Saving for retirement is one of the most important baseline financial steps you must take in order to have a successful retirement. As basic as it is, you might be surprised how many things interfere. Life happens, kids come along, the roof needs to be replaced, etc. Each year, there seems to be yet another reason to postpone actually saving money for retirement. This can be dangerous, and the older you are, the more dangerous that procrastination becomes. Saving for retirement at 50 is critical.

If you’re in your 50s, you need to assess exactly where you are in that journey and what corrective actions if any need to be taken. To get a complete analysis of your financial situation in your 50s, schedule an appointment with an objective financial advisor. In the meantime, we offer the following short primer on saving in your 50s.

What Is The Average Amount of Retirement Savings?

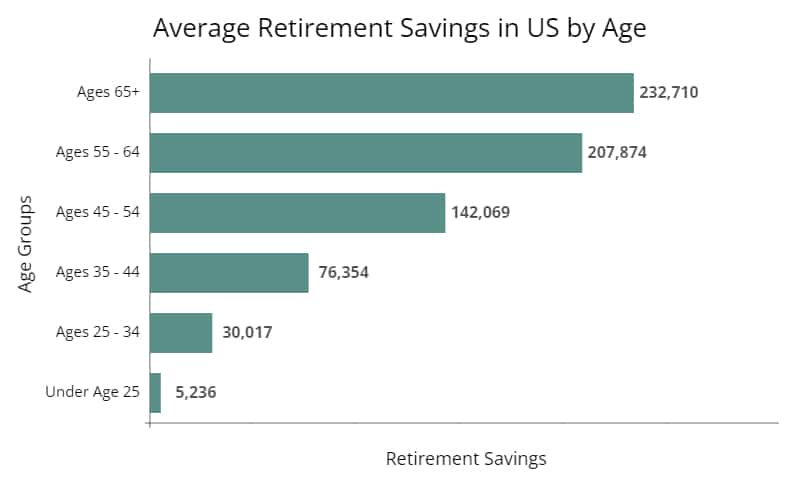

Savings rates are determined by a lot of variable, but one of the primary determinants is age. This makes sense; younger people just coming out of school – perhaps with college debt – don’t have as much discretionary income to stash away as do older people who’ve been in the workforce and worked their way up the career ladder. According to the Federal Reserve, the average retirement savings in the U.S. grows significantly by age:

How Large Should Your Retirement Savings Be?

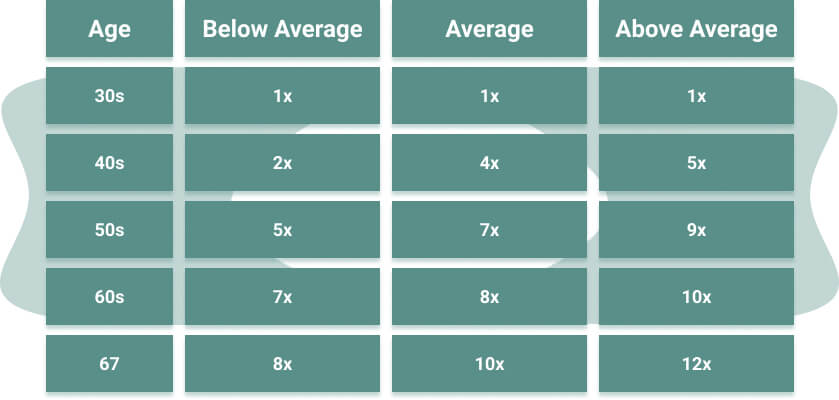

While it’s helpful to have some perspective on what other people in your age group across the country are doing, the more important question is how much you should be savings. This is a more difficult question to answer because it depends largely on your specific situation – another reason to get professional advice. Here’s a rough guide of how much you should have saved for retirement by age band.

In practical application, this would mean that if you’re earning $100,000, you should strive to have $700,000 in your account when saving for retirement at 50. If you exceed these levels, you’re doing well, and if you’re falling short, you’ve got some catching up to do. The logic behind all these guidelines is that you need to have enough money when you start retirement to meet your living standard during retirement and to protect the principal balance from diminishing over time. That’s a real fear, shared by almost 50% of Americans.

And it’s not an unreasonable fear. The fear of running out of money is reasonable because so many Americans have actually failed to do so.

Since most retirements span roughly 20+ years, the ideal situation would be to enter full retirement age with an individual retirement account which will meet your living expenses during retirement AND will double in value by the time you end retirement. With an average inflation rate of 3%, you’ll need to double your money in 24 years in order to have the same amount of purchasing power as when you started.

Think about all the food, clothing, gas, entertainment, and expenses that would be covered by $100,000. Well, in 24 years, you’ll need to have $200,000 just to buy the same amount of food clothing, gas, etc. as when you started. This is why saving for retirement is so important; the bigger your nest egg, the easier it will be to pass that simple test.

Of course, the earlier you start, the easier it is to accumulate the amounts you need. But let’s focus on your 50s. If you determine that you’re behind in saving for retirement at 50, you can get back on track. It will take discipline, but it is possible.

How To Get Your Retirement Savings Back On Track

The first thing to do is to determine how much you need to save from now until the year you want to retire. You may need a little help in calculating this, but it is an important component. If you don’t know where you’re going, how will you know what to do to get there. How can you possible have a retirement age goal without first establishing this?

Reevaluate your budget

If you’re spending too much and “can’t” save as much as you need to, you shouldn’t just accept that as a final answer or some sort of retirement death sentence. Most people have some fluff in their budget. That is not always the case, but very often we get a little lazy, and once we get beyond the starving student, or starving newlywed, stage, we tend to get a little more carefree with our spending. That habit can mushroom quickly, and you may be spending substantially more in certain areas than you think – or need. Take a look and see where you might save.

Be wise about where you put your retirement savings

This applies to both the savings you’ve already accumulated and the annual amounts you’ll be adding to the nest egg. The best type of accounts to use are “tax-deferred” accounts. Tax-deferred accounts are investment accounts in which the earnings are not taxed while the money remains in these accounts. Tax-deferred accounts, unlike regular investment accounts, allow you to keep the amount you would normally pay in annual income taxes on the earnings. That extra amount you get to keep will continue to grow. This allows you to put your retirement savings account on steroids.

There are many different types of tax-deferred accounts to choose from. As such, it’s important to consult an advisor or tax professional to determine which ones are available to you. If you work for a company which offers a employer sponsored retirement plan, such as a 401k, this is the low-hanging fruit of retirement savings. Maximize the amount you can save here up to the legal limits.

If your employer offers a 401k match, at least contribute into the 401k the maximum amount that would be matched. This is “free” money your employer is willing to give you for your retirement.

Explore and take advantage of any additional types of retirement plans that your employer might offer. Of course, you need to start by determining if those plans makes sense and are well managed. Some of the more common types of extra plans include deferred compensation plans, regular pension plans, and supplemental retirement plans. (See our article on pensions vs 401k plans.)

If you own your own corporation, partnership, or are just self-employed, you may actually have many more creative options to increase the amount of tax-deferred savings you can put aside. This topic is too big to tackle in an article, so please schedule a complimentary consultation here if you’d like to pursue these options more. Depending on your circumstances and discretionary cashflow, you may be able to put aside substantially more. In fact, it is common for someone above the age of 50 and making more than $300,000 per year to be able to contribute $150,000 to $250,000 into a defined benefit pension plan.

Explore using regular IRAs or Roth IRAs

These are tax-deferred individual retirement accounts which you can set up without involving your employer. Depending on whether you or your spouse is already contributing to a 401k at work, you may or may not be able to contribute to an IRA or a Roth IRA. Check with a tax professional to determine whether you qualify for these additional retirement plans.

Both IRAs and Roths allow your money to grow tax deferred, but there are differences between them in terms of the tax deduction you receive for making the contribution and for the taxes you pay when you make a withdrawal from them during retirement. The money in both IRA and Roth IRA retirement accounts grows tax-deferred when kept inside the account.

Consider a Mega Backdoor Roth conversion

The Mega Backdoor Roth IRA is a powerful strategy that allows high earners to contribute additional after-tax dollars to their 401(k) and convert those funds into a Roth IRA, significantly increasing tax-free retirement savings. This approach enables contributions beyond traditional limits – allowing you to boost your retirement savings.

Unlike a standard Roth IRA, it has no income restrictions, making it accessible to high earners. The main advantage is that once converted, the funds grow tax-free, and qualified withdrawals in retirement are also tax-free, providing long-term tax efficiency. This strategy is especially beneficial for those who have already maxed out their traditional retirement contributions and want to optimize their savings.

Open a Health Savings Account

A Health Savings Account (HSAs) are another important financial tool to consider when saving for retirement, especially in your 50s. These tax-advantaged financial accounts are designed to help individuals save money specifically for medical expenses. A Health Savings Account offers a unique triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals are tax-free if used for qualified medical expenses.

What makes HSAs particularly valuable in your 50s is that they can serve a dual purpose. While they can cover immediate healthcare costs, they also offer a strategic way to start saving for healthcare expenses in retirement.

After age 65, you can use Health Savings Account funds for non-medical expenses without penalties (though you’ll pay regular income tax on withdrawals). This flexibility can make HSAs a powerful tool for supplementing your retirement income and covering healthcare expenses during your retirement years. Consulting a financial advisor can help you incorporate HSAs into your retirement savings plan to ensure you’re well-prepared for the future.

Consider Using a Regular Investment Account with Tax-Deferred Accounts

A “regular” investment account is simply an account in which you can invest for retirement. The difference is that the earnings are treated normally as taxable income for tax purposes. This doesn’t make them bad. In fact, most successful retirees use a combination of tax-deferred accounts and regular accounts. As we’ve discussed above, each of the tax-deferred accounts have maximum contribution limits. Once you hit those limits, that doesn’t mean you should stop saving for retirement. That would be ludicrous.

Once you’ve determined how much you need to save for retirement in your 50s, start with the tax-deferred accounts. If you have additional savings, they should be invested in a regular account. Do not simply park extra savings in a checking or savings account. At today’s meager interest rates, you run a very high risk of falling behind inflation by doing that. You need to invest your retirement savings, not just stick them in a losing proposition.

Determine how to invest your retirement savings. Once you have put your savings into one or more of the retirement accounts discussed above, you must make a wise decision about how to invest those funds. There are no easy answers here. We cannot provide you with a simple one-size-fits-all rule of thumb; any website, tool or advisor who tries to tell you they have that “rule” is simply trying to get to your money in the fastest way possible.

To invest your retirement account wisely, you have to take into consideration, what you need, how long you have before you start taking withdrawals, how long you will need to take withdrawals, and your risk tolerance. All of these factors combine to determine the ideal asset allocation for your unique situation and result in a target return and a risk threshold. We offer a great Risk Tolerance Questionnaire, but even this is meant as a conversation starter. You need to do more research and retirement planning to determine how best to invest your retirement savings.

Take Action

We’ve given you the most successful way to jump start your saving for retirement at 50 and now it’s time to take action. But unless you’re a professional advisor or investor, please don’t take this all on to your own shoulders. It’s great to be prepared – to look at the issues we’ve raised above – but each of them is more complex than can be properly described in one article. Each of them needs to be tailored specifically to your situation.

The best way to accomplish this, and to achieve a successful retirement, is to work with a 100% objective financial advisor – someone who is morally and legally bound to act in your best interest. We at First Financial Consulting meet that criteria; we offer 100% objective advice, and we meet the fiduciary standard.

Scott Sommers is a Principal with First Financial Consulting. He works with individuals and privately-owned businesses helping them navigate their unique financial planning journey.

Scott Sommers is a Principal with First Financial Consulting. He works with individuals and privately-owned businesses helping them navigate their unique financial planning journey.