Retirement planning is crucial for building and funding the type of life you want to live after exiting the workforce. By making effective investments, addressing potential risks, and understanding available benefits, you can get closer to that goal.

Retirement planning is different for everyone because everyone has different wants and needs for their golden years. It’s absolutely vital to make a retirement plan that’s based on your desired lifestyle, interests, and potential risks.

That said, there are common retirement planning mistakes you need to avoid. These foundational issues can lead to a variety of negative outcomes. At the same time, they can usually be accounted for and avoided by working with a qualified retirement planner.

Let’s take a closer look at seven crucial retirement planning mistakes and how to avoid them.

Retirement Planning Mistake No. 1: Not Setting and Updating Specific and Clear Goals

We list this as mistake #1 because it is so foundational. If you don’t know where you’re going, how can you possibly hope to get there? It’s also common sense, but you’d be surprised how many pre-retirees have not gone through a goal-setting exercise. According to the U.S. Department of Labor, “only half of Americans have calculated how much they need to save for retirement.” That’s a primary goal for retirement planning, but notice that it’s also a specific goal.

Retirement goals need to be SMART, but we don’t mean they need to be brilliant as opposed to stupid. We mean retirement goals need to be:

S – specific

M – measurable

A – achievable

R – relevant

T – time-bound (they have a deadline)

An excellent illustration of a SMART goal is, “I aim to amass $1 million within 20 years to maintain my annual living expenses at $50,000.” This goal is characterized by its specificity, measurability, attainability (given the typical timeframe for middle-income households), relevance due to its direct connection to the required living standard, and time-bound nature thanks to the established deadline.

Now let’s alter this goal a bit to demonstrate what would NOT be a SMART goal:

- "I want to accumulate enough money to retire." – this is not specific, measurable, relevant, or time-bound.

- "I want to accumulate $1 million in 2 years…" – this is not achievable for most middle-income households

- "I want to accumulate $1 million in 20 years because I read that's a good amount to have." – this is not relevant because the goal is not related to a living standard. $1 million may or may not be enough, depending on how much you need each year in retirement

Specific and clear retirement goals let you then develop an action plan to help you actually achieve financial security, and they provide the basis for performance measurement; once you have a clear goal with a timeframe, you can measure how well you’re doing – or whether you need to make some corrections.

If you fail to set effective goals when planning, the odds are overwhelming that you will not be able to retire successfully when you want and in the manner you want. Failure can be extremely painful; some retirees actually run out of money and have to move in with relatives or significantly reduce their living standards.

Retirement Planning Mistake No. 2: Putting Off Retirement Planning

We mentioned above that trying to accumulate $1 million in 2 years was unreasonable for most people, but what happens if you set that as a goal for 3 years? Or 5 years? Or 10 or 20 years? When does it become reasonable?

Putting off retirement planning increases the probability that you will not be able to accumulate sufficient retirement savings to fund enough retirement income. The earlier you start your retirement planning, establish retirement goals, and actually begin saving money, the easier it will be to retire successfully.

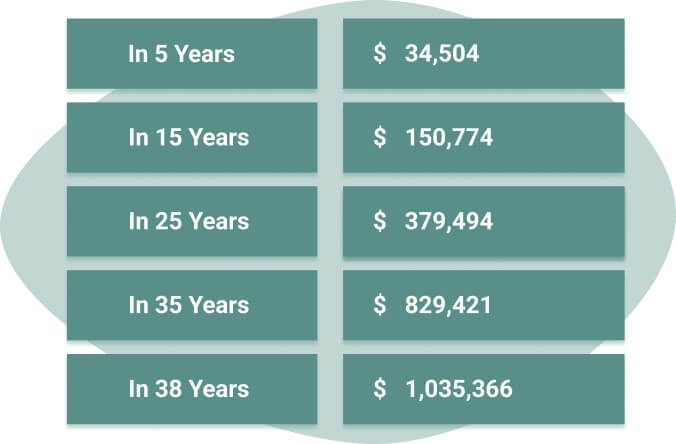

Consider the benefits of having more time. Let’s say you can save $6,000/year and earn 7% per year on your retirement savings. Here’s what you’d accumulate:

It should be obvious why having time to plan and implement strategies is valuable. The more time you have, the more you will be able to accumulate easily. Realistically, the best time to start is in your 20s. In the example above, if you started this program at age 20, you’d easily hit the $1 million mark by age 58. If we continue the calculations to the “normal” retirement age of 65, you’d have accumulated $1,714,495.

The longer you put off planning, the worse this retirement mistake becomes. What if you start saving for retirement at 50? You lose time to accumulate and fund your retirement account, making it harder to save enough for retirement. It’s human nature to let your living standard rise as your income increases.

Typically, as you get a raise, you start spending a little more. All of a sudden, you can wake up 10 years later, very comfortable with all the stuff you buy, and realize you need to cut back in order to start saving enough. Cutting back is infinitely harder than going without in the first place.

Postponing retirement is a triple threat; it decreases the amount of money you can save, it reduces the time your savings have to grow, and it’s emotionally harder to make adjustments. Any type of financial plan is better the earlier you start, but for retirement planning, it is especially critical.

Retirement Planning Mistake No. 3: Not Accounting for Major Costs in Retirement

As important as it is to understand what your normal living standard is – and projecting it into your retirement years – that’s not enough. When people think about their normal living expenses, they think about “normal” stuff. Groceries, mortgages, automobile maintenance, etc., are regular occurrences; almost everyone can identify these items. A few people even list the old water heater or roof repair. These are major costs that are relatively obvious.

Unfortunately, the obvious major costs are just the tip of the iceberg. To fully understand your cost of living standard in retirement, you need to capture your normal expenses, the obvious major costs, AND the less obvious major costs. Here’s a partial list of major costs which most people miss:

- Long-term care costs

- Assisted living facilities

- Increased healthcare costs

- Commitments to support children or grandchildren

- Taxable income on retirement account withdrawals

- Home modifications for wheelchair access or to provide mobility assistance

This list isn’t meant to be exhaustive, but it is meant to illustrate the expense items that most people still in their working years fail to anticipate.

There are also other changes which you might want to take into consideration. Many retirees want to travel or entertain more once they’re retired. The working and child-rearing years are filled with demands that consume your time.

When you finally retire, you typically will have more time. But do you want to sit in a rocking chair on the porch 12 hours a day? Or can you really play golf 8 days a week?

Chances are you may want to take a few more trips or go out with friends more often. These expenses are voluntary, but they are among the things that create a satisfying retirement.

All these expenses need to be built into your retirement accounts. The retirement portfolio you build needs to sustain all your living expenses – from the normal, major, and voluntary ones. Typically, some expenses go away or can be reduced in retirement.

Life insurance needs are typically less in retirement. And once you start withdrawing from your 401k, IRA, or Roth IRA, you probably won’t contribute to them simultaneously.

The trick to avoiding this retirement mistake is to take the time to think through what retirement will look like and what you want it to look like. Your retirement plan should include all these items – the increased costs and the savings. If you don’t get this right, then one of the critical planks of your retirement plan is wrong, and you may jeopardize your entire retirement.

Retirement Planning Mistake No. 4: Not Investing With Retirement In Mind

Investing successfully is not a set-and-forget proposition. Investment strategies that are appropriate in your early career years may be complete disasters in the retirement years. The right investment strategy and plan depend on your earnings goal, comfort level with risk, and liquidity needs. All three of these can change over time.

When accumulating assets for retirement, you need to purposely develop an investment strategy to grow your retirement savings. If you’re too focused on preserving principle, you’ll fail to keep up with inflation. If you don’t properly diversify your portfolio in this stage, you may fail to accumulate sufficient assets for retirement.

When you retire and need to start withdrawing from your retirement nest egg, you need an investment strategy that provides sufficient liquidity for withdrawals, even if the market or economy is down. You may create unnecessary investment losses if you don’t properly diversify at this stage.

But in addition to investment earnings, you need to feel comfortable with your investment strategy. Everyone makes decisions using both their head and their heart. Your investment plan needs to meet the earnings goals and provide liquidity, but it also needs to balance head and heart. If you don’t have the right balance, you won’t maintain your investment plan when the economy or stock market takes a dive, which it does occasionally.

Throughout your investing life, your financial situation changes. It is very common that even if your retirement goals stay the same, your willingness to tolerate investment risk may decrease. Your investment portfolio needs to change accordingly. Stocks may be very appealing in the early years, and while some amount of stocks are still necessary in retirement for most people, there are times when you should consider more exposure to fixed income.

One additional caution is appropriate here. As you approach retirement, you will inevitably receive more ads and sales calls hyping the benefits of “guaranteed income.” Guaranteed income is most often jargon meant to push annuities.

Some annuities are appropriate in some instances, but they are very limited. We’ve covered the dangers of annuities in retirement before. Beware of tantalizing presentations offering anything “guaranteed.”

Investing with retirement in mind should also include an assessment of any retirement benefits available to you from pensions or other employer sponsored retirement accounts. The amount of these benefits – if any – impacts your liquidity needs and risk tolerance.

Retirement Planning Mistake No 5: Miscalculating the Length of Retirement

You will probably live longer than you think. Advances in medical science and healthier lifestyles have combined to dramatically increase life expectancy. This is good news. You will have more time to enjoy retirement, spend time with your partner, and spoil the grandkids. Even if you already know that you probably haven’t factored in how much better it may get.

The “average American lives to an age between 75 and 80.” If you make it to age 60, however, men can expect to reach 82, and women 85.

Those extra years mean you need more money to fund those extra days in the sun. Those extra years also mean more inflation; inflation reduces the effectiveness of Social Security benefits, eats away at the value of your retirement savings, and further increases the amount you need to withdraw each year. Healthcare expenses also increase, which can jump dramatically in your more advanced years.

Even if you have avoided all the retirement mistakes thus far, if your retirement plan doesn’t reflect the correct number of years, you may come up short of cash in the end. Your retirement plan must reflect these realities.

Equally important is the need to review your retirement plan during your retirement. No plan will 100% accurately project your wealth, pre-tax income, and expenses over all these years. You may need to revisit your plan periodically to update it to reflect your situation as time passes. This periodic review allows you to make small adjustments over time to stay on track.

Retirement Planning Mistake No. 6: Failing To Take Full Advantage Of Social Security & Medicare

Social Security and Medicare are two primary components of almost every American’s retirement. However, in each case, the monthly benefits are not as straightforward as we would want.

Among the choices you have to make, there are different ages when you can take your benefits, and a wide variety of supplemental plans are available.

Medicare

Medicare is comprised of Part A (inpatient/hospital coverage), Part B (outpatient/medical coverage), Part C (an alternative way to receive benefits), and Part D (prescription drug coverage). That’s the easy part, but there’s more to know before signing up.

Eligibility is not the same for everyone. Some people get Medicare automatically, while others have to sign up. You can sign up at different times, and there are special enrollment periods for different group plans. Finally, the range of options for supplemental insurance is dizzying, to say the least.

Social Security

There are similar options and confusion surrounding Social Security. You can start as early as age 62, but full retirement age is 67, and deciding to delay social security benefits to age 70 can be worth the wait. All these options have advantages and disadvantages, and your family situation and longevity further complicate them.

While the Social Security Administration and the U.S. Department of Health and Human Services provide excellent resources, they can’t begin to cover the waterfront of all possible options. You’ll most likely benefit from engaging a trusted financial advisor to help navigate your choices but be careful. Many advisors in this area are simply glorified salespeople. You need to find a fiduciary financial planner who is legally committed to your best interests.

Retirement Planning Mistake No. 7: Not Paying Attention To Estate Planning

Estate planning may seem unrelated to retirement, but it is an integral part if you’re married and/or want to leave a legacy for your heirs. Everyone’s retirement goals are unique, but among the common elements is a desire to provide for a surviving spouse and to leave something for your heirs.

An estate plan addresses these specific retirement goals. It specifies the appropriate living trust to use, outlines the management of trust assets for your and your family’s benefit, determines the income taxes you will incur, and conceivably, whether or not the estate needs to pay taxes. The larger your assets, the more imperative it becomes to have a comprehensive estate plan.

If you plan on leaving your heirs anything significant (generally $1 million or more), you will also benefit significantly from working with a fiduciary financial advisor. How assets are left to your heirs and how they are managed determines whether a loving legacy blesses or burdens them.

Get The Help You Need

Retirement planning and financial planning are essential. Sadly, many people fail to realize that there are numerous retirement planning mistakes that you can make.

We routinely meet with prospective clients who have tried to plan their own retirement or have worked with an advisor who wasn’t up to the task. The 7 most common retirement mistakes to avoid listed above are a small sample of the dozens of errors we see and must correct.

Most of the time, we are successful in fixing the problems and helping new clients get back on the road to a successful retirement. Sometimes, though, the damage is too severe, and we must tell the client that their retirement goals must be significantly downsized. Don’t let this happen to you.

The difference is in the quality of advice you receive. First Financial Consulting is a fiduciary retirement planning firm. We have a long 45+ year track record of helping clients by providing 100% objective advice focused on accomplishing their goals. If you’d like to begin a conversation, please use the button below to schedule a complimentary introductory appointment.

Greg Welborn is a Principal at First Financial Consulting. He works with individuals and privately-owned businesses on financial planning issues including investment, retirement, and tax planning, among others.

Greg Welborn is a Principal at First Financial Consulting. He works with individuals and privately-owned businesses on financial planning issues including investment, retirement, and tax planning, among others.