“Crash Proof” Retirement

Several financial advisors offer “crash proof” retirement programs, and understandably it is an enticing offer. Who wouldn’t want a “crash proof” retirement? But what is it, and can it be trusted to deliver what you think it will? Sadly, in our opinion, “crash proof” doesn’t translate into a successful retirement plan, or even a particularly good one. Too often, “crash proof” has been a disaster, but there is hope.

As it’s usually being hyped today, the “crash proof” retirement program is an elaborate sales pitch to sell you an annuity. Not just any annuity, mind you. No, they want to sell you an index-linked annuity because it sounds so special (more bells and whistles to the hype) and because it pays a very handsome commission to the advisor, who is really acting like a salesperson at that point. They’re not selling it to you because it’s the best thing for you.

The Promise

The concept of these annuities is simple enough: you give the insurance company a large sum of your money; they promise the value will never decrease; and if the market goes up, your value will go up. That does sound pretty good. You can’t lose and you will gain! What could be wrong with that? Well, plenty, actually.

The Problem

First, you give up control of your money to someone making a wild promise. Remember, they’ve told you that you can’t lose; you can only gain. Doesn’t that sound too good to be true? Well, remember, if something sounds too good to be true, it probably is too good to be true.

Second, just because something doesn’t go down doesn’t make it good for you or your retirement plan. After all, you could put your money into low-yield CDs at a bank where it is fully insured by the FDIC. It won’t go down. But you would get nowhere doing that, and instinctively you know that. You know that low-yield CDs tread water at best and most often lose ground over time. So standing still (“not losing money“) isn’t really the best plan.

Third, the crash-proof-retirement-index-linked-annuity is loaded with fees. Once your money is inside that annuity, you’ll have to pay mortality costs, administrative costs, rider costs, management fees, and surrender charges, just to name a few of the more popular mechanisms for the insurance company and the advisor-turned-salesperson to make money from your money. It is not uncommon for these costs and fees to consume 2.5% of your money every year. At least the bank (most of the time) wasn’t going to charge you a fee to access their CDs.

Fourth, you will probably lose ground to inflation. Your money might not “crash,” but it will not grow with inflation. You can’t delude yourself by pretending otherwise. Losing purchasing power is a loss, just as real as losing value in the market. As an example, if your living standard today is $50,000, you know instinctively that you’ll need more than that next year, and then the year after, etc.

These hidden drawbacks are so profound that Truth In Advertising.org posted a short expose on the “Crash Proof” Retirement program.

The reality is that if you have $1,000,000 today, and you’re withdrawing $50,000 to fund your living standard, you better have $2 million in 24 years and be able to withdraw $100,000 JUST to stay even with inflation. Yes, that seems like a lot of money. But consider the price of the lowly postage stamp. Today’s $.73 first-class stamp was $.10 in 1975. A dime in 1975! Everything you buy has gone through and will continue to go through, the same process with inflation. You need to keep up with inflation, or you are losing ground. You may not “crash,” but you are far away from a “crash proof” retirement strategy.

Here’s How Annuities Work

We think it is important to understand how the index annuity works. Starting with the basics, you give the insurance company a large amount of your money. Insurance companies always invest the money inside annuities, but how that is done and how it relates to your value is unique inside the index annuity.

The insurance company may give you a choice of indexes or just pick one themselves. One of the most basic indexes is the S&P 500. You pick the index, and they will invest your money in stocks and promise to pay you a portion of the earnings generated over specific periods of time by the index you’ve chosen (the S&P 500 in our example).

But you never get 100% of those earnings. Instead, on certain anniversary dates, you will receive a portion of the earnings based on a “participation rate” and a “cap.”

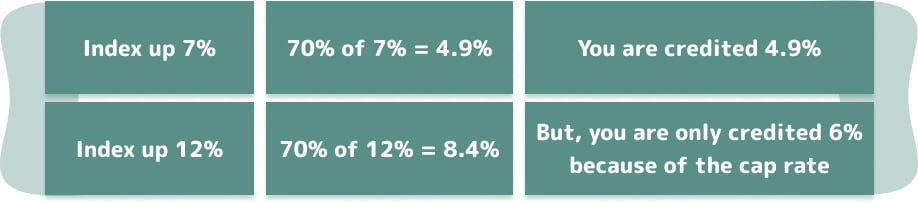

To use a ubiquitous formula, say your participation rate is 70%, and your cap is 6%. If the index goes up by the anniversary date, say 7%, you would receive the lesser of 70% of the anniversary date or 6%. These two examples will explain in more detail:

You get the picture; the insurance company gets to keep 30% of the gain in the worst of circumstances, and they get to keep a lot more if the index goes up by more. Not surprisingly, there is a built-in economic motivation for the insurance company to take more risk with your money than you might normally take so that they can earn substantially more than the cap rate and keep the difference. Hardly a “crash proof” retirement strategy if you ask us.

Annuity Fees and Charges

This is not the end of the calculation, though. Remember those fees and charges we discussed. Well, they get deducted from your account. Remember that these fees can also be as high as 2.5% per year. So, returning to our example, your net earnings would be:

This is just not a good outcome for you. With average inflation in the U.S. of 3% or so, you’re barely earning more than inflation when the market is having a really good year; and you’re falling behind inflation when the market is having a decent year.

The reality for many people is that the really, really good years for the market are few relative to the so-so years; we believe you’ll see more years of losing ground to inflation than staying ahead of it. Do this long enough, and you’ll find that your purchasing power is actually falling during the retirement years; you will not be able to afford the retirement lifestyle in the future that you can enjoy now.

And speaking of the “long-term,” many annuities require you to stay in the annuity for very long periods. It is not uncommon to see surrender charges and waiting periods of 8 to 10 years. That’s quite a while to lock up your money and watch it just wither away.

How to TRULY “Crash Proof” Your Retirement

At this point, you may be disappointed. You thought you had found a good-potential-no-downside way to “crash proof” your retirement. Instead, you’ve learned that someone is trying to sell you a lousy product and earn a fat commission. Fortunately, there is hope. You can “crash proof” your retirement by being smart and disciplined.

Start by acknowledging that there will be market crashes from time to time. They cannot be avoided, they cannot be predicted accurately, but they do not need to hurt your retirement nest egg. The way to do this is to use a portfolio structure strategy that keeps a portion of the nest egg safe from a crash, allows you to withdraw reasonable amounts to fund your retirement living standard, and provides sufficient breathing room for the total portfolio to weather and recover from a market crash.

Best of all, you do not need to give up control of your money, pay huge fees, fall behind inflation, and watch a slow-burning away of your retirement funds and your retirement dreams. You CAN succeed!!

A true “crash proof” retirement is built on a solid plan which:

- Identifies your timeframe of when you want to retire

- Reflects your unique specific situation

- Uses the optimum portfolio structure

- Allows you time to whether a crash AND come out on the positive side, ahead of inflation, enjoying the retirement you’ve dreamed of

First Financial Consulting offers a unique approach to investment management and retirement planning. We offer 100% objective advice, and we meet the fiduciary standard, meaning we always work toward your best interest. Beyond that, we’d love to hear from you to answer any additional questions you have or to schedule a complimentary initial consultation. We’re here to help.