Which Pension Option Should You Choose

If you have a pension and are retiring or changing jobs, you have a very important decision to make. Pension plans give you an option of how you want to receive your benefit. The decision you make will have far-reaching consequence for your financial future. Be very sure you make the right decision.

What Is A Pension

The key question is whether you have a pension. Many people believe they have a pension, but they usually use the terms “pension,” “retirement plan,” and “401K” interchangeably. They are not the same, and the options you have are not the same.

Retirement plan is the generic term for a category of accounts which provide specific tax breaks for people saving for retirement. 401(K)s, profit sharing plans, IRAs, SEPs and pension plans are simply different types of a retirement plan. We will confine our comments in this blog post to pension plans because they are so unique from the others.

Breakdown in Account Balance Ownership

Most of the other types of retirement plans are plans in which you own your account balance. Whether you have made contributions and/or your employer has made contributions, when you receive a statement it shows you exactly how much is in your account. Sometimes the employer’s contributions are owned by the employer until you’ve worked there long enough, but eventually – if you stay with that employer – you will own 100% of the employer’s contribution. The amount you contribute is always owned by you, but you may have to wait up to 6 years before you own 100% of the employer’s contribution.

In a pension plan, you do NOT own any account balance. Yes, you receive a statement (at least yearly) showing your “balance,” but if you read the statement carefully, it will confirm that you don’t own any balance. What you do own is a “benefit”. Pension plans are retirement plans which promise to provide you with a certain benefit once you’ve retired and turned a certain age. There are a lot of different formulas, but one of the more common ones would be a monthly benefit equal to 80% of the average amount you earn each month as an employee over the last 3 years of your employment.

That’s great, but what is that? Employers, which offer pension plans, hire actuaries to calculate an estimate of that benefit and what its value is today. So, the statement you receive shows the estimated value of the benefit, not an actual account balance.

Lump Sum vs Monthly Pension Distribution

When you retire or leave the company, you will typically be provided several pension plan options for how you can receive your benefit. The two most common options are lump sum and monthly distribution. Here’s a quick break down of lump sum vs monthly pension options:

- Lump sum – you can choose to receive one payment which is equal to the present value of the promised benefit.

- Monthly distribution – you can choose to receive the value of your promised benefit in the form of monthly payments for the rest of your life (see more on this option down below).

If you choose to take one lump-sum payment, you can deposit that payment into an IRA account. If you do this, you control that IRA and you get to decide how to invest the money. You also get to decide how much to withdraw each year to meet your needs, although at a certain point the IRS forces you to take a required minimum distribution and you get to leave something to the kids or grandkids if you want.

In short, you get to take control of your retirement plan assets and therefore take control of your financial future. Once you take the single payment, you are no longer dependent on how successful your old employer is. They could go bankrupt the day after, and you would not be affected.

If you take the monthly payment option, then the company will keep control of how the money is invested; they are responsible for paying you the monthly benefit, which you cannot change; you may or may not be able to leave something to the kids or grandkids; and if the company falls on hard times, your benefit may be in jeopardy.

Pros and Cons of Lump Sum vs Monthly Pension Distribution

The biggest benefit of the single, lump-sum payment option is that you retain control of the money. You can invest it, keep up with inflation, grow it, change how much you withdraw, and leave some for the kids or grandkids.

The biggest drawback of the single, lump-sum payment option is that you might not invest it well.

One big benefit of the monthly payment option is the knowledge that unless the company goes under, you should receive income and cashflow consistently for a certain number of years.

The biggest drawbacks of the monthly payment option are that you cannot change how much you receive each month even if inflation drives up living costs; you may lose your benefit if the company goes under; and you may not be able to leave anything for the kids or grandkids.

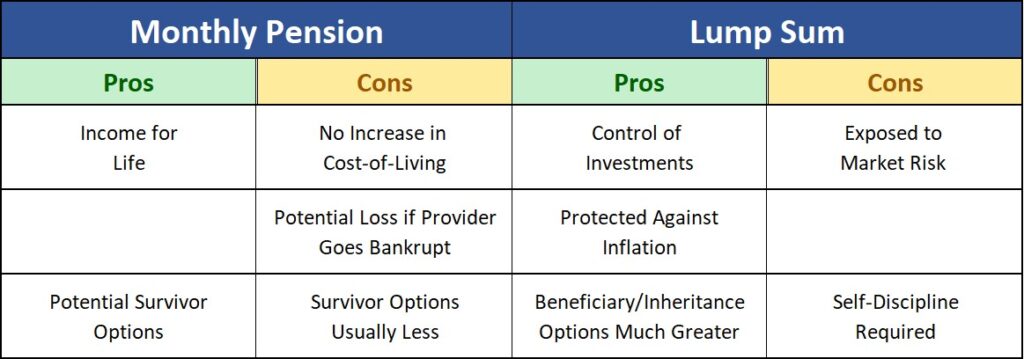

The graph below helps illustrate some of the pros and cons to each pension option.

Variations On The Monthly Pension

While the single, lump-sum pension payment plan option is fairly straight forward, the monthly payment option can actually contain several sub-options; they are simply variations on the theme.

Single Life Annuity

If you select this sub-option, the company agrees to pay you a monthly benefit for as long as you live. If you’re married, or have kids, they will not receive any payments after you die, whether that is in one month or way down the line. As long as you are alive, the company agrees to pay you.

Joint and Survivor Annuity

If you select this sub-option, you tell the company which other life you want included (usually a spouse). The company agrees to pay you a monthly benefit for as long as you OR your spouse is alive. Whichever of you dies first, the survivor will still receive a benefit payment. But the payment is often smaller for the survivor.

Period Certain Annuity

If you select this sub-option, the company agrees to pay you a monthly benefit for however many years you select. Usually, you can choose from between 5 years to 20. No matter what happens to you or your spouse, the company will make payments for the selected number of years. With this sub-option, your kids or grandkids could receive benefits if you passed away early. But when the selected number of years has passed, the payments stop no matter who is alive.

Combinations

It is possible you can combine the sub-options. There are lots of possibilities, but let’s assume you select a “joint and survivor with 10 year certain” annuity. The company will pay a benefit for as long as you or your spouse are alive and for a minimum of 10 years. So, if something happened to both of you within the 10 years, the company would continue to pay benefits for the full 10 years. On the other hand, if either of you lived beyond 10 years, the company would continue to pay benefits until the survivor has passed away.

Benefit Amounts Change

It is extremely important to realize that the monthly benefit amounts change depending on which sub-option you choose. This is one of the greatest complicating factors. Typically, the single life annuity provides the largest monthly benefit, but it also represents the greatest risk.

So… Which Option Is Best For You?

As you may have guessed by now, this is not an easy question to answer. Your unique situation will determine which pension plan option is most likely to be the best. If you are working with an investment advisor and have confidence in your investment strategy, taking the lump-sum, single payment option will most likely allow you to maximize your benefit.

If on the other hand your greatest fear is outliving your money and you’re willing to sacrifice a bit of value in order to gain confidence, one of the monthly payment options may be best for you. The kids and grandkids might not receive an inheritance, but you’d know that there should always be some amount of income each month for you. In selecting a monthly option, you will need to consider your age, what other income sources exist, the likelihood that inflation may grow in future years, and what other assets you have to fall back on if necessary.

In short, you need to conduct a thorough review of your financial situation and your plans for the future. The good news is that an experienced and objective financial advisor can help you. We’ve conducted many of these reviews for clients, and we never try to sell any product or compromise our objectivity.

Greg Welborn is a Principal at First Financial Consulting. He works with individuals and privately-owned businesses on financial planning issues including investment, retirement, and tax planning, among others.

Greg Welborn is a Principal at First Financial Consulting. He works with individuals and privately-owned businesses on financial planning issues including investment, retirement, and tax planning, among others.