There is no sugar-coated way to say this: we have a retirement savings crisis on our hands. Reports from a variety of reliable sources indicate that the majority of American households do not have adequate retirement savings. Americans are also not managing those savings well enough to support their lifestyles in retirement. This may all sound familiar if you have read our previous blog post on retirement, but there is now new and troubling data which indicates the issue may be getting worse.

Inadequate Savings

First and foremost, the amount you save plays a crucial factor in retirement. No matter how you manage your retirement savings, if you aren’t saving enough, you won’t have enough to fund your lifestyle in the golden years. According to the Federal Reserve Board, 28% of non-retired adults have no savings or pension in place. Hopefully, you are one of the 72% who does have retirement savings or a pension. However, this doesn’t mean you’re safe.

Another report by the US Government Accountability Office (GAO) found that upwards of 50% of households age 55 and older have insufficient retirement savings. The median amount is only $109,000. If the median living standard is $53,046 (reported by Infographic citing Experian data), then the average American family has slightly more than 2 years’ worth of retirement savings.

Life Expectancy and Cost of Future Healthcare

That is based on current expense levels. These statistics are even more troubling if we factor in the rising cost of healthcare and life expectancy. When social security was first introduced, life expectancy was approximately 60. In the 1950s – midpoint for the boomer generation – life expectancy was 67. According to the Social Security Administration, average life expectancy has risen to about 84 for men and 86 for women. Clearly, most of us will need to rely on our retirement savings much longer than we anticipated.

It’s also no secret that the cost of healthcare has dramatically increased in recent years. Better diagnosis and treatment of many illnesses are among the top reasons life expectancy has increased, but the cost of coverage and treatment has skyrocketed, showing no signs of slowing down. A Fidelity study found that the average retired couple aged 65 will need approximately $280,000 in after-tax savings just to cover healthcare savings in retirement.

A shift in Retirement Plans

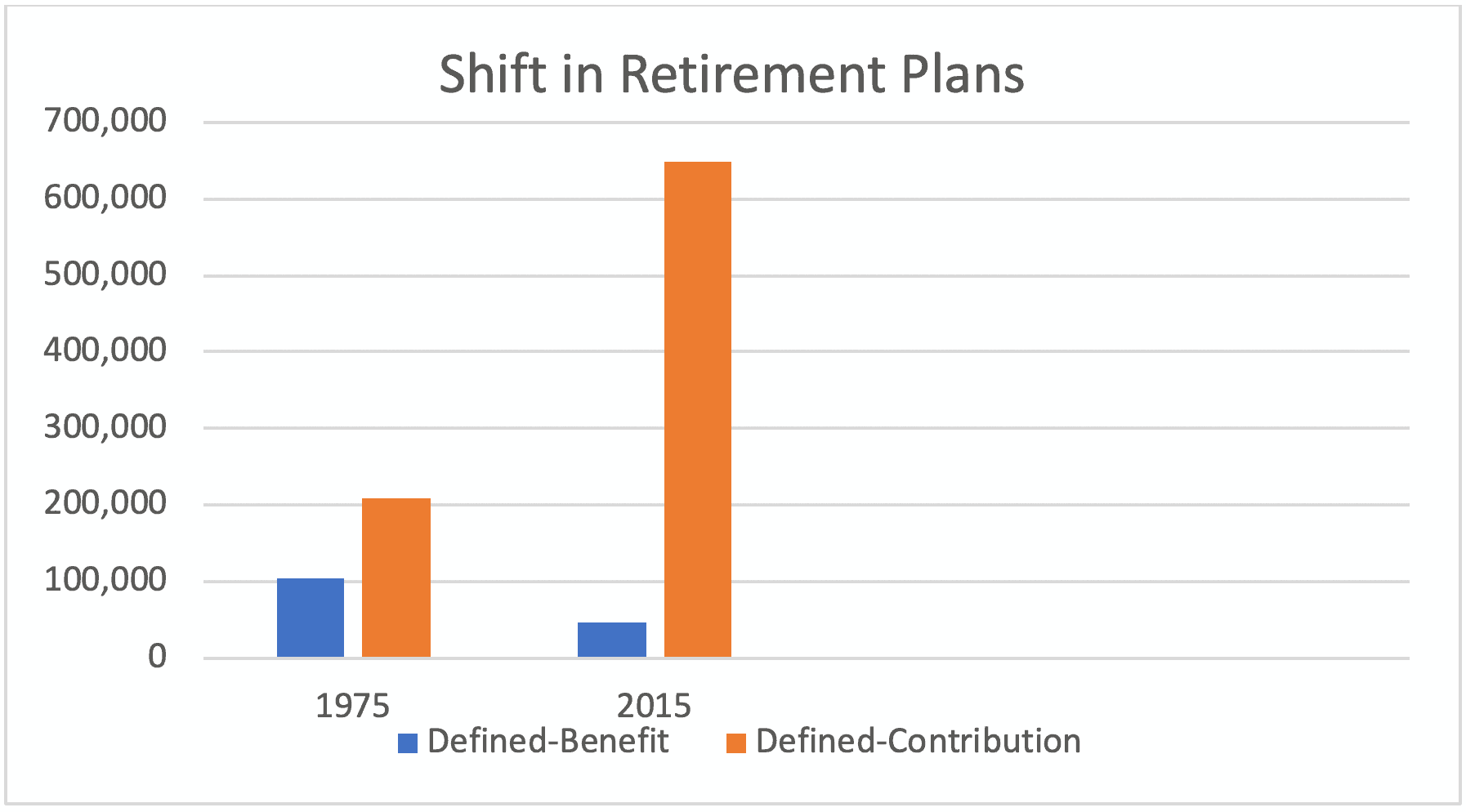

One of the reasons Americans lack sufficient retirement savings is due to the shift away from employer-sponsored retirement plans (traditional pensions) toward employee contribution-based retirement plans. In a bygone era, many employees worked an entire career at one – or just a handful of companies. Many employers were, therefore, willing to provide pension plans which offered guaranteed lifetime income at retirement.

Today, the average American worker will change careers 12 times, sometimes spending 5 years or less with any single employer. Those workers want to be able to take their retirement savings with them, and the employers are less willing to invest in guaranteed pensions when they can’t count on the employees staying invested in the job.

Accordingly, we have seen a dramatic decrease in traditional pension plans and a corresponding increase in the number of 401(k)-type retirement plans in which the employee is the primary contributor. According to the GAO, private sector employers offered 45,600 pension-type plans (legally referred to as “defined benefit” plans) in 2015 opposed to 103,300 in 1975. In 2015, private sector employers offered 648,300 401(k)-type plans (legally referred to as “defined contribution” plans) as opposed to 207,700 in 1975.

We are not criticizing the change. It seems to match the changing dynamics in employment. Employees can now contribute substantial amounts toward their retirement. They can also receive a tax deduction for doing so and take the money with them when/if they change jobs. If properly used, these types of retirement plans really are a great deal.

Take Advantage of Retirement Savings Plans

But that’s not it; the plans have to be used well. Employees must take advantage of the tremendous opportunity and actually make contributions into the retirement plans available to them. Sadly, according to a Wall Street Journal report, less than half of private sector workers even participate into a plan. Alicia Munnell, director of Boston College’s Center for Retirement Research, argues that “most people only save successfully through organized savings mechanisms”, like a 401(k) plan. If that’s true – and from our experience, we believe it is steadfastly true – then failing to participate in your employer’s retirement plan also robs you of the discipline which is so important to a successful retirement.

Investing, Well, Isn’t Easy

The last component of the retirement crisis is the failure to invest properly. Several studies have shown that individual investors are more prone to invest based on greed or fear than on logic and discipline. One of the most startling of these studies demonstrated that over a 10-year period of time, the average investor made investment decisions which converted a possible average annual return of 10% per year into a personal loss of (2)% per year. You read that correctly; investor behavior can snatch defeat from the jaws of victory.

The study covered all equity (stock) mutual funds over a 10-year period. The average return of all those funds was roughly 10% per year. This is not to say the funds earned 10% every year. Hardly so. Some years were much better than 10%, and other years showed substantial drops in stock value. But if investors had stayed with the funds to ride out the market drops, they would have recovered. In this case, they would have earned the 10% average annual return over the 10 years.

Avoid the White Noise

Unfortunately, investors were too often motivated by greed. They buy into stocks when prices were high and news reports were bullish for the future. Then by fear. They sell out of stocks when prices dropped and the news reports had turned bearish. Buying high and selling low has never been a recipe for success.

No matter how much you save for retirement, if you don’t manage your retirement savings logically and consistently, you run a substantial risk of losing ground. In a sense, you’ll be worse off than if you just stuck your money in a low-yield savings account. Of course, we don’t advocate that as a successful retirement strategy, but as bad as that would be, it would be better than allowing your emotions, or the instincts of the heard, to guide your investment decisions.

Avoiding the Retirement Crisis Is Achievable

As this article has made clear, there are several key components to failure. We can identify why Americans face a retirement crisis. But that also means we can identify how to avoid that crisis. In fact, retiring well is achievable for most Americans if they will just practice common sense and be disciplined. There are a numerous objective advisors who can work with you to identify how much you need to save for retirement. We specialize in helping people attain their dreams. If we can help you, we would be honored to begin that conversation.