How long will $500,000 last in retirement is a great question to be asking as you approach, or are in, that 50s decade of your life. This is where it becomes real; this is where you need to get serious with your planning, budgeting, and financial management if you want to have a successful retirement. Fortunately, the answer to this question can be “long enough” for many people, but it depends on their specific situation.

The key to determining how long will $500,000 last in retirement for you lies in the intersection between your ongoing earnings, living expenses, and rate of return on the $500,000. Let’s explore each of these.

Ongoing Earnings

Ongoing earnings is income you receive from sources unrelated to your nest egg. Social Security is a key component of this. Roughly 90% of retirees over 65 receive Social Security. Social Security benefits can represent thousands of dollars per year. Those Social Security payments represent cashflow you do not have to generate from your nest egg, and it can be significant. The more money you can bring in, the less you’ll have to withdraw from your nest egg, increasing the length of time that nest egg will last.

Pension income is another form of ongoing earnings. Suppose you’re lucky enough to have worked for an employer that offers a traditional defined benefit pension plan. In that case, you will be eligible to receive retirement payments for a certain period of time and/or for the rest of your life, depending on which benefit selection you make when you retire. Again, these payments represent cashflow you do not have to generate from your nest egg, and they help stretch out the life of your $500,000 nest egg.

Deferred compensation is yet another form of ongoing earnings, very similar to a pension. Deferred compensation is a program some employers offer whereby you can “defer” some of your income each year into an account controlled by the employer. When you retire, you choose how many years you’d like that deferred income paid to you. At that point, it goes on auto-pilot, and you receive a steady stream of income for as many years as you’ve selected.

Living Expenses

The money coming in is only part of the equation. You have to consider the money going out. What does it take to sustain your standard of living? If you need $50,000 to sustain your living standard, your money will last much longer than if you need $100,000 to sustain yourself. We have worked with clients successfully up and down the spectrum. There is no one perfect answer to this question, other than to say that the goal is to allow you to enjoy retirement, to live in a reasonably comfortable manner without having to worry about expenses. You do not have to try to spend as little as possible and feel unnecessarily constrained in retirement. That is not what you have worked long and hard to achieve. You do want to be reasonable – to maintain a lifestyle that is not profligate – but you do want to enjoy this retirement.

It is critically important that you determine what your living standard is, and of course, you need to consider what it will be if you plan on adding or subtracting activities, trips, etc. There are a couple of ways to determine your living standard:

Detailed Budget: put together an actual line by line (expense by expense) budget. This is easier to do if you’ve kept bank statements and credit card statements. Use at least six months’ worth of these statements to capture those expenses that only occur quarterly or semi-annually. Usually, any 6 month period of time contains enough holidays or birthdays to represent the entire year.

The other way to develop a detailed budget is to use a personal accounting software programs or web services. If you use one of these, you can download transactions directly from your bank or credit cards, and then you can run a report which will tell you exactly what you’re spending and where it’s being spent. Here’s a quick link to a review and listing of the eight best personal finance software options for 2021.

Paycheck-based Budget: if your paychecks are fairly consistent and you know how much money you typically have left over at the end of a month or quarter (whichever timeframe is most reasonable), then by definition, you know how much you’re spending. For example, if you earn $3,000/week and have $700 or so left over every month, you know that you’re spending $11,300/mo ($135,600/yr).

That doesn’t tell you how you’re spending your money (you don’t know the breakdown), but you do have a budget in the sense that you know how much you’re spending for everything together.

Either method will work, although the detailed budget is more accurate. To compensate for that and to ensure that you don’t underestimate expenses, you should add a safety cushion to the paycheck-based estimate. In the example above, you might goose up the $11,300 estimate to $11,600 per month.

Once you’ve gone through the exercise of determining your budget, you can change that cost of living without necessarily depriving yourself. Of course, if you find that you’re spending way too much in some area, well, that’s a no-brainer; cut back to a reasonable level. But if you’re spending is “reasonable,” but you’d still like to reduce it without squeezing, remember your cost of living is influenced by where you live. The products and services you buy do not cost the same in every state; they cost more in some states and less in others. If you don’t want to cut things out of your living standard, you might consider moving to a state with a lower cost of living. To give you a sense for how different this can be, below is a state-by-state recap of the cost of living.

Rate of Return

The final piece of this puzzle determining how long will $500,000 last in retirement is to determine what rate of return is reasonable to earn on your nest egg. To go to extremes to illustrate the point, if all your money is in a checking account earning 0%, then your nest egg is not growing. When you withdraw money, there is nothing to replace any of the money that you withdrew. On the other hand, if your nest egg is earning 10% per year, you will at least replenish some of what you are withdrawing. Therefore, your nest egg should last longer in retirement.

But what rate of return should you use? That is probably the tougher part of this exercise because there are so many options. Your ongoing earnings should be relatively easy to determine, and your budget already exists, even if you don’t know it yet. Following the guidelines above, you should be able to determine what that budget is. Unfortunately, the rate of return component is subject to a lot of misinformation and outright deceit by some salespeople who will manipulate numbers, projections, and statistics to sell you all manner of insurance, annuity, and mutual fund products.

Still, you have to determine this piece of the puzzle, and we have an objective guide for you. At First Financial Consulting, we do not sell any product to anyone for any reason. We do not accept commissions or kickbacks of any type. We remain 100% objective, and we can help you determine a reasonable rate of return.

You can use our blog resources or investment risk questionnaire to narrow down the range of possible target returns. To finalize it, we recommend you talk with one of our advisors. Still, the reality here is that determining what rate of return to use can be relatively easy, very comforting, and also educational for those who want to climb under the hood, so to speak.

How Long Will $500,000 Last In Retirement?

To actually answer the question, you have to pull all these components together. Once you know how much your living expenses will be, and you know how much ongoing earnings you will have, you can calculate how much you have to withdraw from your nest egg. Let’s look at an example.

Is $30,000 reasonable to withdraw annually from a $500,000 portfolio? Well, that withdrawal would represent 6% of a $500,000 portfolio. By comparing that withdrawal percentage to the target return you select, you’ll have a very good estimate of how long $500,000 will last. This is how you determine how long $500,000 will last in retirement.

Where Are You?

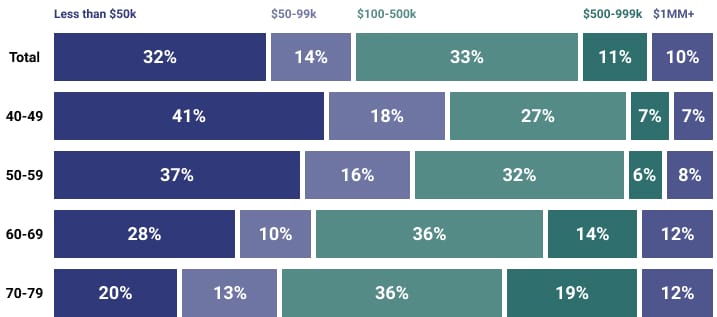

To help you judge where you are in the progression toward building a $500,000 portfolio, we thought it would be helpful to see what the averages are by age group. The retirement poll below was conducted by the Harris Poll on behalf of TD Ameritrade. This poll reviewed how much people have saved for retirement by age.

The poll shows that across the nation most people 60 years or older have saved at least $500,000 for retirement. That should be encouraging, especially if you’re in your 50s and aren’t there yet. There’s time, but you need to get serious about this task.

If you are there, or you’re getting close, but you worry how long $500,000 will last you in retirement and you want a more detailed assessment than this short article can provide, we would love to hear from you. We don’t sell products; we provide solutions. Being 100% objective means you can count on us to make an objective determination of where you are, where you need to go, and how you can get there. We help our clients achieve their goals and dreams, and we give them confidence that they will be able to enjoy the retirement they’ve dreamed of and worked hard to achieve.