Building an investment portfolio from scratch usually means you have little or no, experience. Perhaps this is your first foray into the world of investments; maybe you have a portfolio, but it was locked in a 401K, and you haven’t given it much thought or exercised much control over it; perhaps you’ve just inherited a portfolio, and you want to create a growth portfolio to suit your needs.

Whatever the cause, if you’re building an investment portfolio from scratch, the odds are you’re giving it thought and making decisions at the time when you know the least about investing. You will learn as you go along, but you’re also liable to make some serious mistakes along the way.

Poor results or even substantial losses often lead investors to quit. They retreat back to not giving it much thought and/or not exercising much control. “Set-it-and-forget-it” is not a strategy. It locks into place the type and quality of assets you hold at the moment you walk away. You might get lucky; then again, you might be unlucky, which is a nice way of saying “unwise,” which is a nice way of saying “foolish,” and we’ll leave it at that.

The saddest part of this is that you’ll be walking away from the tremendous benefits of investing successfully. The American dream is alive and well; the average person can retire very comfortably if they are disciplined and wise (or seek wise counsel). The magic of time, diversification, and compound interest are available to anyone; together, they can build awesome wealth.

So, if you’re starting from scratch, it pays dividends to start by acquiring the knowledge necessary to succeed. That’s part of the discipline part. Don’t just jump in. Take a moment to learn. That’s the purpose of this article – to help you learn.

This article is meant to serve as your guide on how to invest well, even if you’re starting completely from scratch.

Someone once said there are “101 financial ratios and metrics” which are important to successful investing. That’s probably true – at one level. The professional investment manager has got these 101 (plus a few more) dialed in. But you don’t need to master all 101 to be successful. In fact, you can be a successful investor by “investing in great businesses with strong competitive advantages and shareholder-friendly management teams trading at fair or better prices.”

The rest of this article will describe how to build a successful portfolio so you can achieve your financial security and retire comfortably.

How Large Should Your Portfolio Be To Retire?

We start with a key question. If you don’t know the answer to the question, then you really don’t know where you’re going; if you don’t know where you’re going, how can you possibly chart a course to take you there? Guesswork might work, but by the time you figure out you made the wrong guesses, it may be too late. Each year that passes is a year that’s gone. You can’t get it back; there are no do-overs.

The portfolio size you need depends on how long you’re going to live and how much you need to withdraw from the portfolio each year. Most people assume they will live fewer years than they actually will. This is especially true for those of you who are close to retirement. You grew up during a time when life expectancy was generally about 65 years, or maybe even 70 years.

Life Expectancy

Today, life expectancy is right around 79. That’s 5 years longer than we suspect most people think. But that only tells part of the story. Today’s 30 or 40 year olds may tell themselves that they know this already. They know to plan on living 80+ years or so. Unfortunately, they are making the same mistake. They are using their experience as a judge for what the future will hold.

Medical advances are coming at an even faster pace. It is not unrealistic to project that by the time today’s 40-year-old is 70, life expectancy will have increased to 90 or more. You have to be realistic in assessing what your reality will be when you get there, not what you think it is today.

Inflation

Most people also underestimate how much they will need to withdraw from their portfolio during retirement. Even if they have accurately assessed how long they will live, they typically assume their living expenses will continue at today’s level. Maybe, if you have a sense of what inflation can do, you may have increased your living expenses a bit.

Sadly, we’ve yet to meet the investor who did this correctly. Part of it is human nature; the other part is our specific experience over the last 10 to 15 years. We have lived through a period of unusually low inflation. Over the last 10 years (2010-2020), the average inflation rate is 1.79%. The average inflation rate since WWII is 3.6% per year.

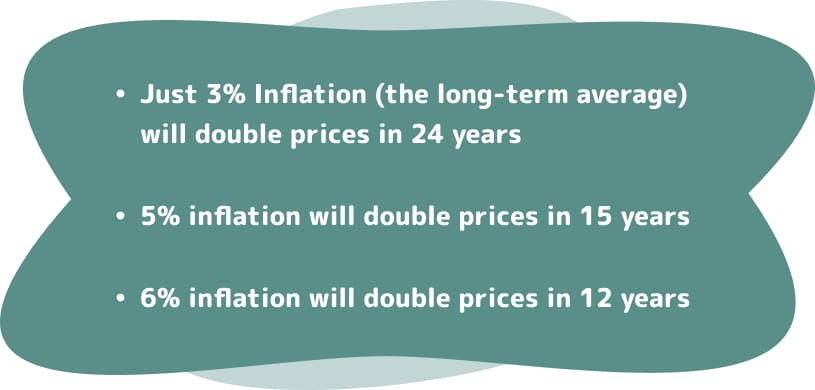

The longer-term trend is almost double what we’ve seen in the last 10 years. If historical norms reassert themselves, we’re likely to see inflation higher than 5% to compensate. How important is that? Consider the following staggering facts:

When you’re building an investment portfolio from scratch, how large should your portfolio be to retire? Large enough to accommodate at least 10 more years of retirement than you probably think and large enough to afford a doubling of prices for the items you use and the things you do every day. You’ll need to pay twice as much for soap, food, gasoline, restaurants, travel, healthcare products, etc.

You need to accurately assess your likely lifespan and your real budget over all those years to figure out how large your portfolio needs to be in retirement. And that’s just the starting point. If you want to leave something for the kids or grandkids, you need to factor that in as well. Figure out what your target is, and then we can determine how large the portfolio needs to be.

How Many Stocks Should I Own?

There is a tradeoff between the number of stocks you own and your potential results. The more stocks you own, the greater your diversification is, and the less volatile your portfolio will be. That means your lows won’t be quite as low, but your highs won’t be quite as high as they could be if you owned fewer stocks.

Take Our Investment Questionnaire to Discover Your Risk Tolerance

Of course, if you keep a concentrated portfolio and picked a handful of the “right” stocks, you return could spike; but if you picked the “wrong” stocks, you could sink your portfolio. Diversification moderates returns and moderates risks because a greater number of stocks determines performance.

Consider a quick example. If you own 3 stocks (and extreme, but it illustrates the point), and one of them tanks, then 1/3rd of your portfolio just disappeared. But if you owned 100 stocks, and one of them tanks, only 3% of the portfolio got hit. Where you make the tradeoff in terms of the number of stocks depends on several issues. The principle works when a stock is successful. If you pick a winner, then in our example, either 1/3rd of your portfolio or 3% of your portfolio would hit a home run. Holding a lot of stocks can mitigate both the lows and the highs of the entire portfolio.

Professional managers regularly struggle with this tradeoff, so you’re not alone in having to face this decision. Warren Buffett, the acclaimed and famously iconic head of Berkshire Hathaway, manages a stock portfolio in which his top 4 holdings have made up as much as 57% of the total portfolio. That is a significant concentration. You can see Buffett’s top 20 stocks here.

On the other hand, Peter Lynch, who managed Fidelity’s Magellan Fund, owned more than 1,000 stocks at a time. During his tenure as head of this fund, he earned an average annual return of 29.2%, making him the best-performing mutual fund manager in the world.

Both extremes have proven to be successful in at least one instance (Warren Buffet and Peter Lynch). But across the spectrum of all managers, looking at the broad averages, which approach is right? From a return perspective (trying to maximize returns), there is much to be said for using a rational concentration (more on that later). But from a risk perspective (trying to mitigate risk), research conducted by Morningstar strongly suggests that 12 to 18 stocks will provide sufficient diversification. The study concluded that “about 90% of the maximum benefit of diversification was derived from portfolios of 12 to 18 stocks.”

In essence, building an investment portfolio from scratch using approximately 20 stocks provides 90% of the diversification benefit of holding 100+ stocks. This assumes that you own 20 diversified stocks. You can’t just invest in any 20 stocks. If you bought 20 automobile component companies, you would not be diversified in any sense. You would have concentrated in one industry in one sector.

To provide some perspective on how broadly you should scatter your hypothetical 20 stock portfolio, consider the 11 sectors contained in the S&P 500.

- Information technology

- Healthcare

- Financials

- Consumer Discretionary

- Consumer Staples

- Communication Services

- Industrials

- Energy

- Utilities

- Real Estate

- Materials

Now, let’s take one of those sectors (Consumer Discretionary) and consider the 11 industries it contains:

- Automobiles

- Automobile Components

- Distributors

- Diversified Consumer Services

- Hotels, Restaurants & Leisure

- Leisure Products

- Household Durables

- Multiline Retail

- Specialty Retail

- Textile, Apparel & Luxury Goods

- Internet & Direct Marketing

We’ll stop the analysis at this level. You need to diversify among sectors and industries for “diversification” to work. Just picking 20 stocks will not necessarily provide any diversification benefits.

What Are You Most Afraid of? A) Losing Money or B) Missing Out on Returns?

This is a very closely related question and concept to the previous one. The discussion above about the number of stocks you should hold explains that appropriate concentration and appropriate diversification both offer potential benefits. The right concentration in the “right” stocks can yield tremendous results if a handful of your picks really take off. The right diversification can prevent any one stock’s failure from significantly damaging your whole portfolio.

Where you land between these is as much dependent on your intellect as on your emotions. Every one of us makes decisions that are influenced by both our hearts and our heads. We know rationally what to do, but so often compromise that by what our feelings tell us we want to do or tolerate doing. This has direct application when you are building your investment portfolio from scratch.

A) Losing Money

If you’re most afraid of losing money, and you don’t take that into proper consideration, you’ll build a portfolio that will inevitably expose you to more volatility (to be read “downturn”) than you can stomach. When faced with a 35% or 40% drop in the market – and we’ve seen those numbers in recent history – the average investor panics and liquidates his or her stock holdings, usually right about when the market is bottoming out. That same investor feels so shell-shocked that they usually delay before reentering the market, usually at a high point.

Watch the video to learn more about how Fear and Impulses can derail your portfolio.

This practice of reacting emotionally to the inevitable downdrafts causes the investor to buy high, then sell low, then repeat the process. It’s a recipe for disaster, and it’s all because the investor didn’t realize how much they were afraid of losing money.

B) Missing Out on Returns

At the other end of the spectrum stands the person who is more afraid of missing out on returns. This investor is always chasing a fantasy. The fantasy is that double-digit returns are plentiful and predictable. We don’t deny that there will be days, or weeks, or months, or even a couple of years of double-digit returns; we’ve seen those as well in recent memory.

But if you’re chasing these high returns, you’ll quickly convince yourself that it’s just a matter of finding that right stock, which is out there somewhere. You’ll be dissatisfied with the stocks in your portfolio because they will never (we repeat, never) consistently deliver double-digit annual returns. They may in any given year do this, but never year after year after year.

Believing stocks can do this, but seeing that your stocks did not do this, you’ll start looking for what you think you’re missing. Believing that you can find them will lead you into chasing fads and rumors. There is no shortage of fish stories about the “killing I made” around the watercooler or on the golf course. But they are fish stories, and you’ll ruin a portfolio chasing them.

Knowing what you’re most afraid of will help you put in place guard rails to make sure you don’t let that fear – that emotion – become the dominant factor in your decision. We’re not saying emotions have no place in the investment process; that’s foolish. Everyone has some amount of emotion at play. The trick is to balance it, recognize it, and counter it with objective, rational considerations. You need to balance the two to make the best decision for who you are and what you need to accomplish.

How Much Money Could I Stand to Lose Tomorrow Without a Lifestyle Change?

What are you trying to accomplish? Do you have time to experience the market drops and still recover? Or will you be retiring tomorrow and need to withdraw a certain amount that you cannot afford to lose? Thus far in this article, we’ve talked about how large a portfolio you need, how many stocks you need to have in the portfolio, and how to balance emotions and reason when building an investment portfolio from scratch. But what do you actually need to do with the portfolio? Assuming that you want to pursue growth and that you’ve properly concentrated a portfolio, you’ll eventually see it grow handsomely over the long-term. You’ll also experience some significant downdrafts in the market and corresponding drops in your portfolio’s value.

Will you have the time to ride out the correction or recession, or are you at a stage of life where you will need to withdraw funds to support your lifestyle? You need to factor this in. You have to determine how much you may need to withdraw over a time period that reasonably allows the market to recover.

Whatever that number is, it must be considered to determine how much of the portfolio to place into stocks. Diversification applies to more than just the number and type of stocks you own. It applies to the proportion of stocks vs. other investment categories that you should own. If your stocks take a hit, where else can you withdraw funds to support your living standard? Bonds are a very logical option for most portfolios. The correct amount of bonds can allow you a safety net, a pool of money that you can withdraw from without having to sell stocks at a loss.

What Else am I Invested in Outside of This Portfolio?

As you consider the proportion of stocks vs. bonds, you need to consider the other investment assets you own. They may not appear on your brokerage statements. Still, if you have rental real estate, annuities, a pension from work, collectibles, etc., you have other assets which might be able to fund some of your retirement and thus reduce your reliance on stocks. At the very least, these other holdings might buy you more time to let the stocks in your portfolio recover from a downturn.

We’ve never said that you should “never” sell stocks. There is a time for that. We just don’t want you to be forced to liquidate stocks when prices are low. We want you to have the greatest flexibility possible to manage your cashflow, draw down on your stocks at the right time, and avoid compromising your goals due to bad market timing.

Although these “other” assets may not be part of your portfolio, their value, growth potential, volatility cycles, and cashflow should influence you when building an investment portfolio form scratch. You must understand this, and we believe that a solid cashflow projection is needed to determine what impact these other assets will have.

What is My Mix of Stocks and Bonds?

With everything discussed above, we finally arrive at the critical asset allocation decision. The mix of stocks and bonds you use is referred to as your asset allocation. It needs to be determined by your return goals, risk tolerance, cash flow needs, ability to withstand downturns, and outside resources.

This decision can, and should be, fairly precise. It’s not a matter of saying, “oh, 50% stocks and 50% bonds feels right”, nor is it something which can be determined by the old rules of thumb. The most common of these is the rule that says your age determines how much you should hold in bonds. There are literally advisors out there (sale reps, really, hungry to make a sale) who will tell you that if you’re 40, you should have 40% in bonds.

By this logic, if you’re 65, you should have 65% in bonds and 35% in stocks. There are a couple of obvious problems with this. First, are all 65-year-olds the same? Look around your age group and ask yourself if every one of you is the same? Do you all have the same job? Have the same family size? Have the same goals in retirement? Earn the same money? Have the same outside assets? Do you have the same tolerance for risk? We could go on, but you get the point.

One of the other big problems with this approach is that it totally ignores inflation’s impact on the portfolio. Remember what we wrote earlier about the ravages of inflation. If you’re retiring in an age of low inflation, you’d conceivably need less allocated to stocks to maintain purchasing power than if you’d need if you were retiring in an age of high inflation. How exactly does your age help determine the percentage of stocks needed to combat inflation? Obviously, it doesn’t.

The best practice here is to consult with an objective investment advisor, a fiduciary who is held to the highest standards of objectivity to work with you to determine what your unique allocation should be given your unique needs and your unique situation. Deprive yourself of that advice, and you’re jeopardizing your future.

Building Your Investment Portfolio Using Stocks, Bonds, Funds, and ETFs

Assuming you’ve taken everything we’ve discussed into consideration and consulted a 100% objective advisor to determine the best allocation for your situation and needs. How do you build this portfolio?

You know how much to put into stocks, bonds, and real estate. But which stocks, which bonds, which real estate should you buy? Truly the devil is in the details.

We’ve talked about the proper number of stocks in terms of diversification (controlling the risk) and in terms of impacting return (the “right” stock in a concentrated portfolio vs. a diversified portfolio). We’ve talked about how the stocks need to be spread between the various sectors and industries. We can also say the same about bonds. Diversification within bonds is just as important as within stocks, and many of the same considerations apply.

But there is a more detailed issue to be addressed before you buy stocks, bonds, or real estate investments. To be successful, each of these needs to be purchased at the right price and sold at the right price, with the proceeds then invested in a replacement at the right price.

Consider an entirely fanciful hypothetical. As we write, the price of Coca Cola stock is fluctuating around the $50 range. Theoretically, at this moment, that is the price range which represents the value of Coca Cola’s profits for the next several years. We’d all agree that those profits would be seriously jeopardized, and thus its stock price devalued, if the secret formula for Coke was suddenly stolen, released on the market, and a dozen major competitors introduced exact knock-offs. Or on the flip side, we’d all agree that if China decided it didn’t like the politics of Pepsi’s senior leadership and banned Pepsi from the Chinese market, Coke would likely pick up market share, profits, and its price would soar. So what is the right price for Coke?

If you buy Coke and don’t know what’s going on with senior management or what’s happening in its market segment, you’re guessing as to what the right price is. You could be buying something which will soar or fall flat. Even if Coke is the right type of company in the right industry in the right sector in a properly diversified portfolio, if it’s purchased at the wrong price, it will hurt your results.

Our example is extreme, but it illustrates that there are lots of variables that will impact the future profits of any company whose stock or bonds you can buy. Those future profits impact the price. Professional money managers have to research, analyze, and master all this information to know what company to buy, what price to pay, and equally important, at what price to sell. There comes a time when any company’s stock was a good deal but no longer represents as good a deal as another company’s stock.

These professionals wake up every day to analyze all this and then buy and sell based on their analysis. Trying to compete with them seems foolhardy at face value. We believe the best investment portfolio will be constructed using professional managers to make these decisions for you.

Our advice; building your investment portfolio from scratch using individual stocks or bonds that you select is dangerous. Let the professionals work for you. Mutual funds and ETFs are simply mechanisms through which you can hire a professional money manager. Let’s say you decide appropriately that you need to put 10% of your portfolio into the S&P 500. Instead of trying to pick which individual S&P 500 companies to buy, and in what percentage, you can simply invest your money in an S&P 500 mutual fund or ETF. Each of these will employ a professional money manager – or a team of them – to use your money along with all the other people who invest in that fund or ETF to buy into the S&P 500. As a shareholder of the fund or ETF, you will own a share of each S&P 500 company owned by the fund.

Using professional managers is the most efficient way to gain diversification, compete effectively in the investment market, and control costs. If you implement this strategy – and we highly recommend you do – you will invest in a fund or ETF in each of the various investment categories determined by your asset allocation.

If your allocation indicates you should own large-cap US growth companies and small-cap value companies, then you’ll most likely use a fund or ETF which specializes in the large-cap growth companies and one which specializes in the small-cap value companies. Those are just two categories, but the concept holds across all the categories.

Building an Investment Portfolio From Scratch

Building a successful investment portfolio is not complicated, even though you may be a bit overwhelmed after reading this article. That holds true whether you’re building the investment portfolio from scratch, taking over an inherited portfolio, or just deciding to review one you’ve let sleep unattended for too long. You can take control, and you can be successful.

The greatest lesson that we want you to learn from this article is that you will be better off working with a professional to help you with each of the steps above. Each step is relatively easy to describe, and the concepts are tried and true. It’s the implementation of each and the coordination of all of them together that can be tricky. It’s also an area where emotions can have a strong and negative impact.

It is extremely difficult for any of us to look dispassionately and objectively at our own situation, to determine where our weaknesses lay, where our blind spots are hidden. A fiduciary advisor – one who is legally obligated to provide 100% objective information, who doesn’t sell product, who doesn’t take a commission by selling you something – can make the process easy and successful.

Financial and investing success is one easy step away. First Financial Consulting is a fiduciary advisor, and we’ve got 40+ years of experience helping people with these issues. We’d be happy to offer you a complimentary consultation.

Greg Welborn is a principal with First Financial Consulting. He has a long history of helping people build investment portfolios that prepare them for the retirement of their dreams.

Meet Greg Welborn

Greg Welborn is a principal with First Financial Consulting. He has a long history of helping people build investment portfolios that prepare them for the retirement of their dreams.