Avoid Running Out of Money In Retirement

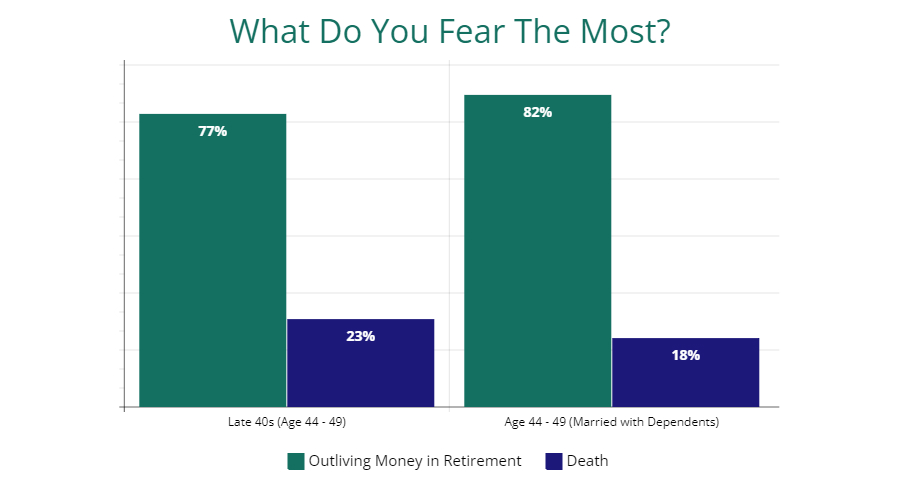

Life is full of things to worry about, and a recent survey showed that two-thirds of people are more afraid of running out of money in retirement than they are of actually dying. That may seem surprising, but it can be a real possibility – and therefore a very legitimate fear – if you haven’t planned properly. Now, we assume you’ve done some planning. If not, well, that’s the first place to start. You need to put together a retirement plan; don’t leave this to chance. But assuming you have a plan, the trick is to make sure you’ve done it properly. Here are ten preventative steps to help you avoid running out of money in retirement.

1. Assume You’ll Live Longer Than You Think

Many people who are close to retirement today spent their formative childhood years during a time when life expectancy was significantly lower than it is now. When the Social Security Program was first created, life expectancy was around 65. Today, life expectancy is in the mid-80s. So, don’t let your memory of what things were like back then distort the realities of today. You need to plan for your assets and cash flow to last much longer than you think.

2. Continue Investing In Stocks

Don’t get too conservative in your retirement years. There are many rules and old adages which suggest that you should automatically shift from stocks to bonds as you age. We don’t think that makes sense because it doesn’t take into consideration inflation and the fact that both your income and assets will need to grow to keep up with inflation. Inflation is a silent killer. Those who fail to structure their portfolio to keep up with inflation may find themselves running out of money a lot quicker than those who do. Stocks have consistently shown themselves to be better than bonds over the long term in fighting inflation. Stocks can be volatile, of course, but figuring out how many you should have in your portfolio will go a long way toward retirement planning.

A lot of people have come to us asking how they can better structure their retirement portfolio. So we built our investment risk tolerance questionnaire to help you better determine how to best structure your portfolio and estimate a reasonable target rate of return based on your current financial situation and willingness to take risk.

3. Run The Numbers

Remember, we assume you’ve done some planning. But you can’t stop there. You need to run some alternative financial plans that are designed explicitly to stress-test your plan. What if your “plan A” doesn’t work out? Do you know what types of events could set you back, how much the damage would be, and how you could overcome those setbacks? You must update your retirement plan to consider multiple “plan B” scenarios so you can be prepared.

4. Fine Tune The Budget

We’re not advocating that you need to put yourself on an austerity budget. Retirement is supposed to be a time when you can enjoy a lifestyle you’ve dreamed of having. But as you approach retirement, you should revisit your budget to make sure it accurately reflects what your typical expenses will be, as well as accurately reflecting what extra costs you might have. For example, if you want to travel more than you have time to do now, you should make sure your budget includes an increase in this expense item.

5. Monitor Your Assets

Every great retirement plan is built on an assumption of what your assets will earn. If you don’t know what that earnings rate is for each key asset, stop right now and ask your advisor to tell you what that number should be. You might be surprised by how unreasonably high that assumption is. Beyond that, however, it’s important that you monitor your assets as you prepare for and enter retirement. That way you can see if you are, in fact, earning that assumed rate of return. There’s no better time than NOW to see if your investments are doing what they need to for your retirement. Learning what may be bad news today at least gives you time to recover. It can be a disaster if you wait until you’re already retired.

6. Ease Into Retirement

Don’t feel pressure to go from 100% to 0%. You may be counting the days until you can quit your present job, but that doesn’t mean you can’t take on some part-time work you enjoy. Keeping busy and productive will help your physical and mental health, but it can also do wonders for helping you avoid running out of money in retirement. Every dollar you earn is one less dollar you have to withdraw. And, every day you delay withdrawing from a retirement account is one more day your dollars can keep growing. Retirees should enjoy their retirement.

7. Delay Taking Social Security

This may not be the best strategy for everyone, so some analysis is needed. But if it makes sense and doesn’t put too much of a burden on your financial assets, you should consider delaying your social security benefit. Every year you delay taking your benefit increases the amount of that benefit for the rest of your life. This can be a very powerful strategy.

8. Build Up Your Emergency Fund

Life happens as they say, and Murphy hasn’t retired. You need to assume that there will be some blow-ups around the house, on the car, and in the economy. At least to the extent that you have some short-term resources which allow you to accommodate those inconveniences. Your emergency fund isn’t just confined to a checking or savings account. You should absolutely have money in these accounts for emergencies. But, your portfolio should also include some segments of assets that can be tapped to meet living expenses when the other sectors are suffering from a market hiccup. Failing to plan for an unforeseen emergency can potentially drain your accounts quickly. Planning for these events is an essential step in helping you avoid running out of money in retirement.

9. Consider Long-Term Care Insurance

A good number of people will have sufficient funds to meet their retirement needs so long as their health doesn’t take a severe and prolonged turn for the worse. Some people will also be able to afford long-term care by just relying on their assets. But for some people, long-term care will deplete their assets to the point where a comfortable retirement is no longer possible. You need to know which group you belong to, and if you need long-term care insurance, there are some excellent options available.

10. Don’t Forget The House

The “home” you’re living in probably provides a great deal of emotional comfort. It may be where you raised the kids, where you’ve experienced wonderful memories, and where you’ve built a beautiful life. Whether or not you’re considering downsizing at some point, you should keep in mind that your “home” is also an asset, and the equity in that asset may provide a secondary emergency fund. We don’t recommend that everyone should tap into their home to fund retirement. But as you’ve probably gathered from the tone of this article, we’re big advocates of developing “plan B” options so you can weather all the storms life may throw at you. Your home may be one of those contingency plans.

Success in Your Retirement

There you have it – 10 concrete steps you can take to avoid running out of money in retirement. If you implement these steps, you’ll be in a significantly stronger position to enjoy the retirement you’ve always dreamed of having, and your confidence level will be very high. Having one less thing to worry about can be a tremendous blessing. First Financial Consulting is happy to help you with any of these steps and to give you the peace of mind you deserve.