how your legacy is to be preserved, managed, and protected.

At First Financial, our team of fiduciary advisors has helped clients develop and manage successful financial and estate plans for over 45 years. We’ve helped our clients avoid common estate planning mistakes and we understand the importance of protecting your loved ones financially and emotionally during your passing, and we know that proper estate planning can help.

Schedule your complimentary consultation today and learn more about the estate planning process.

Greg Welborn is a Principal at First Financial Consulting. He has more than 35 years’ experience in providing 100% objective advice, always focusing on the client’s best interests.

Greg Welborn is a Principal at First Financial Consulting. He has more than 35 years’ experience in providing 100% objective advice, always focusing on the client’s best interests.

FAQs | Estate Planning Checklist and Documents

Estate planning is the process of organizing your assets and outlining your wishes for how they will be managed, distributed, or preserved in the event of your death or incapacitation. It includes documents like wills, trusts, and powers of attorney.

Estate planning ensures your loved ones are cared for, helps avoid the cost and delays of probate, minimizes taxes, and reduces the financial and emotional burden on your family during difficult times.

An estate planning checklist helps ensure all key elements are covered. Here’s what to include:

- Asset Inventory: List all your physical assets and digital assets, such as real estate, investment accounts, personal property, bank accounts, and retirement plans.

- Beneficiaries: Identify primary and contingent beneficiaries for all financial accounts and policies to ensure assets are distributed according to your wishes.

- Key Estate Planning Documents: Draft essential legal documents, including a will, one or more trusts, and powers of attorney for healthcare and financial decisions. You also need important financial information, like bank and other financial accounts, insurance policies, credit card info, and mortgage documents.

- Decision-Makers: Appoint trusted individuals as your executor, trustee(s), and powers of attorney to carry out your wishes and manage your affairs.

- Plan Updates: Review and update your estate plan periodically - at least every 2 - 3 years or after significant life changes - to keep it current and effective.

A will and a trust serve different purposes in estate planning. A will outlines how your assets will be distributed after your death, names an executor, and can appoint guardians for minor children. However, it only takes effect after your death and must go through probate, which can be time-consuming, costly, and public.

A trust, on the other hand, allows you to manage and distribute assets during your lifetime or after your death, bypassing probate. It offers greater privacy, flexibility, and control over how and when your assets are distributed. Trusts can also help minimize estate taxes and protect assets from creditors.

Most comprehensive estate plans use both a will and one or more trusts to ensure a smooth transfer of assets while addressing specific needs. Consulting with an estate planning professional can help you decide which is right for you.

It’s recommended to review your estate plan every 2–3 years or after significant life events such as marriage, divorce, the birth of a child, or changes in tax laws.

Probate is the legal process of validating a will and distributing assets under court supervision. It can be time-consuming, expensive, and public. Proper estate planning, such as using trusts, can help avoid probate.

When choosing an executor or trustee, pick someone who is trustworthy, organized, and capable of managing financial and legal responsibilities. For more complex estates, consider appointing co-trustees, including a professional fiduciary.

Minimizing estate taxes involves strategic planning to reduce the taxable value of your estate. Common strategies include making lifetime gifts to beneficiaries, establishing trusts like irrevocable life insurance trusts, and utilizing spousal exemptions or charitable giving. These methods can significantly lower the estate tax burden while preserving your legacy. Consulting a financial advisor or estate planning attorney ensures these strategies are tailored to your specific needs and compliant with current laws.

Yes, business owners should include succession planning, business valuations, and buy-sell agreements in their estate plans. These ensure a smooth transfer of ownership and management after their passing.