A Mega Backdoor Roth IRA is one of the best ways for high-income earners to maximize their retirement investments. Investors can use their traditional IRA or 401(k) to increase their contributions to a Roth IRA or Roth 401(k) account using after-tax dollars – ideally reducing their tax liability and growing their retirement income in the long term.

In this article, we’ll cover everything you need to know about Mega Backdoor Roth IRAs, from how they work to their benefits and misconceptions.

Key Takeaways

- A Mega Backdoor Roth IRA is a retirement investment strategy that allows investors to add significantly more annually to tax-sheltered retirement accounts.

- To utilize this strategy, individuals must have a 401(k) plan that allows after-tax contributions and in-service rollovers to a Roth IRA or Roth 401(k). Proper execution is crucial to avoid tax penalties.

- Properly navigating the Mega Backdoor Roth IRA requires careful planning to avoid unnecessary taxes, penalties, and compliance issues. A fiduciary financial advisor can help ensure that contributions, conversions, and rollovers are executed correctly, maximizing the tax benefits while staying within IRS regulations.

What is a Mega Backdoor Roth?

A Mega Backdoor Roth IRA is a retirement investment strategy that allows investors to add significantly more annually to tax-sheltered retirement accounts than is typically allowed.

The basic logic is fairly straightforward. It involves making after-tax contributions to an IRA or 401(k) plan and then immediately rolling them into a Roth IRA or Roth 401(k).

How Mega Backdoor Roths Differ from Traditional Roth IRAs

Mega Backdoor Roth IRAs offer higher contribution limits, tax-free growth and withdrawals, and no income limits. However, this specialized retirement investment strategy has unique requirements and tax implications compared to a traditional Roth IRA.

Requirements for a Mega Backdoor Roth IRA

There are a few considerations to consider when determining whether or not you qualify for a Mega Backdoor Roth.

Employer 401(k) Limits

This strategy is generally available to individuals who have a 401(k) plan that allows in-service distributions or conversions to a Roth account. This means your plan must permit you to convert your after-tax contributions into a Roth 401(k) while you are still employed.

If your employer-sponsored 401(k) plan does allow you to make after-tax contributions, then you can take advantage of the Mega Backdoor Roth strategy. After-tax contributions are separate from your traditional 401(k) contributions. 401(k) contributions put into this bucket have already been taxed, meaning you won’t have to pay taxes on withdrawals in the future. This also means that you won’t pay taxes on what those contributions grow to.

You’ve Got Money Left Over for Savings

A Mega Backdoor Roth IRA is a great way to funnel more money into retirement savings, but it’s most advantageous for people with additional income to spare. The first thing you should do is max out the regular contributions you can make to your 401(k). After you’ve done that, and if you have additional money available to contribute to retirement savings, you should explore the Mega Backdoor Roth.

Contribution Limits of the Mega Backdoor Roth

Contribution limits are essential to understand because they determine how much you can contribute to a Mega Backdoor Roth IRA without facing unexpected tax bills and penalties. Exceeding these limits can result in additional taxes and penalties, which can significantly impact your retirement savings. Therefore, it’s vital to understand and adhere to these limits to avoid any financial pitfalls.

These limits will vary depending on the investment vehicle you fund for retirement.

Roth IRA Limits

Regular Roth contribution limits for 2025 remain at $7,000 for individuals under 50, and they are capped at $8,000 for individuals over 50. These annual contribution limits can change every year. Sadly, these contribution limits are further restricted based on income. For 2025, the contribution limit is reduced when your modified adjusted gross income hits $150K ($236K for a married couple) and is completely eliminated when that income hits $165K ($246K for a married couple).

If you have additional funds you’d like to contribute to a Roth but your income exceeds the limits, you have to take advantage of the backdoor strategy. This is where your 401(k) becomes useful.

401(k) Limits

The limits on 401(k) contributions are significantly higher. In 2025, you can contribute a maximum of $23,500 to your IRA, and if you are over 50, you can contribute an additional $7,500, bringing the total you can contribute to $31,000 per year.

In addition, your employer can contribute another $46,500 on your behalf, but this is voluntary for the employer. In total, though, if the employer is willing, this means that the total amount that can be contributed to your 401(k) is $70,000, or $77,500 if you are over 50. These numbers are important because they affect the amount you can contribute to a Mega Backdoor Roth through your 401(k).

The Mega Backdoor Roth IRA Strategy: A Step-by-Step Guide

Let’s take a closer look at the basics of this strategy and the steps you need to take.

Step One: Make Regular 401(k) Contributions

Since your 401(k) has higher contribution limits, this is often the best vehicle for a Mega Backdoor Roth IRA conversion. You should meet these contribution limits first before using the Mega Backdoor strategy. It’s important to be aware of the mega backdoor roth limit to ensure you are maximizing your contributions without exceeding the allowable amounts.

Once you contribute the maximum into the “regular” 401(k) portion, then any additional contributions are, by definition, “after-tax” contributions. This is important because you only want “after-tax” contributions to go into a Roth.

Step Two: Determine How Much After-Tax Contributions You Can Make

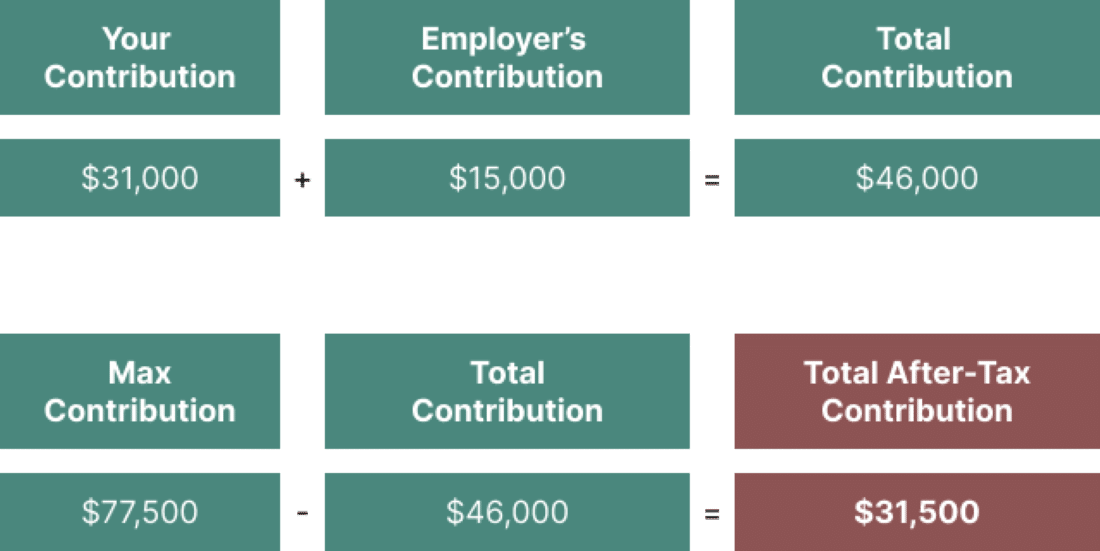

As mentioned above, the maximum contribution to your 401(k) is limited to $70,000 or $77,500 if you’re older than 50. You need to add up the amount you have contributed plus the amount your employer contributes. Then subtract this total from the limit that applies to you ($70,000 or $77,500).

For example, if you’re 51 and contribute $31,000 while your employer contributes $15,000, the total contribution stands at $46,000. The amount you could then contribute to the Mega Backdoor Roth strategy is $31,500 ($77,500 limit minus the $46,000 already contributed).

In this example, this additional $46,000 contribution would be considered an “after-tax” contribution, which is exactly the type of contribution you want to make to a Mega Backdoor Roth.

The closer you get to the maximum contribution, the more you can roll over into your Roth IRA.

Step Three: Make The After-Tax Contribution

Once you’ve determined how much of an after-tax contribution you can make, you need to instruct your employer to deduct this amount from your paychecks. You may have to use more than one paycheck in order to reach your after-tax contribution maximum.

Step Four: Implement the Mega Backdoor Roth Strategy Immediately

Each time you make an after-tax contribution (each time you make one out of your paycheck), you need to immediately inform your employer or the 401(k) plan sponsor to convert this after-tax contribution into the Roth 401(k). This is the trickiest part of the strategy.

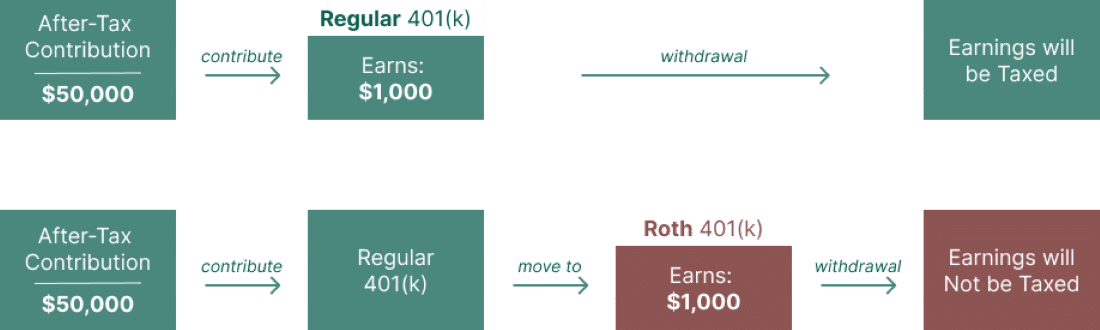

Tax laws are not consistent, so this may seem confusing. The earnings from after-tax contributions that remain in the regular 401(k) will be taxed when you withdraw them. However, the earnings from after-tax contributions that are moved into the Roth 401(k) will not be taxed. Let’s look at an example.

If you contribute $50,000 after-tax into the regular 401(k), leave it there, and it earns $1,000, then eventually, when you withdraw the $1,000 in earnings, they will be taxed.

But, if you contribute $50,000 after-tax into the regular 401(k), immediately move it to the Roth 401(k) where it earns that $1,000, then when you withdraw the $1,000 in earnings, they will not be taxed.

The “after-tax” contribution will not be taxed when you withdraw them; that remains protected. However, the earnings on that protected contribution may not be protected if you leave the money in the wrong part of the 401(k).

If you make the mistake of leaving the money in the wrong side of the 401(k) year after year after year, you could be looking at tens of thousands of dollars of unnecessary taxes.

Therefore, we emphasize again that each time you make an after-tax contribution from your paycheck, you need to get the employer or the plan sponsor to move that money into the Roth 401(k). Don’t wait a week, a month, or a quarter. If you wait, you run the risk of earning money in the wrong side of the 401(k), and you will be responsible for documenting that way down the line when you retire, and you’ll have to pay taxes on those earnings.

Sadly we’ve seen many people do this wrong for many years and be forced by the IRS to go back and painstakingly figure out how much of the earnings are taxable and how much are not. This calculation is difficult enough to do for a couple of years; it’s brutal to do for a decade or more.

This mechanism can sometimes be automated in many retirement plans, but you must be careful that the automation doesn’t break down or change because of some software update at the plan provider’s level.

Now, let’s look a real-world example that illustrates the power of the Mega Backdoor Roth:

Backdoor Roth Example

Bob is a 55-year-old employee who wants to retire after he turns 65. He regularly contributes the maximum regular 401(k) contribution amount of $23,500. Since the IRS limit is $70,000, he can contribute an additional $46,500 to the 401(k).

If Bob contributes this $46,500 into his 401(k) as an after-tax contribution each year and immediately moves it to the “Roth” side of his 401(k), then he will be able to contribute a total of $511,500 into his Roth 401(k) over the 11 years until he retires.

If the 401(k) earns an average of 8% per year, then Bob will have earned a total of $324,436 over and above his contributions. Normally, these total earnings would be subject to income taxes, but because it has occurred in the Roth 401(k), it is tax-free.

Bob’s total tax savings at age 65 would be $32,444 if he is in the 10% tax bracket, but it would be $97,331 if he was in the 30% tax bracket.

If Bob decides to leave the money in a Roth for the next 9 years, the tax-free compounding continues; at the end of 20 years, Bob would have cumulative earnings of $1,159,541, and he would save $347,862 in taxes.

Benefits of Using a Mega Backdoor Roth IRA

So, why use a Mega Backdoor Roth IRA if it can be complex? There are three primary benefits:

1. Increased Contribution Limits

The Mega Backdoor Roth IRA strategy allows for higher contribution limits than Traditional Roth IRAs. This means you can save more for retirement and grow your wealth faster.

2. Tax-Free Growth

The Mega Backdoor Roth IRA strategy offers tax-free growth and withdrawals. This means you won’t owe taxes on your investment gains, and you can keep more of your hard-earned money.

3. Flexibility in Retirement

With a Mega Backdoor Roth IRA IRA, you can withdraw funds without penalty after they have been in the account for five years and you are over age 59 ½. This gives you more flexibility in retirement and allows you to use your money as needed.

Debunking Common Myths

Despite its benefits, there are some common myths and misconceptions about this retirement investment strategy. The top three myths include:

Myth 1: It’s Only for the Wealthy

While the Mega Backdoor Roth is for individuals with more substantial income and an abundant cash flow, those taxpayers may or may not be considered wealthy. That’s because “wealthy” is so subjective. A high-net-worth individual with liquid assets of at least $1 million certainly falls into this category. But so can someone with $300,000 or $500,000 in liquid assets.

Depending on where they live, someone earning between $150,000 – $200,000 is considered a high-income earner, which means they are likely eligible for a Mega Backdoor Roth IRA.

Myth 2: It’s Complicated

Opening a Mega Backdoor Roth IRA is fairly straightforward.

However, to ensure you handle it correctly, hire an experienced and 100% objective financial advisor to help set up the Mega Backdoor Roth. Let them deal with the complexity.

Myth 3: It’s Not Worth the Effort

The effort to set up and maintain this investment is minimal, especially with the right help. You only need to check with your employer’s retirement plan administrator, set aside the money, and complete the conversion. Much of this process can be automated. And it’s possible to accumulate tens of thousands of dollars in your retirement account each year, which grows tax-free for you and your heirs.

Evaluating Your Financial Goals and the Mega Backdoor Roth

Is a Mega Backdoor Roth IRA right for your portfolio? You’ll want to evaluate a number of factors to find out:

Understanding Your Financial Objectives

Investing in a Mega Backdoor Roth IRA can jumpstart your retirement savings. Once you’ve revisited your financial goals, evaluate whether that strategy aligns with what you and your family need in retirement.

Assessing Your Risk Tolerance

Consider your risk tolerance and whether the Mega Backdoor Roth IRA strategy aligns with your investment goals. If you’re risk-averse, you may want to consider alternative retirement savings options.

Considering Alternative Retirement Savings Options

Other retirement savings options are available, such as traditional IRAs and 401(k)s. Consider whether these options better fit your financial goals and risk tolerance.

Implementing the Mega Backdoor Roth Strategy with Your 401(k) Plan

Not everyone should use a mega backdoor roth strategy. It principally benefits high earners with lots of cash flow or those who may not have put away money for retirement and want to start doing so.

Another consideration is after-tax contribution limits. If your 401(k) plan doesn’t allow after-tax contributions, you may not be eligible for the Mega Backdoor Roth IRA strategy. Consider speaking with your HR department or plan administrator to see if they can add this feature to your plan.

Tax Implications of a Mega Backdoor Roth IRA

After-tax contributions are made with dollars that have already been taxed. In other words, you won’t owe taxes on these contributions when you withdraw them in retirement.

Additionally, understanding how income taxes impact your overall tax strategy is crucial when considering a Mega Backdoor Roth IRA.

Avoiding Common Mistakes with Mega Backdoor Roth IRAs

The Mega Backdoor Roth IRA strategy can be complex, and mistakes can result in tax traps and penalties. Some of the financial impacts of a poorly constructed Mega Backdoor Roth IRA are:

- A 10% penalty for dipping into your Roth early

- A 6% excise tax due to overfunding

- Additional taxes from inaccuracies transferring converting pre-tax and after-tax funds

Consider Consulting a Financial Advisor for Guidance

The Mega Backdoor Roth IRA strategy offers increased contribution limits, tax-free growth, and flexibility in retirement. It’s a powerful tool for high-income earners looking to maximize their retirement savings. The long-term tax savings from tax-free growth and withdrawals can significantly enhance your retirement income.

However, despite seeming simple, the Mega Backdoor Roth IRA strategy can be complex and requires careful planning. An experienced fiduciary financial advisor can help you navigate the process and ensure you make the most of your retirement savings.

On a basic level, a financial advisor can help you determine if the Mega Backdoor Roth IRA strategy is right for you. And if it is, they can also help you set up the strategy and ensure you follow the correct process. They can also offer alternative strategies based on your goals, risk tolerance, and eligibility in the event a Mega Backdoor Roth isn’t right for you.

At First Financial Consulting, we have over 45 years of experience helping our clients achieve their investing and retirement goals. As fiduciaries, we only provide 100% objective advice in determining what makes the most sense for each of our client’s unique situations. If you’re contemplating a Mega Backdoor Roth IRA, we’d love to help. Use the link below to schedule a complimentary meeting with one of our advisors today.

Greg Welborn is a Principal at First Financial Consulting. He has more than 35 years’ experience in providing 100% objective advice, always focusing on the client’s best interests.

Greg Welborn is a Principal at First Financial Consulting. He has more than 35 years’ experience in providing 100% objective advice, always focusing on the client’s best interests.

FAQ | Mega Backdoor Roth

A Mega Backdoor Roth IRA is a retirement savings strategy that allows individuals to contribute after-tax dollars to a 401(k) and convert those funds into a Roth IRA or Roth 401(k). This strategy enables tax-free growth and withdrawals in retirement, making it a valuable tool for high earners looking to maximize tax-advantaged savings.

This strategy is available to individuals with a 401(k) plan that permits after-tax contributions and in-service rollovers or in-plan Roth conversions. High-income earners who are unable to contribute directly to a Roth IRA due to income limits often find this strategy particularly useful.

For 2025, the total 401(k) contribution limit, including employer contributions, is $70,000 for individuals under 50 and $77,500 for those 50 and older. After-tax contributions can be made up to this limit after accounting for any pre-tax or Roth employee contributions and employer contributions.

Yes, improper execution can lead to unnecessary taxation on earnings, penalties for excess contributions, and potential IRS scrutiny. It's crucial to ensure that after-tax contributions are converted quickly to avoid taxable growth, and to carefully track limits and employer plan rules.

Ideally, as soon as possible - preferably immediately after making the contribution. This prevents any earnings from accumulating in the after-tax 401(k) portion, which would otherwise be subject to taxation when converted to a Roth account.

No, unless you leave your job and roll the funds into a Roth IRA. If your plan doesn’t permit in-service rollovers or conversions, it may be worth discussing with your HR department to see if plan updates are possible. Otherwise, alternative Roth strategies may need to be considered.

Contributions are made with after-tax dollars, meaning they are not taxed again upon withdrawal in retirement. However, any earnings that accumulate before conversion will be subject to taxation. Proper timing of contributions and conversions is key to minimizing tax liability.

While not mandatory, consulting a financial advisor is highly recommended. The Mega Backdoor Roth strategy involves navigating complex IRS rules, employer plan restrictions, and tax considerations. A professional can help assess eligibility, structure contributions properly, avoid costly mistakes, and ensure that the strategy aligns with your overall retirement and tax planning goals. Since improper execution can result in unnecessary taxes or compliance issues, working with an advisor can provide peace of mind and maximize the benefits of this powerful savings strategy.